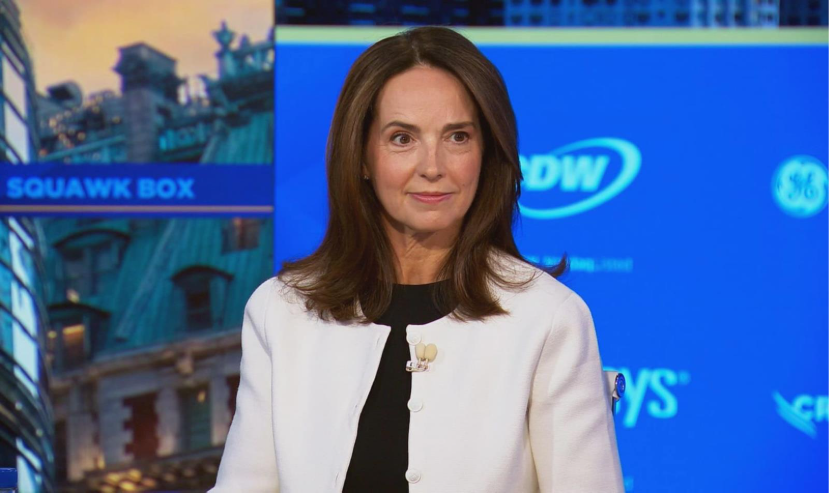

OpenAI’s Chief Financial Officer Sarah Friar’s comments about seeking a government “backstop” have stirred market concerns. Although she issued a swift clarification within hours, fears have already been triggered about the AI industry’s potential overreliance on government support and a budding bubble. At the same time, Deutsche Bank is quietly discussing ways to hedge its large exposure to AI infrastructure, including potentially shorting a basket of AI stocks.

OpenAI CFO Sarah Friar says company is not seeking government backstop

OpenAI financing remarks ignite market panic

At a “Tech Live” event on Wednesday, OpenAI CFO Sarah Friar said the company is looking to build an ecosystem of banks, private funds, and a federal government “backstop” or “guarantee” to help finance its massive chip investments.

When the host pressed whether this implied federal subsidies, she responded affirmatively, saying she was referring to “backup or guarantees that can help secure financing.” The remarks quickly sparked concern that AI giants might need U.S. government guarantees to sustain their hefty investment commitments. As sentiment intensified, Friar moved fast to clarify on Thursday via her LinkedIn page, stressing that “OpenAI is not currently seeking a government ‘backstop’ for its infrastructure investment commitments.” She explained that her use of the word “backstop” had caused confusion; what she meant was that America’s tech leadership requires real industrial capacity, with the private sector and government each playing their roles.

OpenAI CEO Sam Altman also stepped in, stating clearly, “We are not asking for and will not seek government guarantees for OpenAI data centers.” He further explained that Friar’s actual intention was to propose that the U.S. government establish a “national strategic compute reserve” and sign substantial compute procurement agreements—serving the public interest rather than enriching any single private company.

Despite the rapid clarifications from OpenAI executives, the market still responded with a sharp selloff. The Nasdaq fell 1.9%, the S&P 500 dropped 1.12%, and the Dow slipped 0.84%, with AMD, NVIDIA, Qualcomm, Oracle and others moving lower together. Meanwhile, broader concerns are spreading. Michael Burry, the investor whose story inspired The Big Short, shared data showing that the five-year CAGR of capital expenditures in the U.S. tech sector has reached 18.1%, comparable to the 1999–2000 dot-com bubble era.

David Sacks, an AI adviser to the Trump administration, responded to the situation by stating unequivocally that “the federal government will not bail out AI.” He added, “The U.S. has at least five major frontier AI model companies—if one fails, others will take its place.”

Deutsche Bank’s hedging move

Amid rising volatility, Deutsche Bank is exploring ways to hedge its exposure to the AI sector. According to two people familiar with the matter, the bank has begun discussing the possibility of shorting a basket of AI stocks.

“Deutsche has extended significant loans to the data-center industry,” said a banking executive with knowledge of the matter. “They’re now considering using tools like synthetic risk transfer (SRT) to protect those positions, which is standard risk-management practice.” However, the person emphasized that these discussions remain preliminary, and whether they proceed will depend on how market conditions evolve.

DA Davidson analyst Gil Luria warned that OpenAI is in no position to fulfill so many investment commitments. He estimates that OpenAI may lose around $10 billion this year, and noted that “fake it till you make it” is a creed many Silicon Valley firms subscribe to—part of which relies on getting people involved in the process.

Michael Burry sounded an even harsher warning on social media. His firm, Scion Asset Management, has concentrated roughly 80% of its positions on shorting Palantir and NVIDIA, with a notional value exceeding $1 billion.

This wave of market turmoil, sparked by a single “misstatement,” exposes the AI industry’s real-world dilemma: while requiring massive capital outlays, it must still prove the sustainability of its business models to the market. As institutions like Deutsche Bank begin considering risk hedges, the AI sector may indeed be facing a major test.