- The Euro trims some of the recent losses but upside attempts remain capped below 1.1525.

- Upbeat US employment and services sector data keep US Dollar bearish attempts limited.

- Eurozone Retail Sales disappointed in September, adding weight on the Euro recovery.

EUR/USD posts moderate gains on Thursday, trading above 1.1500, although the pair is struggling to extend gains above 1.1525 following grim Eurozone Retail Sales data. The pair bounced up from three-month lows on Wednesday, amida brighter market mood as concerns about the US tech sector eased and European corporate earnings improved the outlook of the region's economy.

Data released by Eurostat revealed that Retail Sales in the Eurozone fell 0.1% in September, against expectations of a 0.2% increase, following a downwardly revised 0.1% drop in August. Year-on-year, Eurozone retail consumption grew at a 1% pace, as expected, down from 1.6% in August.

These figures are likely to weigh on the Euro recovery, especially after Wednesday's positive surprises on US employment and services activity cast further doubt on a Federal Reserve (Fed) interest-rate cut in December, underpinning support for the US Dollar.

The focus now shifts to a slew of Fed speakers, whose comments will be observed with interest after the positive surprise from the ADP Employment Report.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.17% | -0.04% | -0.09% | -0.05% | -0.07% | 0.07% | -0.11% | |

| EUR | 0.17% | 0.13% | 0.07% | 0.12% | 0.10% | 0.24% | 0.06% | |

| GBP | 0.04% | -0.13% | -0.04% | -0.01% | -0.03% | 0.12% | -0.07% | |

| JPY | 0.09% | -0.07% | 0.04% | 0.04% | 0.03% | 0.14% | -0.01% | |

| CAD | 0.05% | -0.12% | 0.00% | -0.04% | -0.01% | 0.10% | -0.06% | |

| AUD | 0.07% | -0.10% | 0.03% | -0.03% | 0.01% | 0.14% | -0.03% | |

| NZD | -0.07% | -0.24% | -0.12% | -0.14% | -0.10% | -0.14% | -0.18% | |

| CHF | 0.11% | -0.06% | 0.07% | 0.00% | 0.06% | 0.03% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Euro appreciates as risk aversion ebbs

- The Euro is trimming some losses amid a higher appetite for risk, with equity markets trading back in the green. A sharp recovery, however, is off the cards as the positive US data has strengthened the case for Fed hawks, which supports the USD.

- US data beat expectations on Wednesday, contributing to improving investors' mood. The ADP Employment Change showed 42,000 new jobs in October, after an upwardly revised 29,000 decline in September and beating expectations of a 25,000 increase.

- The US ISM Services Purchasing Managers' Index revealed a stronger-than-expected business activity. The index jumped to 52.4 in October from 50.0 in the previous month, above the 50.8 consensus. New Orders increased to 56.2 from 50.4.

- Market expectations of a Fed rate cut in December have declined to 62% from 68% earlier this week and above 90% before last week's monetary policy meeting, according to data from the CME Group's FedWatch Tool.

- Also on Wednesday, the final Eurozone HCOB Services PMI increased to 53.0 in October, up from the previous month's 51.3 reading, surpassing the preliminary estimate of 52.6.

- Estimates from the LSEG data firm released by Reuters revealed that European corporates are expected to report an average growth of 4.3% in the third-quarter earnings, beating expectations of the 0.4% growth forecasted by market analysts.

