ARTIKEL POPULER

- Bitcoin's price followed institutional demand over the past year.

- The trend aligns with price gains following Strategy's $1.25 billion worth of BTC purchase, alongside strong inflows into Bitcoin ETFs.

- A decline in the number of BTC holders has preceded a price rise over the past two months.

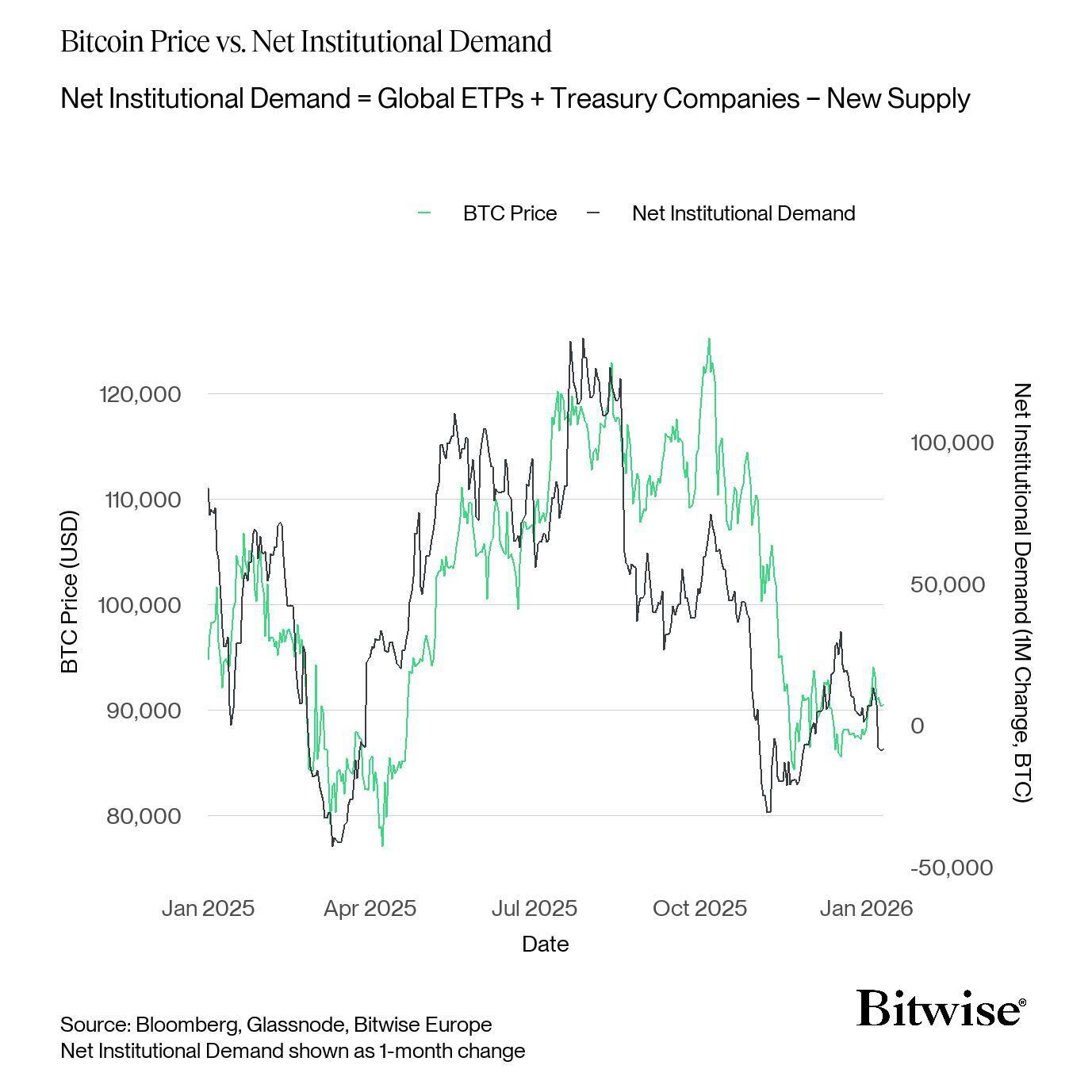

Bitcoin's price has largely tracked net institutional demand over the past year, according to Bitwise. Net institutional demand is the buying activity of global exchange-traded products (ETPs) and treasury companies minus new supply.

The trend played out again after Strategy (formerly MicroStrategy) purchased $1.25 billion in BTC, alongside $753 million in net inflows into US spot BTC exchange-traded funds (ETFs).

Following the move, Bitcoin rose above $97,000 for the first time in three months on Wednesday. The top crypto has continued to extend its post-Consumer Price Index (CPI) gain, rising 6.7% over the past two days.

