POPULAR ARTICLES

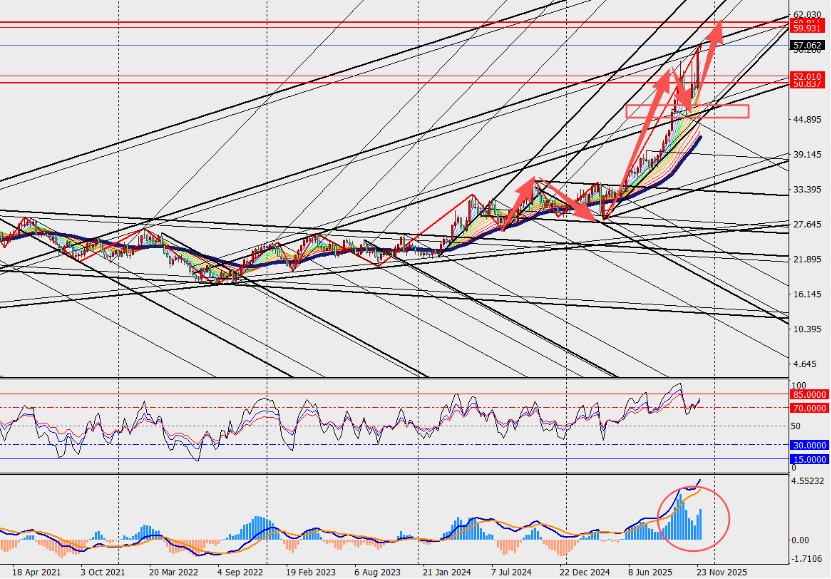

This Monday, the price of spot silver not only broke above the high set on October 17, but also pushed its all-time record to above 57.00 US dollars.

The strong rise in silver prices has mainly been supported by growing market expectations of a Federal Reserve rate cut in December, increased capital inflows into exchange-traded funds (ETFs) backed by physical silver, and ongoing tightness on the supply side.

On Friday, as futures trading on CME Group’s Comex exchange was temporarily halted for several hours, both gold and silver markets saw sharp price swings and extremely thin liquidity.

In October, London, as a major silver trading hub, experienced severe supply shortages. This drove prices there sharply higher, even surpassing those in the Shanghai and New York markets.

Although the arrival of nearly 54 million ounces of silver eased the squeeze at that time, the market remains clearly tight, and the one-month cost of borrowing silver is still far above normal levels.

The inflow of silver into the London market is now putting pressure on other trading centers. According to data from exchanges and brokerage firms, silver inventories in warehouses linked to the Shanghai Futures Exchange have recently fallen to their lowest level since 2015, while trading volume on the Shanghai Gold Exchange has dropped back to its lowest level in more than nine years.

In addition, investors are closely watching the potential tariff risks for silver, as this precious metal was placed on the US Geological Survey’s critical minerals list in November.

Market Analysis:

Silver has been rising continuously on the weekly chart, with both MACD lines and the histogram expanding again above the zero line. Although 75 million ounces of silver have flowed out of the New York futures exchange vaults since early October, concerns over a sudden premium on US silver have made some investors hesitate to move silver out of the United States.