Bullish Reversal Patterns

These patterns appear after a downtrend and suggest a potential reversal to the upside.

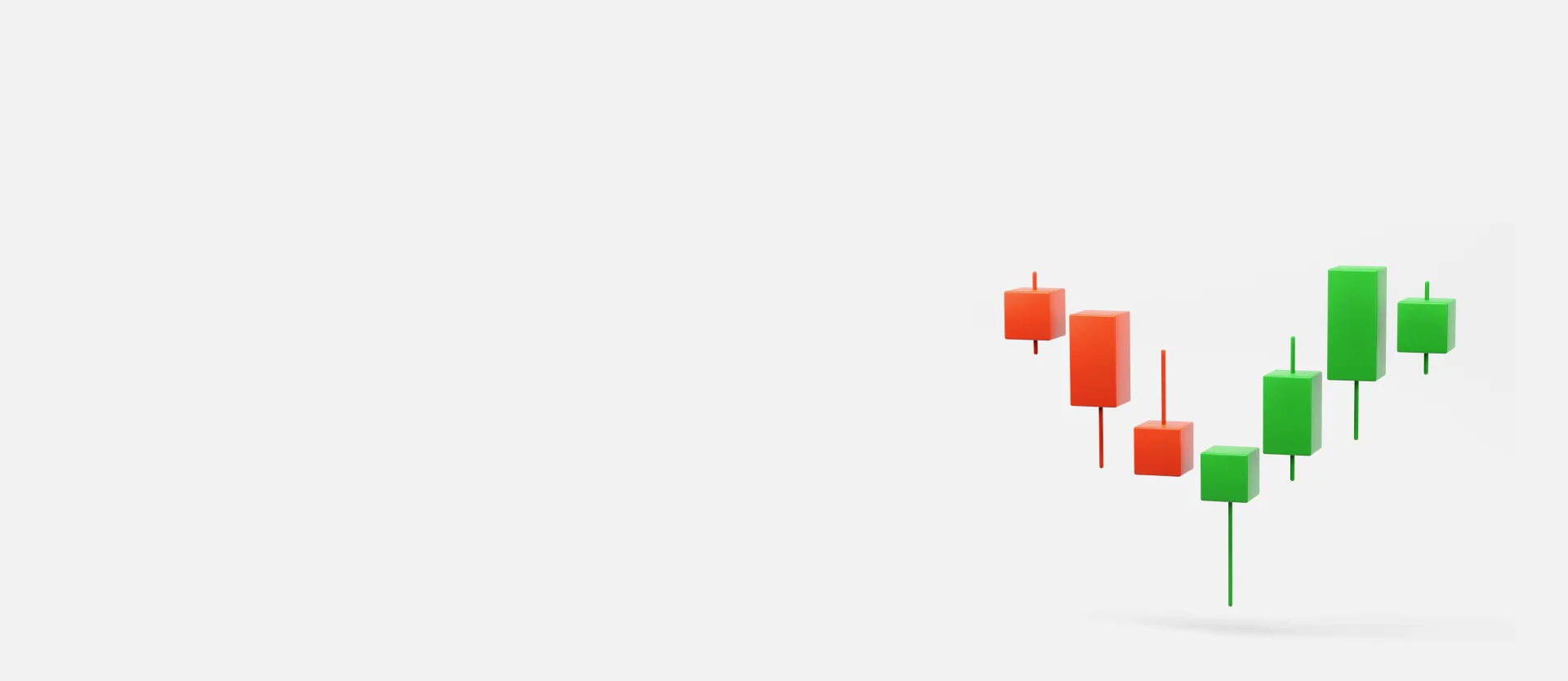

1. Hammer Candle

Description: A small body at the top with a long lower shadow that’s typically twice the size of the body.

Meaning: Indicates rejection of lower prices and signals potential buying pressure.

Context: Appears after a downtrend and often acts as the first sign of a bullish reversal.

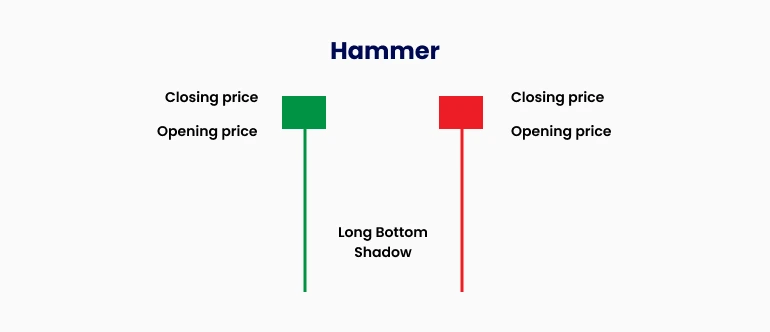

2. Inverted Hammer Candle

Description: A small body at the bottom with a long upper shadow.

Meaning: Suggests potential for a bullish reversal, as selling pressure diminishes near the end of a downtrend.

Confirmation: Requires a follow-up bullish candle to confirm the reversal.

