POPULAR ARTICLES

LDP party will vote to select its leader on Sat. It is a full-spec vote, meaning that the election is conducted in its complete format. Each of the LDP's 295 Diet members will cast a vote, and another 295 votes will be determined based on ballots of rank-and-file members (about 1.1mio of them). If no candidate obtains an outright majority in the 1st round of the election, a runoff between the top 2 contenders will be held on the same day. USD/JPY was last at 147.50 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

2-way trades remained likely

"Public polls suggest that the race is tight between Takaichi and Koizumi. But the survey of LDP lawmakers shows more than 80 members endorse Koizumi, 60 backed Hayashi (chief cabinet secretary) while around 40 supported Takaichi. Sanae Takaichi who favours stimulus measures and was vocal against BoJ hiking rates, had suggested that she wants to review the US trade deal especially the $550 billion Japanese investment fund. Shinjiro Koizumi is an agriculture minister and was known as the 'Rice man' - responsible for bringing down rice prices."

"On monetary policy, Koizumi said he hoped the BoJ would work in lock step with the government to achieve stable prices and solid economic growth. We expect JPY weakness to reverse when political uncertainty fades and that BoJ to proceed with policy normalisation. Wage growth, broadening services inflation and upbeat economic activities in Japan should continue to support BoJ policy normalisation. The next meeting is on 30 Oct and another one in Dec. Markets are coming close to pricing in a hike at Dec meeting."

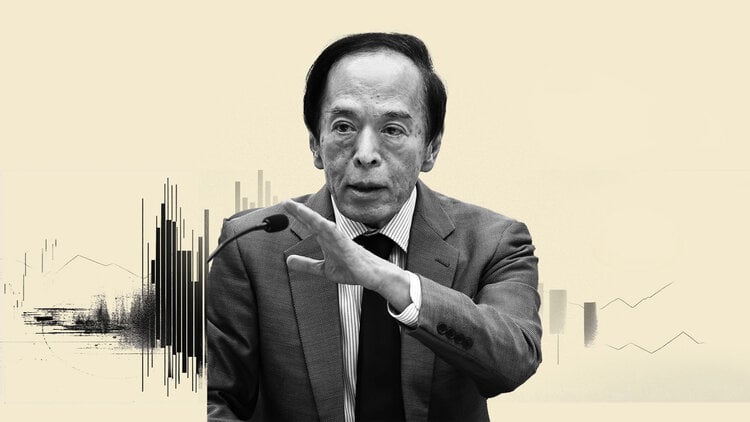

"USD/JPY saw upticks this morning on comments from BoJ Governor Ueda. He said that the BoJ will raise policy rate if its economic outlook is met and that it is necessary to watch global economics and tariff impact. He also expects wage-inflation cycle to be maintained and that price increases could last more than expected. Daily momentum is mild bearish but RSI rose. 2-way trades remained likely. Resistance at 147.80 (21, 50 DMAs), 148.20/30 levels (200 DMA, 23.6% fibo retracement of Apr low to Jul high). Support at 146.50/70 levels (100 DMA, 38.2% fibo) and 145.40 (50% fibo)."