POPULAR ARTICLES

- The Dow Jones recoiled on Friday after tapping record highs this week.

- Consumer sentiment indicators showed a steeper-than-expected decline.

- Next week’s upcoming Fed rate call will also include an SEP update.

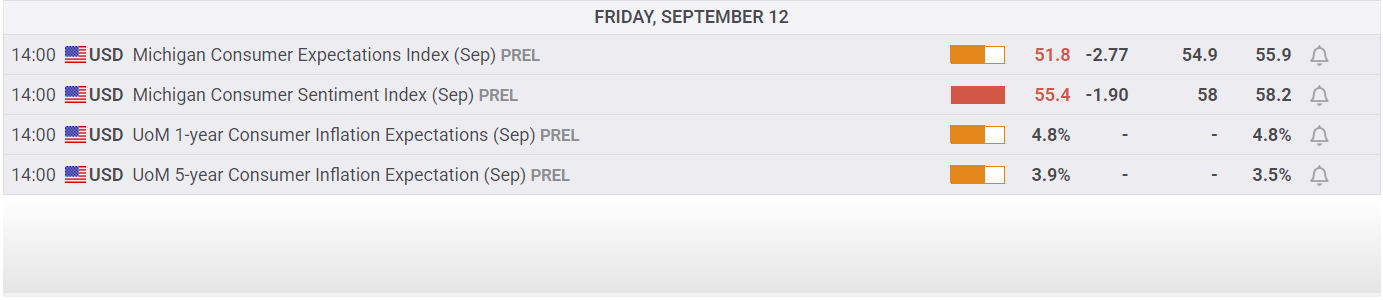

The Dow Jones Industrial Average (DJIA) pared gains on Thursday, slipping back below 46,000 after chalking in record levels through the midweek sessions. University of Michigan (UoM) Consumer Sentiment Index figures for September declined much faster than forecasts expected, and long-term inflation expectations also rose.

The Federal Reserve (Fed) is broadly expected to trim interest rates on September 17 in the face of crumbling labor market data despite a near-term uptick in inflation. The Fed will also be delivering an updated Summary of Economic Projections (SEP) at next week’s interest rate decision, promising an information-dense rate call for investors to grapple with.

The Dow Jones shed four-tenths of one percent on Friday, testing 45,900 after closing above 46,000 for the first time ever on Thursday. Equities have leaned firmly into the bullish side in September despite the month historically involving poor performance for stock markets. Major indexes are broadly higher for the week, with the Dow Jones gaining over 500 points from Monday’s opening bids and ending the week up over 1.1%.

Consumer sentiment continues to sour in the face of tariff impacts

The UoM Consumer Sentiment Index contracted to 55.4 from the previous print of 58.2. The consumer outlook on durable goods improved, but all other index components declined, particularly among lower and middle-income consumers. Respondents broadly noted economic vulnerabilities in business conditions, labor markets and hiring, and inflation. Consumers expect both their incomes and purchasing power to decline moving forward, with over 60% of respondents offering unprompted statements about the Trump administration’s tariffs and their negative impacts on US consumers. According to UoM Surveys of Consumers Director Joanne Hsu,

“Trade policy remains highly salient to consumers… Still, sentiment remains above April and May 2025 readings, immediately after the initial announcement of reciprocal tariffs.”

US consumers remain apprehensive about inflation looking ahead, with 1-year inflation expectations holding steady at 4.8%. Despite the 5-year long-run inflation outlook rising for a second straight month to 3.9% in September, it still remains below the peak 4.4% reached in April following the tariff announcements.

The Fed is broadly expected to deliver an opening 25-basis-point interest rate cut next week when the Federal Open Market Committee (FOMC) convenes for its next rate decision to be announced on September 17. Despite inflation continuing to tease another comeback, the Fed is widely expected to step into a rate-cutting cycle in the face of steep declines and multiple sharp downward revisions to US labor and hiring data. The FOMC will also be delivering its latest SEP, and investors will be curious to see if Fed officials share the market’s expectations for three straight cuts through the end of the year.

Read more stock news: Adobe stock whipsaws despite initial earnings rally

Dow Jones daily chart

Economic Indicator

UoM 5-year Consumer Inflation Expectation

The University of Michigan's Survey of Consumers includes a long-run, five-year, inflation expectation component that the Fed uses when calculating its quarterly Index of Common Inflation Expectations.

Read more.Last release: Fri Sep 12, 2025 14:00 (Prel)

Frequency: Monthly

Actual: 3.9%

Consensus: -

Previous: 3.5%

Source: University of Michigan