POPULAR ARTICLES

Ethereum price today: $3,540

- BitMine acquired 110,288 ETH last week, pushing its holdings to 2.9% of Ethereum's circulating supply.

- BMNR shares gained over 4% on Monday following its latest purchase.

- ETH is testing the $3,660 level after a weekend recovery above the $3,470 resistance.

Ethereum (ETH) saw a brief spike above $3,600 on Monday as BitMine Immersion (BMNR) increased its stash by over 110,000 ETH.

BitMine adds over 110,000 ETH, reaches 2.9% of circulating supply

Ethereum treasury company BitMine Immersion's holdings have crossed the 3.5 million ETH mark as the company continued its buying spree of the second-largest cryptocurrency.

The Nevada-based firm stated that it capitalized on the decline in crypto prices last week to acquire 110,288 ETH.

"The recent dip in ETH prices presented an attractive opportunity and BitMine increased its ETH purchases this week," said BitMine Chairman Thomas Lee in a Monday statement.

BitMine's holdings now account for 2.9% of the total ETH circulating supply, bringing it closer to its 'alchemy of 5%' of ETH goal.

The firm also increased its cash balance to $398 million, while maintaining a Bitcoin holding of 192 BTC and a $61 million stake in Worldcoin (WLD) treasury Eightco Holdings (ORBS).

BitMine shares gained over 4% at the time of publication following its latest treasury update. The rise comes after last week's decline, which was driven by $438 million in weekly outflows from global Ethereum investment products, according to data compiled by CoinShares.

Meanwhile, investment firm ARK Invest, led by technology investor Cathie Wood, increased its position in BitMine last week. The company bought $9.2 million in BMNR shares across three of its actively managed ETFs.

BitMine ranks as the largest Ethereum treasury, followed by SharpLink Gaming (SBET) and The Ether Machine (ETHM), with holdings of 859,395 ETH and 496,712 ETH, respectively, according to the StrategicETHReserve website.

Ethereum Price Forecast: ETH faces $3,660 test after clearing the $3,470 resistance

Ethereum saw $85.3 million in liquidations over the past 24 hours, spearheaded by $48.4 million in short liquidations, per Coinglass data.

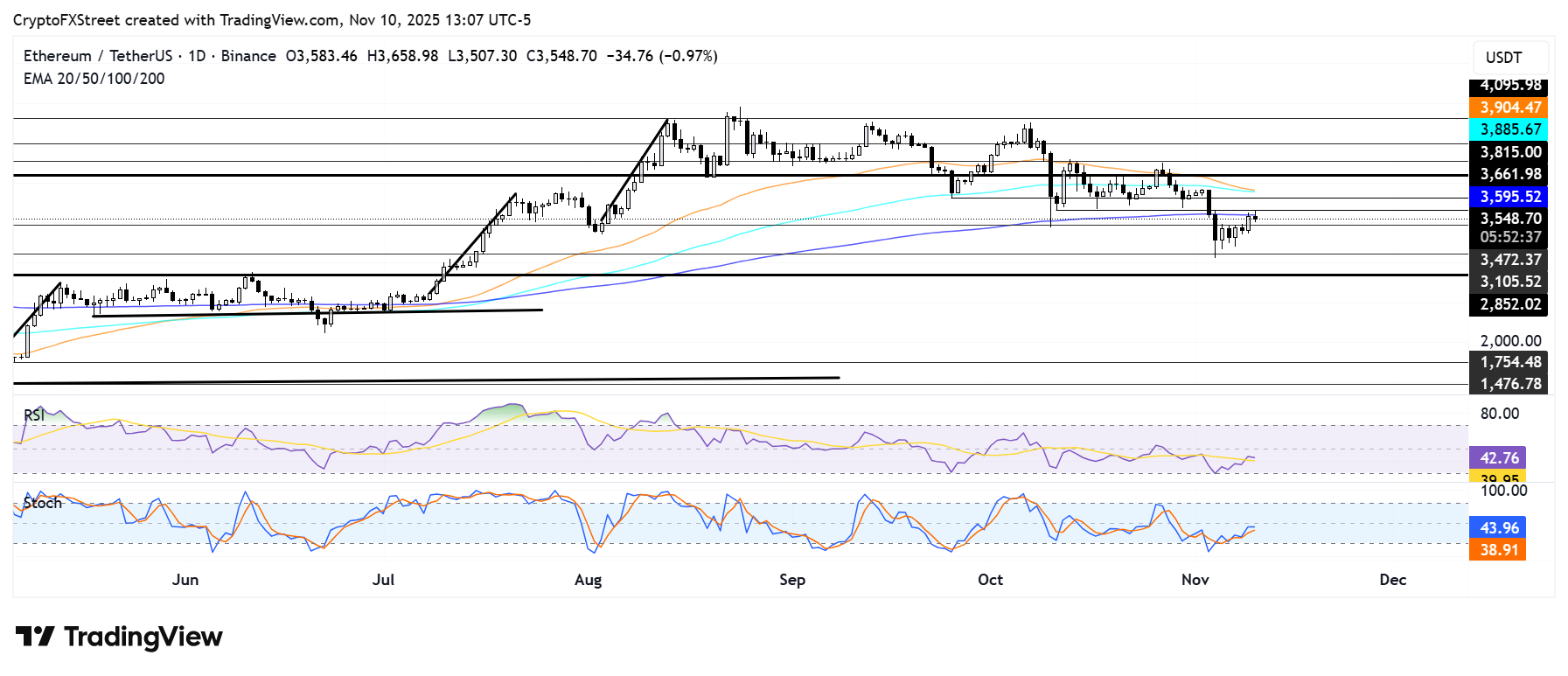

ETH recovered above the $3,470 resistance over the weekend, following four consecutive rejections at that level last week. The top altcoin is now testing the $3,660 level, just above the 200-day Exponential Moving Average (EMA).

A firm recovery above $3,660 could push ETH to test the convergence of the 50-day and 100-day EMAs slightly above the $3,815 level.

On the downside, ETH could find support near $3,100 if it breaks below $3,470.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending upward toward their neutral levels. A firm cross above in both indicators could help resume a dominance in bullish momentum.