Reversal Candlestick Patterns

What is Price Action? A Quick Overview

Before diving into reverse candlesticks, it's important to grasp the basics of price action. Price action is the study of historical prices to identify patterns and make trading decisions.

Unlike other forms of analysis that rely on indicators or algorithms, price action focuses purely on the price itself. This approach is particularly popular among traders using platforms like TMGM, where a direct understanding of the market's movements can give you a strategic edge.

Reverse Candlesticks: Your Key to Market Reversals

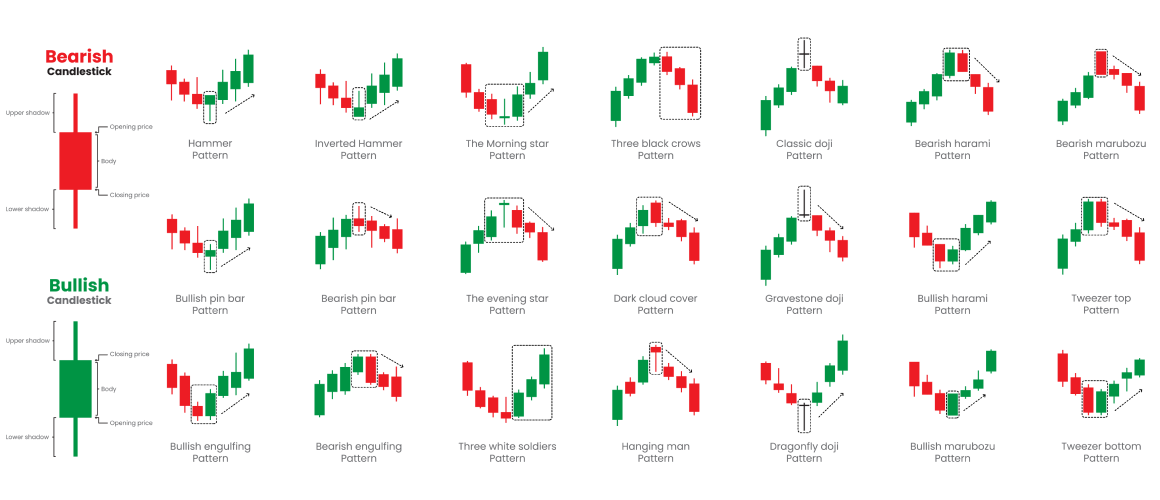

Reverse candlesticks are specific patterns within price action that indicate a potential reversal in market direction. These patterns are formed when a bullish or bearish trend begins to lose momentum, and a shift in the opposite direction is likely to occur.

Recognizing these patterns can be particularly advantageous when trading on TMGM, as they offer early warning signs that allow you to adjust your strategy accordingly.

Key Reverse Candlestick Patterns

Doji Candlestick

The Doji is a common reverse candlestick pattern that occurs when the open and close prices are almost identical, signaling indecision in the market. On TMGM, spotting a Doji after a strong trend may indicate a potential reversal.