The rise has triggered over $360 million in BTC short liquidations in the past 24 hours, the largest since the October 10 leverage flush, according to Coinglass data. The largest single liquidation order occurred on the HTX exchange, wiping out a BTC-USDT position worth $34.9 million.

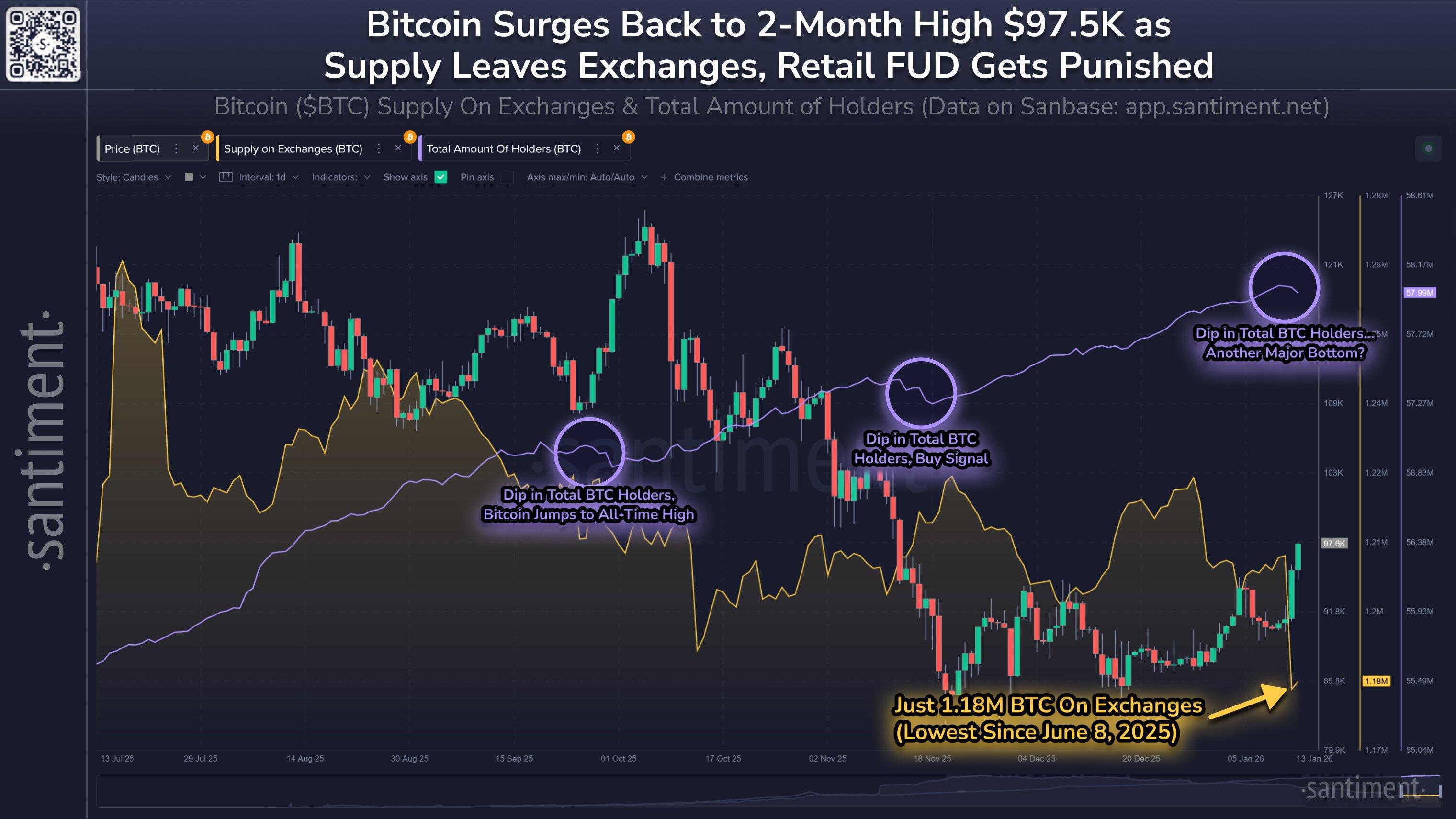

Decline in number of holders precedes price rise

The price rise coincides with a 47,244 decrease in the number of BTC holders, a move that has preceded gains on three occasions over the past two months, according to Santiment data. At the same time, the supply of Bitcoin on exchanges dropped to 1.18 million BTC, a seven-month low.

"When non-empty wallets drop, it's a sign that the crowd is dropping out (a good sign)," wrote Santiment in an X post on Wednesday. "Similarly, less supply on exchanges decreases the risk of a selloff."

Bitcoin is trading near $97,100, up 2% over the past 24 hours, at the time of publication on Wednesday.