POPULAR ARTICLES

Bitcoin open interest has dropped off as the cryptocurrency’s price has slid over the past month, which an analyst argues could see Bitcoin hit a bottom and spark a “renewed bullish trend.”

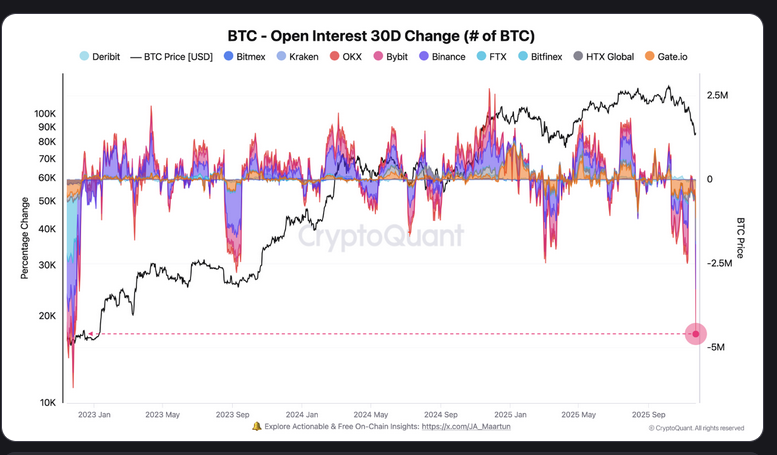

Open interest in terms of Bitcoin has seen its “sharpest 30-day drop of the cycle” at around 1.3 million BTC, currently worth $114 billion with Bitcoin trading at $87,500, analyst “Darkfost” posted to CryptoQuant on Sunday.

The cascading price of BTC over the past few weeks “continues to trigger liquidations,” pushing traders to double down or readjust their strategies. However, it now appears investors are halting futures trading to “reduce risk exposure.

Historically, these cleansing phases have often been essential to forming a solid bottom and setting the stage for a renewed bullish trend. Deleveraging, forced closures of overly optimistic positions and a gradual decline in speculative exposure help rebalance the market.

Darkfost noted that the last time Bitcoin open interest fell so quickly over 30 days “was during the 2022 bear market, which highlights how significant the current cleanup really is.”

Bitcoin has declined by 20% over the past month and has seen a decline of over 30% since hitting a peak of over $126,000 nearly two months ago in early October.

Bull market could return with climb above $90,000

Crypto analyst and MN Fund founder Michaël van de Poppe argued this coming week is going to be “decisive” for the price of BTC and chances of it hitting a new all-time high in the near future.

In an X post on Sunday, van de Poppe said that if BTC can surge back and stay between the region of $90,000 to $96,000, “then the chances of a revival toward a new ATH have significantly increased.”

“Fear and panic are max during the past days. Those are the best opportunities in the markets,” he said.