On the first trading day of the week, the global precious metals market witnessed a historic moment as spot silver broke through the psychologically important $80 per ounce barrier and set a new record high.

This breakout was not limited to silver alone. Gold, platinum, palladium and other members of the precious metals complex also refreshed record or multi-year highs, significantly boosting overall market sentiment.

The latest explosive rally across precious metals is the result of multiple drivers acting in concert.

First, monetary policy expectations provide the core macro backdrop. Markets increasingly expect the U.S. Federal Reserve to extend – and potentially deepen – its rate-cutting cycle in the first half of 2026. This outlook directly suppresses the path of real U.S. interest rates, lowers the opportunity cost of holding non-yielding precious metals, and offers the most fundamental source of upside for gold and silver prices.

Second, structural market factors and geopolitics are overlapping. Year-end market liquidity is relatively thin which tends to amplify price swings. At the same time, global geopolitical tensions – particularly the ongoing Russia-Ukraine situation – together with rising uncertainty around international tax and policy discussions continue to fuel safe-haven demand. This risk-off sentiment is not only visible in gold, but is spilling over into the entire precious metals space.

Third, silver’s own supply–demand dynamics are providing unique momentum. Compared with gold, silver has a much stronger industrial profile. On the one hand, its newly elevated status as a “critical mineral” in the United States has increased long-term strategic attention on the metal. On the other hand, the silver market has been experiencing a persistent supply deficit.

Looking across the broader metals complex, platinum’s sharp gains have been driven by robust industrial demand, supply-chain concerns and investment flows rotating out from gold. Silver is similarly benefiting from the dual narrative of strong industrial usage and rising investment demand. This helps explain why silver’s yearly performance has far outpaced that of gold.

Market Commentary:

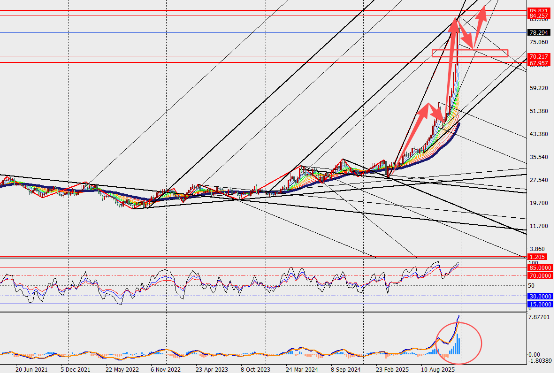

On the weekly chart, silver continues to climb aggressively with MACD lines and histogram extending deeper into overbought territory above the zero line. The powerful rally since early December has created strong upside momentum in its own right, attracting a wave of momentum traders and speculative capital. This flow-driven behavior tends to become particularly pronounced when prices break through major psychological levels.