POPULAR ARTICLES

- BNB price trades near its record high of $1,375 as the crypto market generally recovers following last week’s sell-off.

- China Renaissance Holdings plans to raise $600 million to set up a BNB-based digital treasury.

- The digital treasury will be managed through a new US subsidiary dedicated to accumulating the BNB token.

Binance Coin (BNB) trades slightly below $1,300 at the time of writing on Monday, down approximately 5.5% from its record high of $1,375. Despite a drastic fall to $861 on Friday, sentiment around BNB remains bullish, backed by retail and institutional demand.

China Renaissance Holdings eyes a BNB token treasury

Beijing-based Chinese investment bank China Renaissance Holdings is reportedly planning to raise $600 million to set up a public investment company that will invest in BNB, a token backed by Binance.

According to Bloomberg, YZi Labs, the family office of Binance co-founder Changpeng “CZ” Zhao, will invest in the deal along with China Renaissance Holdings.

Upon raising the $600 million, the digital treasury dedicated to accumulating the BNB token will be managed by a company incorporated in the US.

Retail and institutional demand for BNB has increased significantly, with the token’s value more than doubling this year. CEA Industries and 10X Capital are the other BNB-focused treasury companies.

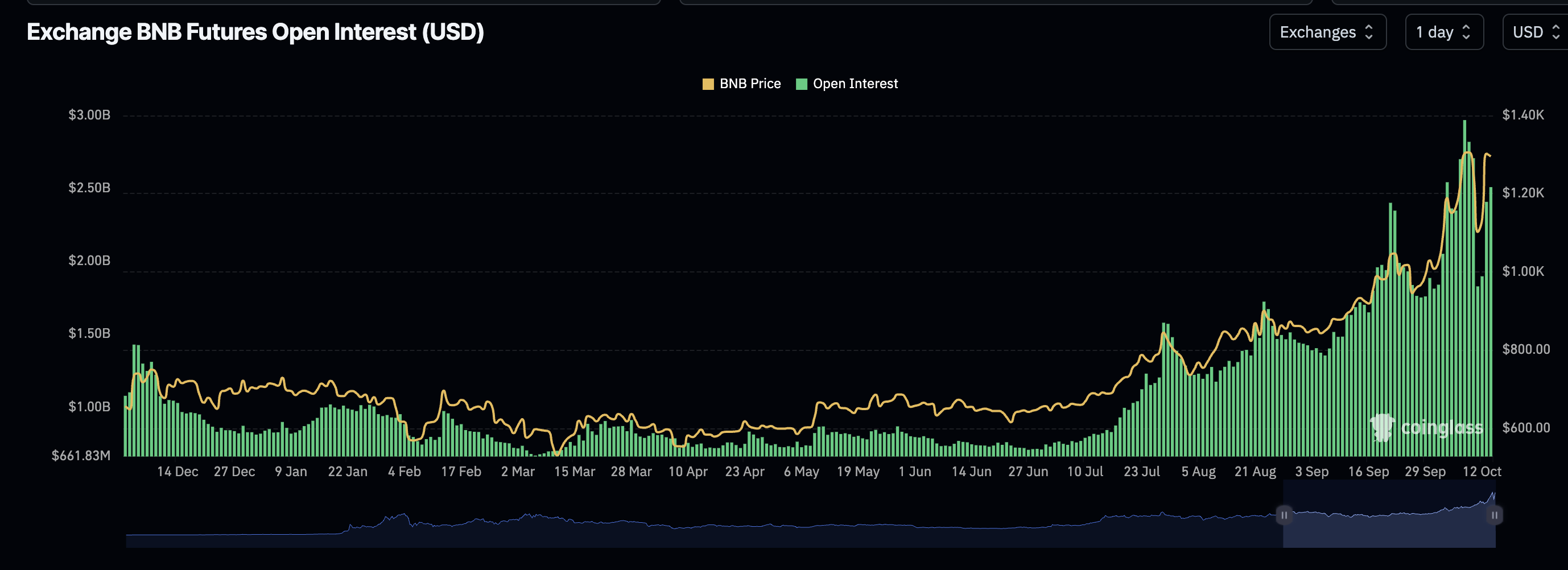

Meanwhile, the BNB futures Open Interest (OI), representing the notional value of outstanding futures, hit $2.97 billion, marking a historical high. The OI averaged approximately $745 million on July 1, marking a 75% increase. CoinGlass data shows the OI averaging $2.51 billion as of writing, up from $1.83 billion on Sunday. The surge in OI backs BNB’s bullish outlook and soaring retail demand.

BNB Futures Open Interest | CoinGlass

Technical outlook: BNB slides from record high amid profit-taking

BNB faces increasing selling pressure at the time of writing on Friday, highlighting increased profit-taking after reaching a new record high of $1,375. The downward-facing Relative Strength Index (RSI) at 57 on the daily chart shows that bullish momentum is easing.

Still, a buy signal from the Moving Average Convergence Divergence (MACD) indicator on the same daily chart supports a short-term bullish outlook. If the blue line remains above the red signal line, traders will increase risk exposure, contributing to buying pressure.

BNB/USDT daily chart

Traders should look out for a daily close above $1,300 to validate the uptrend’s continuation. However, profit-taking may continue in the short term. Key levels of interest include the 50-day Exponential Moving Average (EMA) at $1,211, the 100-day EMA at $1,157 and the 200-day EMA at $1,076, all of which could serve as tentative support levels.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.