ARTICLES POPULAIRES

Ethereum price today: $2,730

- The Ethereum Coinbase Premium Index has plunged to -0.128, its lowest level since February.

- Ethereum ETFs have shed over $1.28 billion after recording eight consecutive days of outflows.

- ETH could drop to $2,300 if it fails to recover the $2,850 key level.

Ethereum (ETH) is down 3% on Friday, as the top altcoin faces intense selling pressure from retail and institutional US investors across the spot and derivatives markets.

US investors spearhead Ethereum's decline

Ethereum, like the broader crypto market, has maintained a downtrend amid a strong US jobs report and fears of an AI bubble, further dampening sentiment in risk assets.

US investors continue to spearhead the selling activity in ETH, as evidenced by the sustained decline in the Coinbase Premium Index, according to CryptoQuant data. The metric plunged to -0.128 on Thursday, its lowest level since February. The drop represents a 295-point decrease from its October 10 high, the metric's steepest five-week decline in 2025.

-1763749162115-1763749162117.png)

The risk-off sentiment has also continued to rack US institutional interest, with US spot Ethereum exchange-traded funds (ETFs) recording eight consecutive days of outflows totalling $1.28 billion. This represents their largest outflows on a negative streak since launching in 2024, per Farside Investors data.

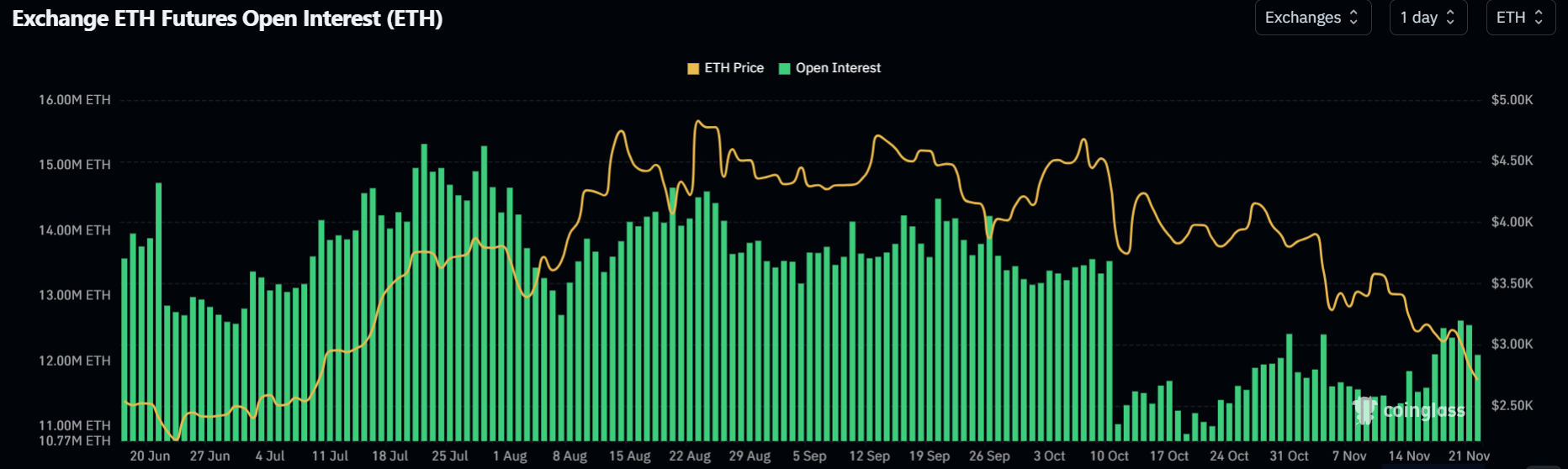

On the derivatives side, US futures traders have scaled back leverage, according to Coinglass data. The Chicago Mercantile Exchange (CME) Ethereum open interest, which surpassed Binance's earlier in October, has returned below that of the crypto exchange, coming in at 2.13 million ETH against 2.53 million ETH.

Overall open interest across all exchanges has declined by 500,000 ETH over the past 24 hours. However, open interest rose slightly by 250,000 ETH on the weekly timeframe. This signals that a few traders may be opening positions in anticipation of a price reversal.

Ethereum's network activity tells the same story as active addresses have been on a downtrend. The seven-day moving average of active addresses dropped by over 25% to 356,000, reaching levels last seen in June, according to CryptoQuant data.

