POPULAR ARTICLES

- Dash records a 31% rise in the last 24 hours, approaching the $100 psychological level on the Aster listing.

- Aster marks a falling channel pattern after Changpeng Zhao acquires over 2 million tokens.

- Internet Computer takes a breather after a 24% surge on Sunday.

Dash (DASH), Aster (ASTER), and Internet Computer (ICP) outperform the broader cryptocurrency market during the weekend rally. DASH extends rally approaching the $100 mark on Aster-listing gains, while ASTER and ICP take a breather.

Dash targets the $100 breakout rally

Dash ticks higher for the fourth consecutive day, rising over 2% at press time on Monday, following a 21% increase the previous day. The recent listing on the Binance-backed Decentralized Exchange (DEX) Aster fuels the DASH rally.

The uptrend approaches the $100 level, and a decisive close above this level could target the R3 Pivot Point at $108.

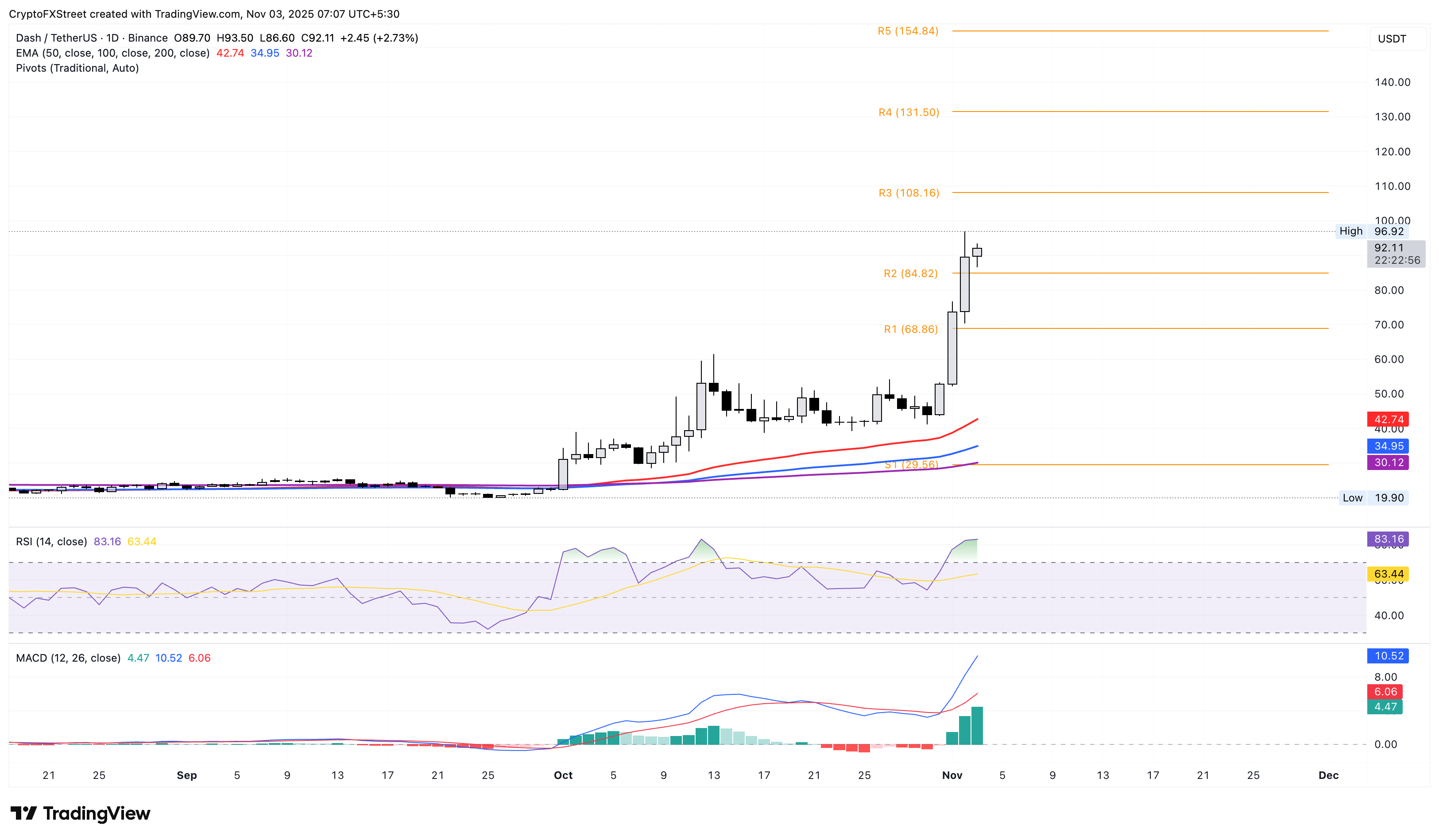

A steady uptrend in the 50-day, 100-day, and 200-day Exponential Moving Averages (EMAs) suggests a strong bullish trend.

The momentum indicators on the daily chart suggest elevated levels of buying pressure as the Relative Strength Index (RSI) reads 83, hovering in the overbought zone. Meanwhile, the Moving Average Convergence Divergence (MACD) displays the average line on a parabolic rise, suggesting strong bullish momentum.

DASH/USDT daily price chart.

On the other hand, the key support levels for DASH are located at $84 and $68, marked by the flipped R2 and R1 Pivot Points, respectively.

