ARTIKEL POPULER

National Bank of Canada’s Taylor Schleich and Ethan Currie argue that, under current regulations, the Federal Reserve has limited room for major further reductions in its balance sheet, now around $6.5 trillion after prior QT. They highlight that liabilities such as reserves and the Treasury General Account constrain asset shrinkage and expect no restart of QT, only modest tweaks to reinvestment strategy.

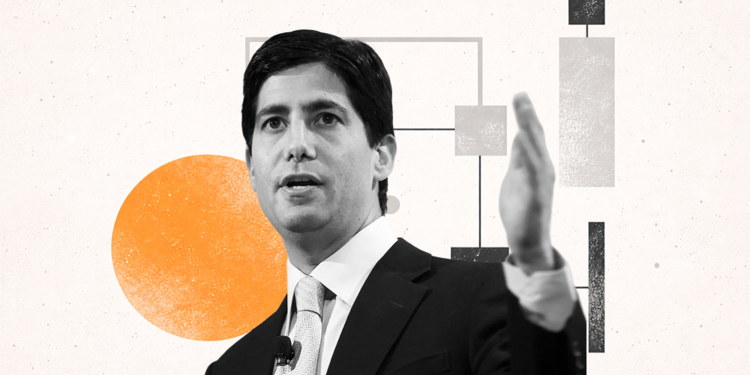

Warsh’s stance and QT constraints

"In summary, we view the scope for major further reductions to the Fed’s balance sheet as limited under the current regulatory framework."

"Financial market deregulation—reducing the demand for reserves and allowing banks to absorb the Fed’s Treasuries—would create scope to lessen the FOMC’s portfolio. Still, there are risks when the most stable and predictable buyer/holder of Treasuries is replaced by riskier entities."

"Ultimately, it’s the Fed’s liabilities that drive their assets. Currency demand grows with the economy and the TGA is dictated by the Treasury."

"Without reducing the demand for reserves (chiefly, through regulation), scope for further asset run-off is limited unless the Fed becomes comfortable with greater volatility in funding markets."

"Since QT ended, outright UST buying has all been in T-bills, lowering the duration of the Fed’s portfolio. While we don’t think Warsh will shrink the balance sheet much more, this strategy could be used more (e.g., reinvest UST proceeds in shorter-term debt vs. proportionately on the curve)."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)