Over the weekend, the probability of a Fed rate cut in December jumped from under 40% to around 70% within 24 hours, with dovish remarks from New York Fed President John Williams acting as the key catalyst for the shift in sentiment. At the same time, the recently hard-hit cryptocurrency market staged a broad rally on Sunday: Bitcoin climbed back above USD 87,000 with a 24-hour gain of more than 2%. Amid this violent market swing, the Trump family’s crypto holdings have been hit hard, with their wealth shrinking from around USD 7.7 billion in early September to about USD 6.7 billion.

Fed’s No. 3 Turns Dovish, December Rate-Cut Odds Spike

Just days before the Fed enters its blackout period on 29 November, rate-cut expectations have flipped dramatically. The sharp swing is largely driven by dovish comments from New York Fed President John Williams.

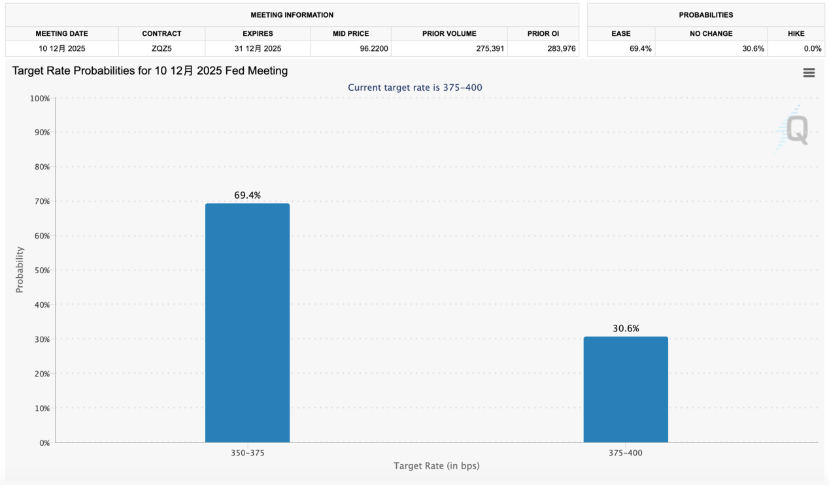

He argued that as downside risks to the labour market grow and upside risks to inflation ease, the Fed still has room to cut rates further in the near term. According to CME’s “FedWatch” tool, the probability of a 25-basis-point rate cut in December has risen to 69.4%, up from less than 40% just one day earlier.

(Chart: bar chart – description automatically generated.)

However, there is clear internal disagreement within the Fed over whether it should continue cutting rates in December, and that split has been evident in recent public remarks by Fed officials.

Boston Fed President Susan Collins, who is a voting member of the FOMC this year, stated bluntly on Saturday that she does not believe another rate cut in December is necessary. Chicago Fed President Austan Goolsbee is also cautious about cutting again in December, saying: “Inflation seems to have stalled, and you could even say there are warning signs it’s heading the wrong way. That makes me a bit uneasy.”

At this point, if Chair Jerome Powell, Vice Chair Philip Jefferson and New York Fed President John Williams – the Fed’s three top leaders – decide in favour of a cut, they are likely to be backed by the three governors appointed by Donald Trump. Including those three Trump-appointed governors, the “cut” camp could secure 6 votes out of 12 voting members, but they would still need a seventh vote to gain a majority.

Complicating matters further, all four regional Fed presidents with votes at this meeting (Goolsbee, Collins, Musalem and Schmid) have expressed reservations about cutting rates, making the December outcome even more uncertain.

A research report from CITIC Securities maintains its forecast that the Fed will cut rates in December, expecting a 25-basis-point move. The firm notes that in the near term, macro factors may no longer be the main source of pressure on markets, which could instead refocus on issues such as bond issuance by AI companies and the trajectory of cryptocurrencies.

Are Cryptocurrencies Sensing the Policy Shift First?

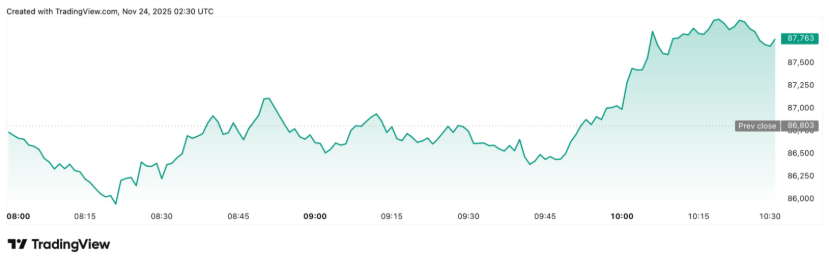

Boosted by rising rate-cut expectations, the crypto market staged a broad rebound on Sunday.

As of the morning of 24 November Beijing time, Bitcoin was trading above USD 87,000, up more than 2% over 24 hours. Ethereum gained more than 1%, Dogecoin over 3%, and XRP more than 4%. This stands in stark contrast to last Friday, when Bitcoin at one point slumped 6% to around USD 81,500.

Bank of America chief investment strategist Michael Hartnett wrote in his latest “Flow Show” report that cryptocurrencies will be the first to sense a shift in central bank policy. Hartnett believes that given the damage tightening liquidity has inflicted across multiple asset classes, the Fed is under growing pressure to keep cutting rates. Because the crypto market is extremely sensitive to liquidity, it is likely to detect a Fed policy pivot earlier than others.

He expects that when the Fed is ultimately forced into aggressive rate cuts, Bitcoin – historically one of the most sensitive assets to liquidity – tends to start surging before the rescue signals are fully confirmed.

Trump’s Second Son: “Buy the Dip – This Is a Great Opportunity”

In the latest crypto sell-off, the Trump family’s digital-asset holdings have taken a heavy hit.

According to the Bloomberg Billionaires Index, the Trump family’s wealth has fallen from around USD 7.7 billion in early September to roughly USD 6.7 billion, a drop of about USD 1 billion. The decline is closely tied to their rapidly growing crypto-business investment portfolio.

Trump Media’s Bitcoin investments have suffered steep losses. According to a statement released in July, the company spent about USD 2 billion to purchase some 11,500 Bitcoins at an average price of around USD 115,000, leaving it sitting on an unrealised loss of roughly 25% on that position.

Eric Trump’s stake in Bitcoin mining company American Bitcoin Corp has also halved in value from its peak, falling from about USD 630 million to around USD 300 million. Yet despite the sharp market sell-off, Eric Trump remains unfazed.

In a statement to the media, he said: this is an excellent buying opportunity. Those who buy into the downturn and are willing to accept volatility will be the ultimate winners. “I have never been more optimistic about the future of cryptocurrencies and the modernisation of the financial system.”