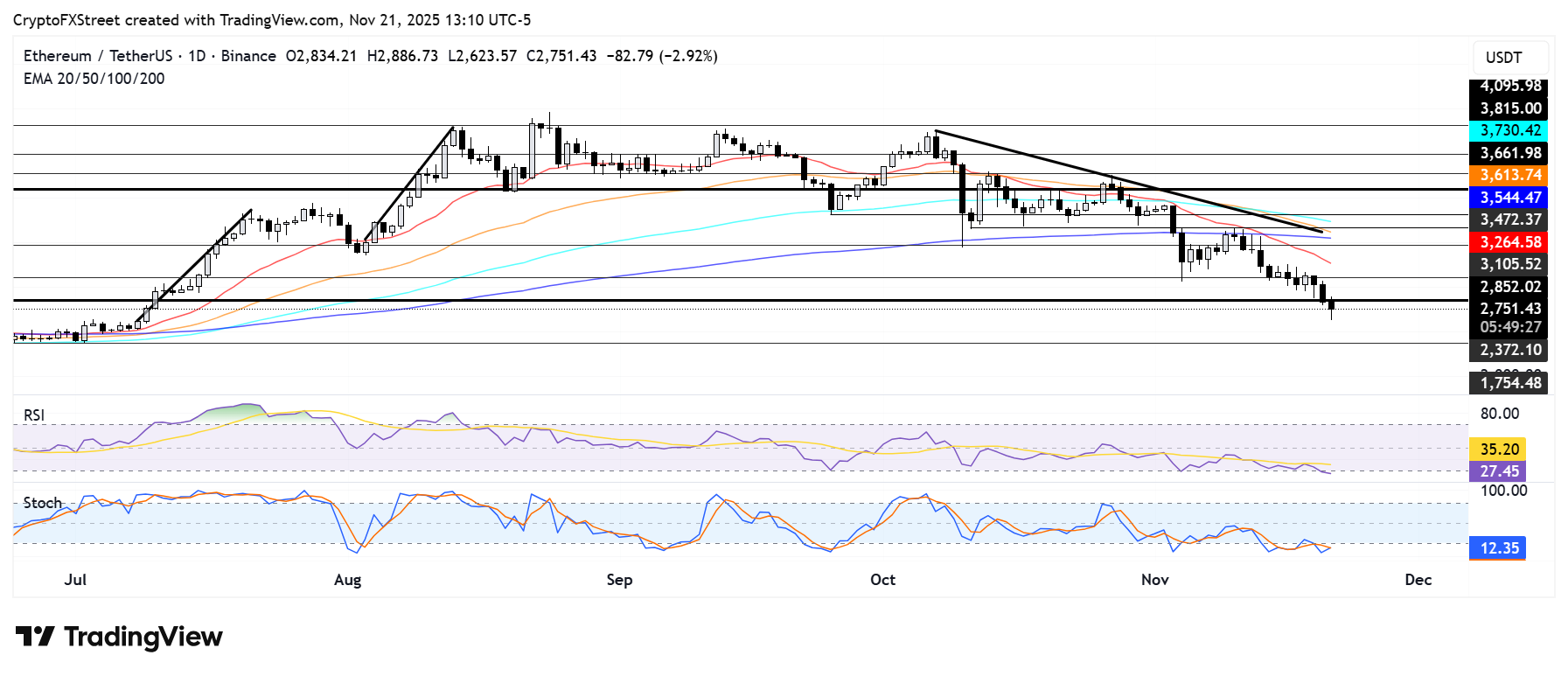

Ethereum Price Forecast: ETH risks decline to $2,300 if it fails to recover $2,850

Ethereum has seen $407.5 million in liquidations over the past 24 hours, led by $340.6 million in long liquidations, per Coinglass data.

ETH is looking to recover the $2,850 key support after declining below it on Friday. The level also marks the average cost basis of accumulation addresses, whales holding 10,000-100,000 ETH and small-scale holders, making it a critical level, according to CryptoQuant data.

These investors could be incentivized to push prices back above their average cost basis. However, if wider risk-off sentiment lingers, they may accelerate distribution to cut losses. Such a move could see ETH find support near $2,300, the same region as its overall average cost basis for all investors.

On the other side, ETH has to rise above its Exponential Moving Averages (EMAs) and hold them as support levels to resume an uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in oversold territory, indicating a dominant bearish momentum. Oversold conditions in both momentum indicators could spark a short-term reversal.