POPULAR ARTICLES

- The broader cryptocurrency market reportedly lost $19 billion on Friday.

- Hyperliquid’s founder, Jeff Yan, alleges underreporting of user liquidations by Binance and other centralized exchanges.

- The cryptocurrency market capitalization rebounds to $3.85 trillion, with a recovery in retail interest.

Jeff Yan, the founder of perpetual Decentralized Exchange (DEX) Hyperliquid, has accused Binance and other such centralized exchanges (CEXs) of concealing user liquidation data during the market crash on Friday. This shares a risk of potentially billions of liquidations swept under the carpet, keeping the market makers and traders in the dark.

The largest liquidation event in crypto history could be even bigger than reported

The broader cryptocurrency market took a nosedive on Friday as US President Donald Trump announced a 100% tariff on Chinese goods – over any and all crucial software – beginning on November 1. This resulted in a total liquidation spree of over $19 billion in a day, as seen in the CoinGlass data below, wiping out multiple overleveraged positions.

Cryptocurrency market liquidations data. Source: CoinGlass

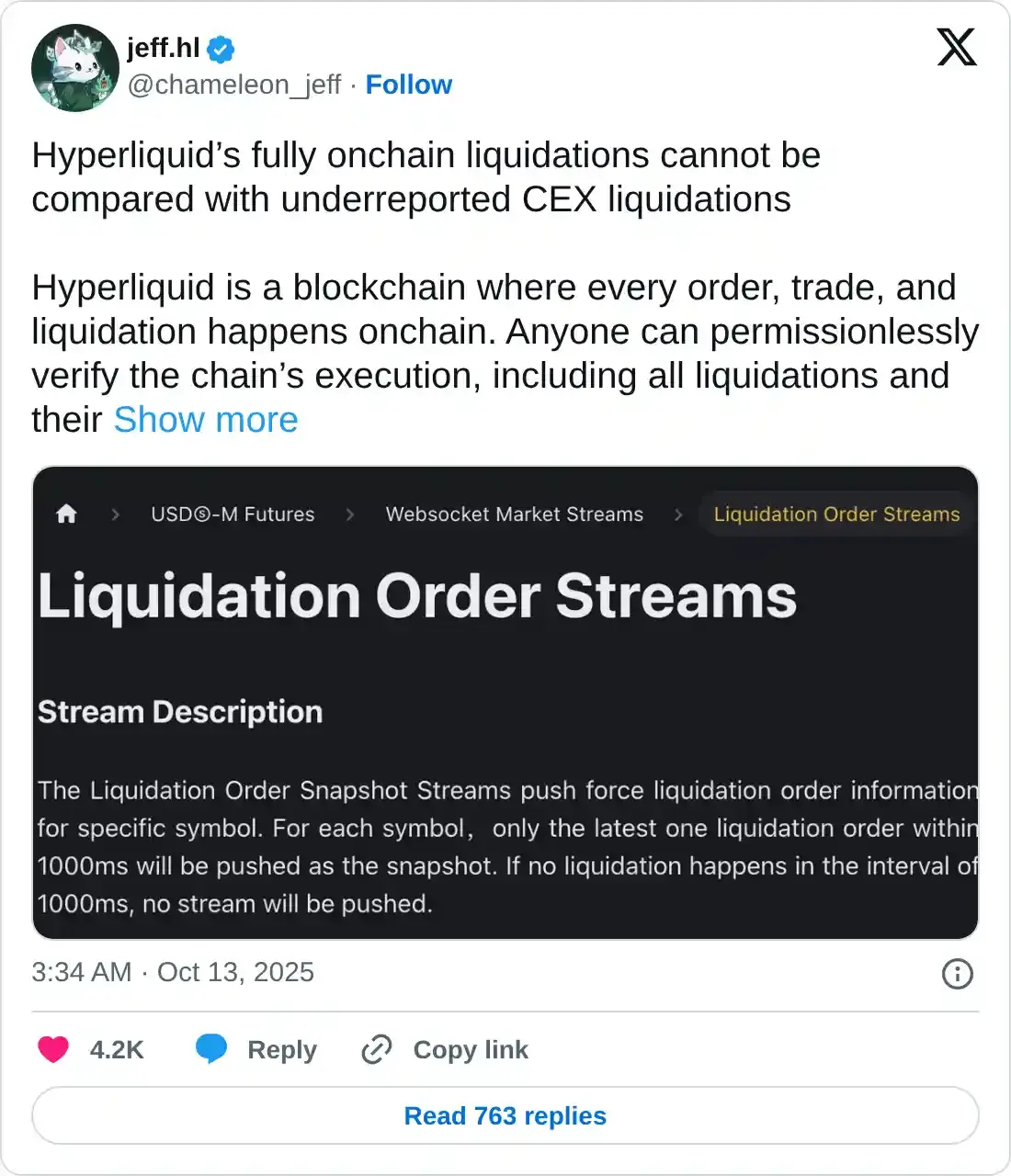

However, the market remains on edge over the value of liquidations. On Monday, Hyperliquid’s founder, Jeff Yan, shared in a post on X a technical limitation of the Liquidation Order Snapshot Stream in Binance. This stream shares the liquidation data but pushes the snapshot of the latest single liquidation event with a 1000 milliseconds (ms) time gap.

Jeff says "Hyperliquid’s fully on-chain liquidations cannot be compared with underreported CEX liquidations", arguing that on on-chain systems, "anyone can permissionlessly verify the chain’s execution, including all liquidations and their fair execution for all users." Furthermore, anyone can verify the solvency of the entire system in real time. Hyperliquid’s CEO complains that "some CEXs publicly document that they dramatically underreport user liquidations.".

Jeff also highlights that during market volatility, as it happened on Friday, liquidations occur in bursts, and the release of just one liquidation order in a 1000ms gap could lead to serious underreporting.

Crypto market recovers from the largest liquidation event

The cryptocurrency market capitalization stands at above $3.85 trillion on Monday, reclaiming over half of the $400 billion lost on Friday. Similarly, retail interest has returned according to CoinGlass data, showing the futures Open Interest rising to $164 billion. A rebound in OI refers to traders reacquiring long positions, anticipating a bottom formation.

Total crypto market capitalization daily price chart.

Notably, the future OI dropped to $154.88 billion on Saturday, from $220.36 billion on Friday, reflecting a decline in the notional value by nearly $66 billion. The futures OI refers to the notional value of all open contracts that could be leveraged, distinguishing this decline from the liquidation value.

Cryptocurrency market futures Open Interest. Source: CoinGlass

Still, if true, the underreporting claims could increase leverage exposure in the short-term recovery, considering that the market cycle has hit bottom, and affect the hedging strategies of institutional investors.