What is CFD Trading?

A Contract for Difference (CFD) is a popular financial instrument that allows traders to speculate on the price movement of assets, like the DAX Index, without actually owning them. When trading CFDs, you enter into a contract with your broker. If you predict the price correctly, you’ll profit based on the difference between the asset’s opening and closing prices. However, if the price moves against your prediction, you’ll incur a loss based on that difference. Here are a few fundamental aspects of CFD trading:

Long and Short Positions: CFDs allow traders to profit from both rising (long position) and falling (short position) markets, providing flexibility in all market conditions.

Leverage: One of the main attractions of CFD trading is leverage, which allows you to control a larger position with a smaller initial investment. However, while leverage can amplify profits, it also increases potential losses, making risk management crucial.

No Ownership: Unlike traditional investments where you own the asset, CFD trading only involves speculating on price changes. This can be advantageous in terms of lower fees and easier access to international markets but also means you don’t gain any ownership rights, dividends, or voting rights on the stocks.

Why Trade the DAX Index with CFDs?

The DAX is a popular index among CFD traders because of its liquidity, volatility, and representation of the German economy. Here’s why it attracts traders globally:

Leverage Opportunities: Leveraged trading allows you to amplify your trading capital. For example, with 10:1 leverage, a £1,000 investment can control a £10,000 position. While this can increase profits, using leverage wisely is essential, as it can also magnify losses.

High Volatility and Liquidity: The DAX is known for its volatility, with prices often moving sharply in response to economic data, geopolitical events, and market sentiment. This volatility provides numerous trading opportunities. Additionally, high liquidity ensures that trades can be executed quickly, reducing slippage.

Ability to Trade in Both Bull and Bear Markets: Unlike traditional stock investments that primarily benefit from rising prices, CFDs allow you to profit from upward and downward trends. If you anticipate a drop in the DAX, you can open a short position and potentially profit if the index declines.

Extended Trading Hours: Many CFD brokers offer extended trading hours for the DAX, allowing traders to react to economic events and news outside standard market hours. This flexibility is particularly beneficial in today’s interconnected global economy, where developments in Asia or the U.S. can impact European markets.

Steps to Begin Trading DAX CFDs

1. Choose a Reliable Broker

Selecting a reputable broker is essential for CFD trading on the DAX. Look for brokers offering competitive spreads, robust trading platforms, and educational resources. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular for CFD trading due to their analytical tools, customizable charts, and ease of use.

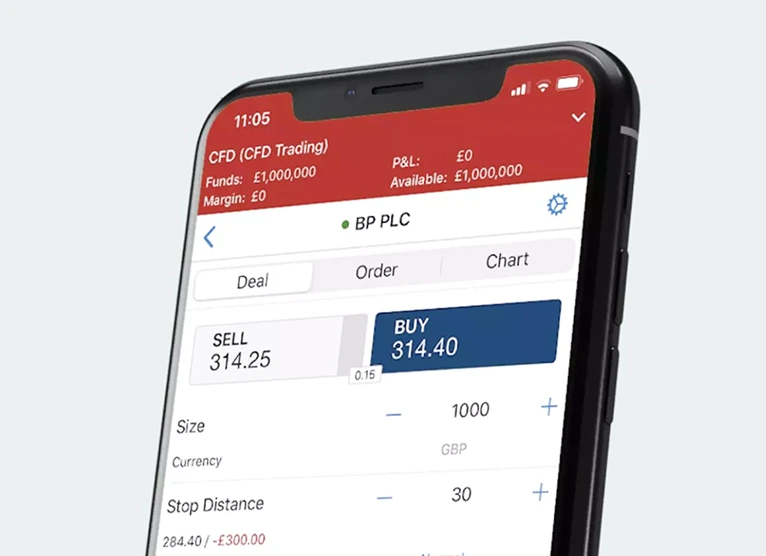

2. Set Up a Trading Account

Once you’ve chosen a broker, you must set up an account. Most brokers require identity verification and financial information to comply with regulatory standards. Many brokers also offer demo accounts, allowing you to practice trading without financial risk. This is a good way to get familiar with the platform and develop your trading strategy.

3. Fund Your Account

After opening your account, transfer funds to begin trading. Most brokers accept funding methods, including bank transfers, credit cards, and e-wallets. Be aware of minimum deposit requirements and any potential currency conversion fees if your funds are not in the currency used by the broker.

4. Analyze the DAX Index

Before placing trades, conduct both technical and fundamental analysis to assess market conditions. Fundamental analysis includes understanding macroeconomic factors, such as German GDP, inflation rates, and the performance of major DAX-listed companies. Technical analysis, on the other hand, involves reading price charts, using indicators, and identifying trends or patterns that suggest potential entry or exit points.

5. Develop a Trading Strategy

A solid trading strategy is essential for long-term success in CFD trading. Common strategies for trading the DAX include:

Trend Following: Identifying and trading along the current market trend.

Breakout Trading: Entering trades when the price breaks through a significant support or resistance level.

Mean Reversion: Taking positions based on the expectation that the price will revert to an average level after a significant move.

A strategy with clear entry and exit points and risk management rules helps maintain consistency and discipline.

6. Place Your Trade

Once confident in your analysis and strategy, decide whether to go long or short based on your market outlook. Determine your position size and set up stop-loss and take-profit levels to manage risk. These tools automatically close your position at predetermined profit or loss levels, protecting you from excessive losses or helping lock in gains.

7. Monitor and Adjust Your Position

Market conditions can change rapidly, so keeping an eye on your active trades is essential. Regularly monitor economic news releases, especially those impacting Germany and the broader EU, and adjust your position to align with updated market conditions.

Key Tips for Beginners

Use Leverage Cautiously: While leverage can enhance returns, it also increases risk. It is advisable to start with lower leverage levels until you gain more experience.

Practice on a Demo Account: Before trading with real money, use a demo account to refine your strategy and gain familiarity with the platform.

Stay Updated: Watch global news, as economic events and policies in the US., Europe, and Asia can influence the DAX.

Set Stop-Losses: Stop-loss orders are essential in managing risk, as they automatically close your position when it reaches a specified loss level.

Avoid Overtrading: Focus on quality trades rather than placing too many trades without a clear analysis or rationale.

Benefits and Risks of DAX CFD Trading

Benefits

Profit from rising or falling markets

Access to leverage for efficient capital use

Flexible trading hours for reacting to global events

Risks

Amplified losses due to leverage

Market volatility can lead to rapid price changes

The complexity of CFDs may require in-depth knowledge of trading and risk management

Conclusion

Trading CFDs on the DAX Index offers traders a flexible and potentially profitable way to engage with the German market. With the ability to trade on rising and falling prices and the benefits of leverage, DAX CFDs appeal to traders looking for dynamic opportunities.

However, success requires thorough research, a disciplined trading strategy, and strong risk management practices. For beginners, starting with a demo account and familiarizing yourself with the nuances of CFD trading on the DAX can pave the way for a more informed and confident trading journey.

By using a broker with the right tools and resources, traders can gain valuable insights, hone their strategies, and navigate the DAX market more easily. Remember, CFD trading on indices like the DAX can be rewarding but inherently risky, so always trade cautiously and continually improve your knowledge and strategies.