POPULAR ARTICLES

- XRP slides to $2.40 amid sticky bearish sentiment on Tuesday.

- Investors remain unfazed by Ripple’s partnership with Immunefi, which aims to test and strengthen the proposed XRP Ledger Lending Protocol.

- Low retail demand in the derivatives market subdues the odds of XRP’s recovery in the short term.

Ripple (XRP) is trading above $2.40 support at the time of writing on Tuesday, after breaking a three-day recovery streak in the wake of last week’s violent sell-off.

Meanwhile, after experiencing Friday’s dramatic deleveraging, XRP derivatives show signs of stability, which could usher in new opportunities in the coming weeks.

“With excessive leverage purged and structural risks reduced, the market setup now looks far healthier. We view the coming weeks as an opportune window for capital deployment,” K33 Research stated in the latest report.

Ripple and Immunefi collaborate on institutional lending protocol

Ripple announced on Monday that it has partnered with Immunefi, a platform dedicated to blockchain protection and security operations, to test the robustness of its proposed protocol.

The collaboration encompasses a $200,000 Attackthon, aimed at testing and strengthening the XRP Ledger Lending Protocol. Ripple stated that the program will run between October 27 and November 24, calling on security researchers to review the code and uncover vulnerabilities, and earn rewards in RLUSD.

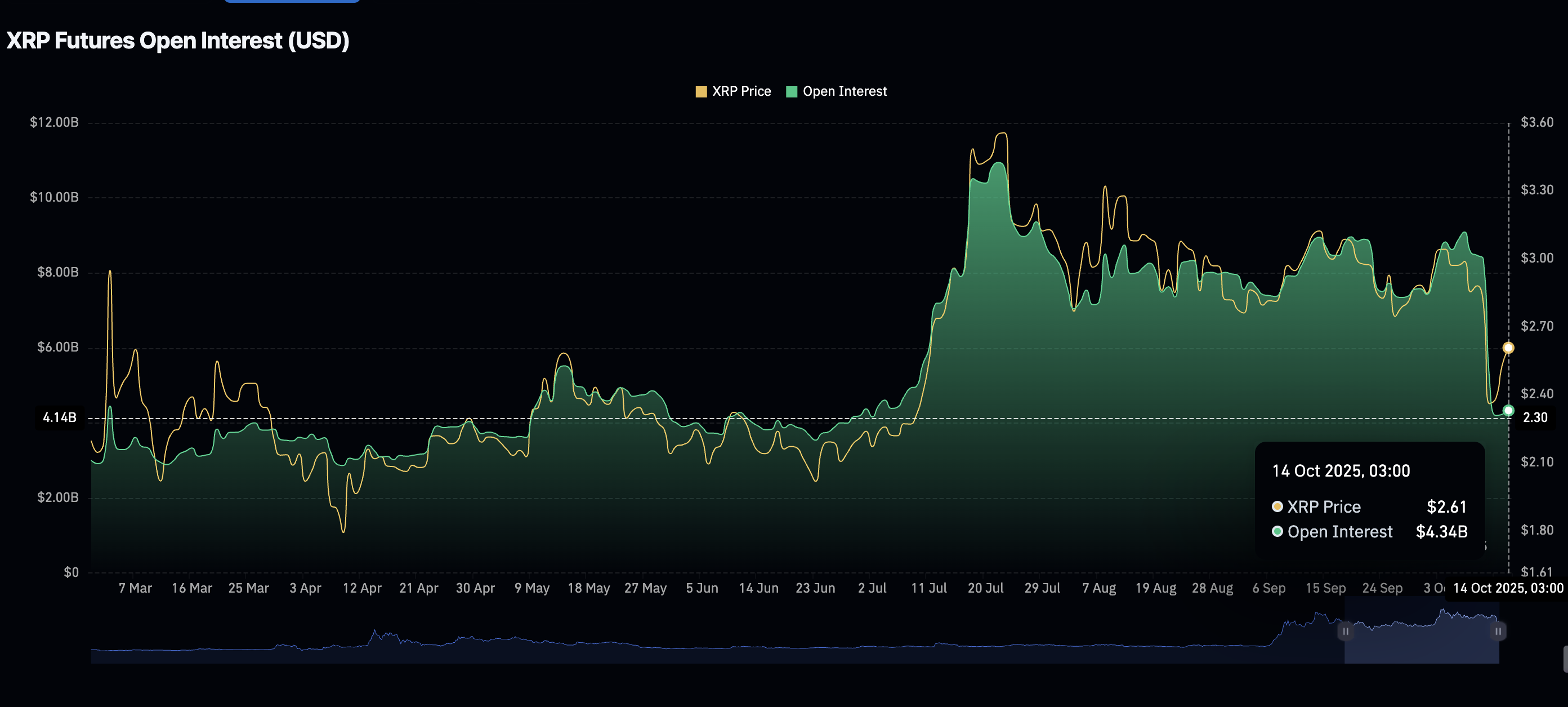

On the other hand, retail interest in XRP has stabilized in the past few days. However, it remains significantly below the level seen during last week’s deleveraging event, which triggered massive liquidations. The XRP futures Open Interest (OI) averages $4.34 billion on Tuesday, after increasing to approximately $9 million on October 7.

Still, a minor uptick from a four-month low of $4.2 billion, observed on Sunday, suggests that XRP has the potential to attract retail demand. An ascending OI trend would indicate that investors are strongly convinced of the token’s ability to sustain recovery.

XRP Open Interest | Source: CoinGlass

Technical outlook: XRP bulls defend key support

The price of XRP has been hammering on the short-term $2.40 support on Tuesday, following a rejection from the previous day’s high around the 200-day Exponential Moving Average (EMA) at $2.63 on the daily chart.

Investors are struggling to see a clear bullish narrative, especially with the Moving Average Convergence Divergence (MACD) indicator upholding a sell signal since Thursday.

The downtrending Relative Strength Index (RSI) at 35 in the same daily time frame indicates that bearish momentum is increasing. It would be an uphill task for bulls to defend the short-term support at $2.40 if the RSI extends its decline into oversold territory.

XRP/USDT daily chart

Key areas of interest include $2.00, which was tested in late June, and $1.61, last tested in early April. On the upside, traders will look out for a break above the 200-day EMA at $2.63 to ascertain the uptrend’s strength for an extended price action toward the $3.00 psychological level.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.