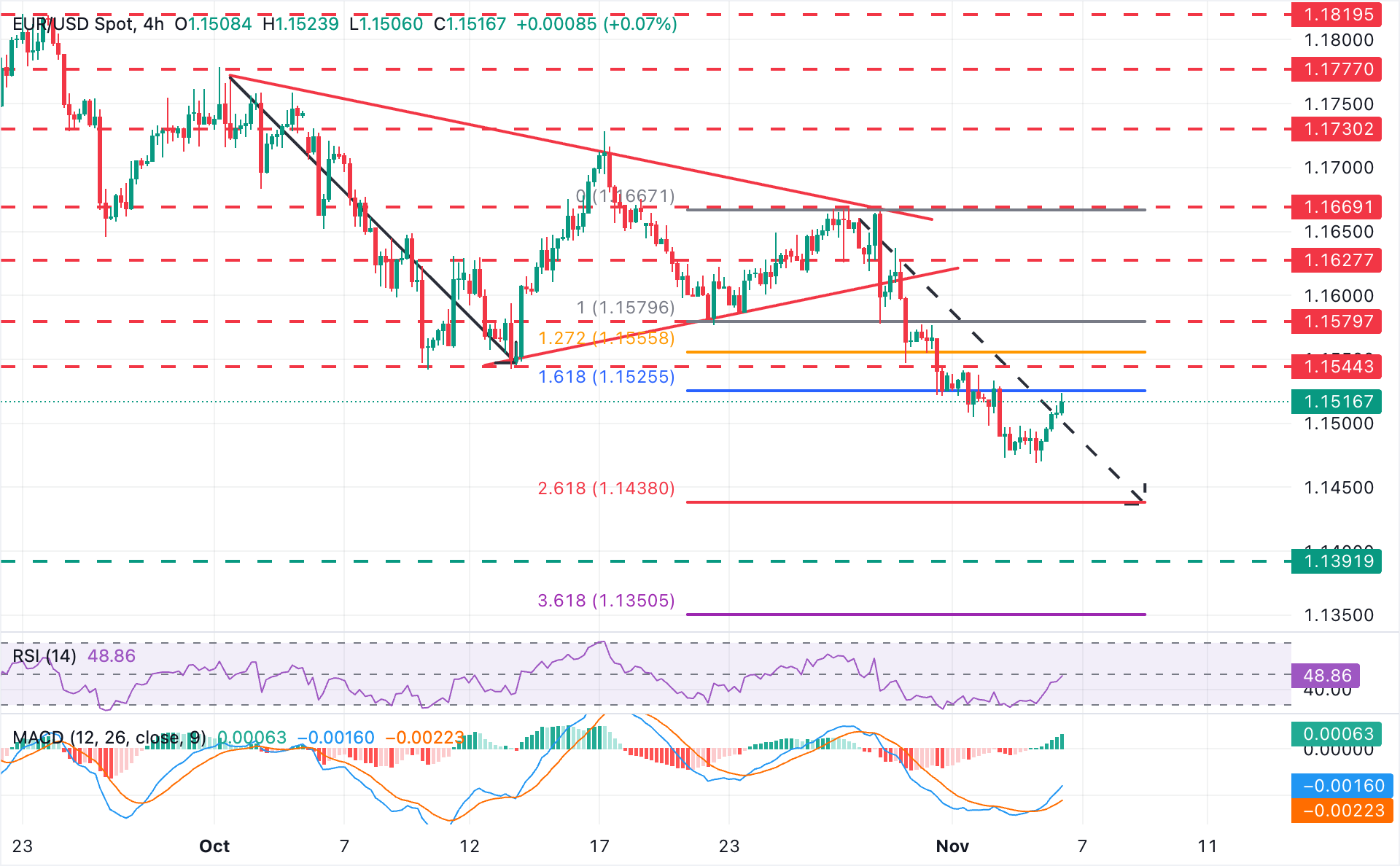

Technical Analysis: EUR/USD corrects higher within the broader bearish trend

The EUR/USD pair appreciates further on Thursday, putting some distance from the mid-term lows near 1.1470 hit earlier this week. The 4-hour Moving Average Convergence Divergence (MACD) has crossed above the signal line, and the Relative Strength Index (RSI) is about to test the key 50 area, which endorses the view of a bullish correction after a nearly 1.5% sell-off following the Fed's hawkish shift seen last week.

Bulls, however, are likely to meet significant resistance at a previous support area near 1.1545 (October 14, 30 lows). If this level gives way, the next target is around 1.1580 (October 22, 23 lows) ahead of 1.1635, the October 30 high.

On the downside, immediate support is in the area of 1.1470, which held bears on Tuesday and Wednesday. Further down, the measured target of the broken triangle pattern, which meets the price at the 261.8% Fibonacci retracement of the late October rally, is near 1.1440. August's low comes around 1.1390.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.