POPULAR ARTICLES

On Thursday, Banco de Mexico (Banxico) reduced interest rates by 25 bps as expected by analysts, leaving the main reference rate at 7.75%. The decision was not unanimous, as Deputy Governor Jonathan Heath, for the second consecutive meeting, voted to keep interest rates unchanged, with the rest of the board opting for an interest rate cut.

Banxico justified its decision based on the latest inflation reading, as headline inflation in July dipped within the Mexican institution 3% plus or minus 1% goal, to 3.51%, from 4.51% registered in the previous month. However, underlying inflation remains high, coming at 4.23% up from 4.20% for the same period.

In addition to this, Banxico considered “the behavior of the exchange rate, the weakness of economic activity, and the possible impact of changes in trade policies worldwide. It also considered the level of monetary restriction that has been implemented. Thus, with the presence of all its members, the Board decided by majority to lower the target for the overnight interbank interest rate by 25 basis points to 7.75%.”

Voting in favor of the decision were Victoria Rodríguez, Galia Borja, Gabriel Cuadra, and Omar Mejía.

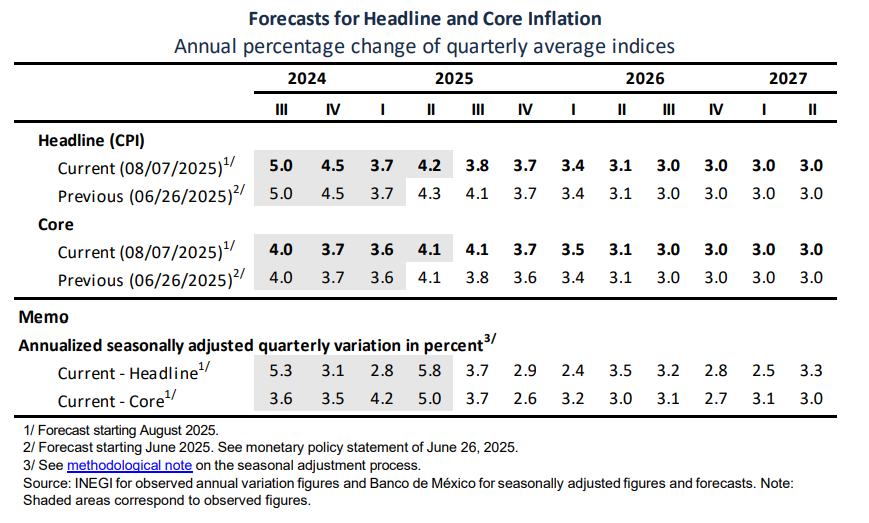

Banxico projections of inflation

USD/MXN Price Chart - Daily

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.