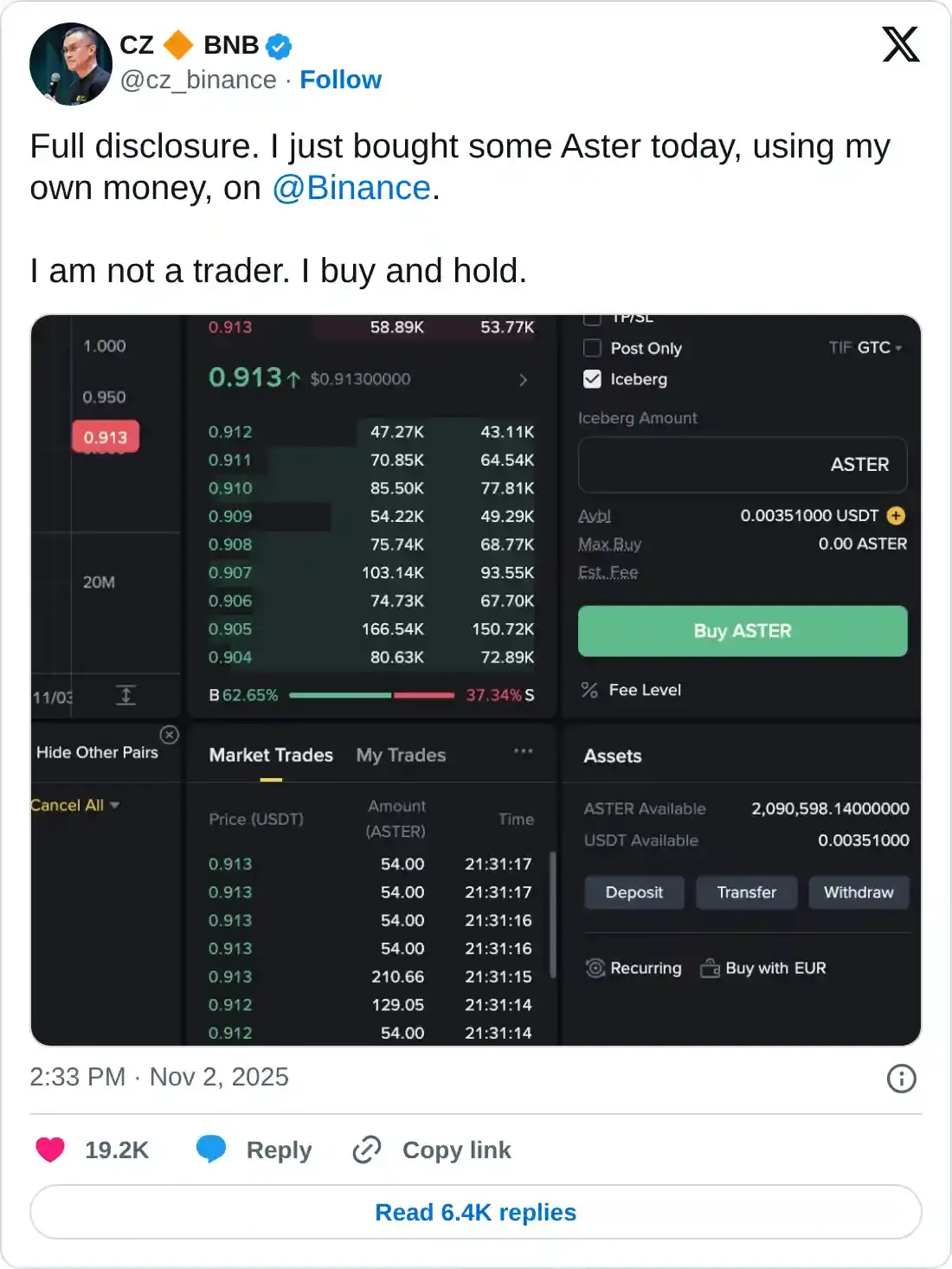

Aster rally gains strength with Changpeng Zhao’s buy-and-hold move

Changpeng Zhao, ex-CEO of Binance, officially announced purchasing over 2 million ASTER tokens on Sunday, igniting the weekend surge. Zhao reinforces his buy-and-hold strategy in his announcement, a strategy previously demonstrated with BNB tokens, which he acquired during the Token Generation Event (TGE).

Aster’s falling channel breakout rally on the 4-hour chart, triggered by the 27% rise on Sunday, struggles to surpass the $1.29 resistance level. At the time of writing, ASTER is down over 4% on Monday, risking a pullback to the $0.93 support, marked by the October 23 low.

A potential breakout of the $1.29 level could extend the rally to the $1.59 level, marked by the October 13 high.

However, the RSI reads 60 on the 4-hour chart, reverting from the overbought zone as buying pressure declines. At the same time, the MACD and signal line gradually move closer, risking a potential crossover that could trigger a bearish shift.

ASTER/USDT 4-hour price chart.

If the DEX token retests $0.93, it would nullify the falling channel breakout rally, risking further losses.

Internet Computer breakout hits the 100-day EMA resistance

Internet Computer trades above the $4 mark at press time on Monday, following the 24% gains on Sunday. The ICP token rally exceeds a local resistance trendline, formed by connecting the August 13 and October 5.

However, the rally faces opposition from the declining 100-day EMA at $4.28, resulting in the trendline retest near $4.11. If ICP rebounds above $4.28, it could target the 200-day EMA at $4.99.

The RSI is at 64 on the daily chart after a sharp increase from near the overbought zone towards the overbought boundary. The further space available before the overbought zone suggests upside potential.

Furthermore, the MACD and signal line are rising towards the zero line, aiming to cross into positive territory, which would confirm a bullish shift in trend momentum.

ICP/USDT daily price chart.

Looking down, if ICP breaks below the 50-day EMA at $3.80, it could extend the decline to the central Pivot Point at $2.93.