In her speech to the Diet on Wednesday, Sanae Takaichi set out her preferences on how to respond to the current bout of inflation, and later continued to send subtle signals at the first meeting of the government’s Council on Economic and Fiscal Policy. She stressed the need to “implement appropriate monetary adjustment strategies,” wording that stands in sharp contrast to her long-standing image as an advocate of aggressive fiscal and monetary easing.

Takaichi’s recent comments have also stirred controversy abroad. Some reports say that “Takaichi’s remarks have angered China,” and that scholars see them as reflecting “mainstream public opinion in Japan,” urging Taiwan to recognize “one key fact.” (Image source: Internet.)

It is also noteworthy that Bank of Japan Governor Kazuo Ueda attended the council meeting. Afterward, Takaichi said she would “continue to work together to promote economic progress,” hinting that she wants monetary authorities and the government’s macroeconomic policies to move in step. However, she did not explicitly voice opposition to interest-rate adjustments, merely requesting that Ueda report to the council on a routine basis in line with established procedures. Ueda made no comments after the meeting, maintaining the BOJ’s customary cautious stance.

Takaichi’s personnel choices for the council further reveal her policy leanings. She appointed former BOJ Deputy Governor Masazumi Wakatabe—well known for his “reflation” theories—as a member of the council, a move that drew wide attention from markets. Speaking to the media after the meeting, Wakatabe said he expects the BOJ to make decisions appropriate to economic conditions, but also noted that “there are pressures on the current state of the economy.” He highlighted the possibility that third-quarter GDP could contract, and that inflation might lose momentum as food prices ease.

The economic data indeed pose a challenge for policymakers. Analysts estimate that Japan’s economy may record its first negative growth in nearly six quarters in the three months to September. At the same time, inflation has met or exceeded the BOJ’s 2% target for three and a half years, while households’ real purchasing power has been weakened for much of that period. This disconnect between growth and inflation makes monetary-policy choices particularly difficult.

Weak yen and rate-hike expectations coexist

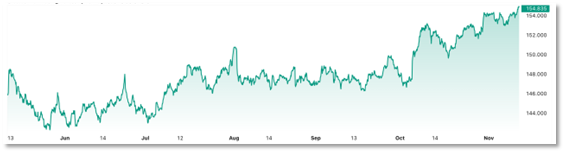

Following Takaichi’s comments, the reaction in FX markets was pronounced. The dollar climbed to ¥154.79, pushing the yen to its lowest level in about nine months. According to analysis from Mitsubishi UFJ Financial Group (MUFG), “the poor performance of the yen is likely to continue. Official intervention becomes a more credible threat when the exchange rate moves above 155.00, which should help slow the rise of USD/JPY.”

Finance Minister Satsuki Katayama acknowledged in Wednesday’s Diet session that the negative impact of the weaker yen has now surpassed the positive effects. She also pointed out that “there have recently been one-sided and rapid moves in the foreign-exchange market,” and warned that the authorities are “monitoring developments with a high degree of vigilance.”

Despite the risks of intervention, expectations for the normalization of BOJ monetary policy remain intact. A recent media survey showed that almost all analysts polled expect the BOJ to take action by the end of January next year, with around half of them seeing the policy meeting that concludes on 19 December this year as the most likely timing for the first rate hike.

For now, markets are closely watching the BOJ’s December policy meeting, which will be a key test of the central bank’s independence and of how it coordinates with government policy. As the yen edges toward the 155 level, the risk of intervention by Japanese authorities is rising. However, unless underlying fundamentals change, any such intervention is likely to have only a temporary impact.