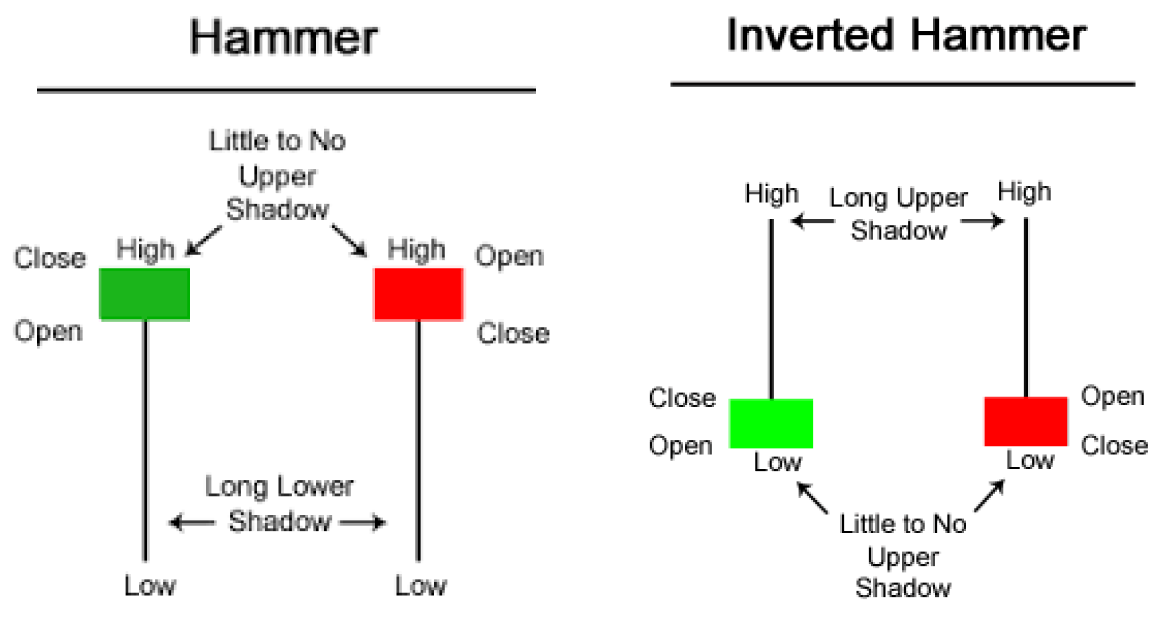

Hammer and Inverted Hammer

Source: Commodity.com

These patterns are characterized by a small body and a long lower or upper wick. A Hammer forms after a downtrend, suggesting a potential bullish reversal, while an Inverted Hammer appears after an uptrend, signaling a possible bearish reversal. Recognizing these on the TMGM platform can help you anticipate shifts in price action.

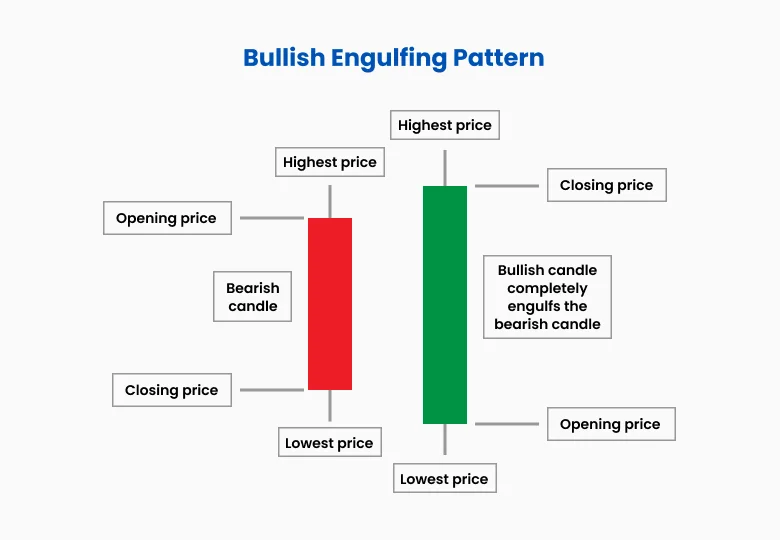

Engulfing Candlestick

An Engulfing pattern occurs when a small candle is followed by a larger candle that completely "engulfs" the previous one. A Bullish Engulfing pattern after a downtrend can indicate the beginning of an upward trend, while a Bearish Engulfing pattern after an uptrend can suggest a downturn is imminent.

How to Trade Reverse Candlesticks on TMGM : A Step-by-Step Guide

Step 1: Monitor Price Action Closely

To effectively trade reverse candlesticks on TMGM, closely monitor your chosen asset's price action. Look for signs of exhaustion in the current trend, which often precedes a reversal. Understanding price action becomes crucial here, as it allows you to identify potential entry and exit points with greater accuracy.

Step 2: Identify Reverse Candlestick Patterns

Once you've established a baseline for the price action, start looking for reverse candlestick patterns. Whether it's a Doji, Hammer, or Engulfing pattern, these formations can signal that a reversal is likely. On TMGM, you can use advanced charting tools to spot these patterns in real-time, ensuring you’re always one step ahead of the market.

Step 3: Confirm the Signal

Before making a trade based on a reverse candlestick pattern, confirming the signal is essential. This can be done by looking at additional price action indicators, such as support and resistance levels, or by observing the volume to see if it aligns with the reversal signal. TMGM's platform offers various tools to help you validate these patterns before taking action.

Step 4: Execute Your Trade

Once you’ve confirmed the reversal signal, executing your trade is time-consuming. Whether you’re entering a new position or exiting an existing one, use TMGM’s order execution features to set up stop-losses and take-profit levels, effectively managing your risk.

Trading Safely with TMGM

When trading on TMGM, it’s important to ensure that your strategies comply with regulations set by major authorities such as the EU and the Australian Securities and Investments Commission (ASIC).

Understanding price action and reverse candlesticks can help you make informed decisions that comply with these regulations. Additionally, to protect your capital, always employ risk management techniques, such as setting stop-loss orders and limiting exposure.

Leveraging Price Action and Reverse Candlesticks on TMGM

Mastering price action, especially through the lens of reverse candlestick patterns, can significantly enhance your trading performance on TMGM. By understanding and identifying these key patterns, you’ll be better equipped to anticipate market reversals and make strategic trades. As with all trading strategies, continuous learning and practice are essential, so take the time to refine your skills and explore the powerful tools available on TMGM.