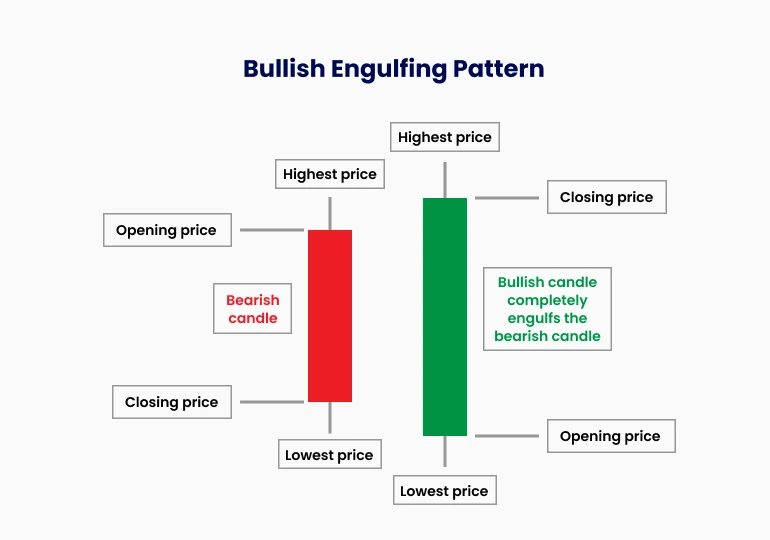

3. Bullish Engulfing

Description: A green (bullish) candle completely engulfs the previous red (bearish) candle.

Meaning: Shows strong buying momentum, often leading to further upward movement.

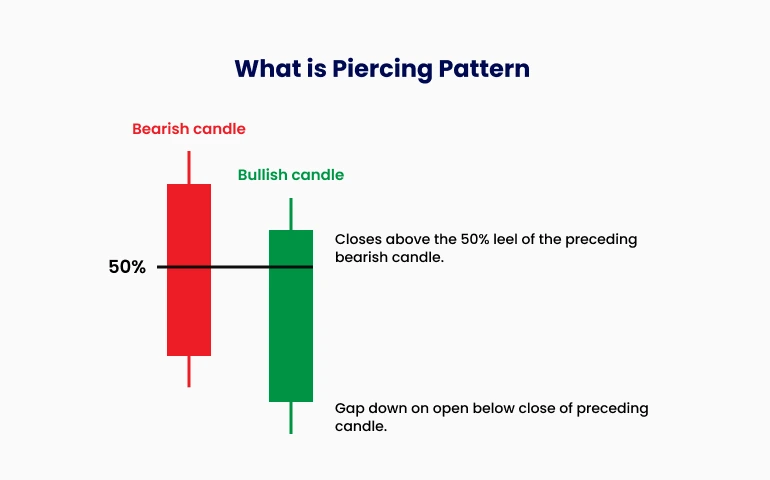

4. Piercing Line

Description: A two-candle pattern where the second candle opens lower but closes above the midpoint of the first bearish candle.

Meaning: Signals strong buyer intervention, hinting at a possible trend reversal.

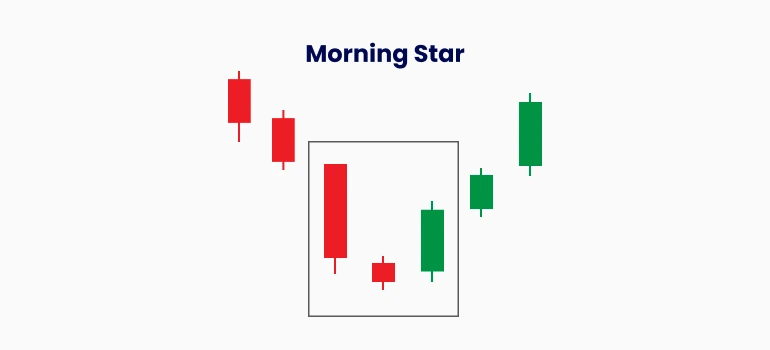

5. Morning Star

Description: A three-candle pattern consisting of:

A long bearish candle.

A small-bodied indecisive candle (gap down).

A bullish candle that closes into the body of the first bearish candle.

Meaning: Indicates a shift in momentum from sellers to buyers.

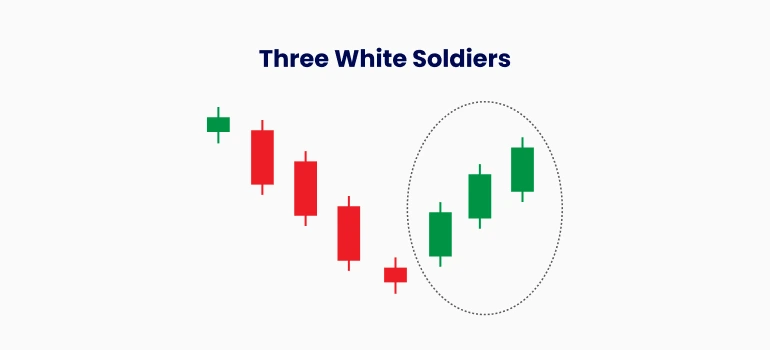

6. Three White Soldiers

Description: Three consecutive bullish candles with progressively higher closes.

Meaning: Reflects strong and consistent buying pressure, signalling a robust uptrend.

Bearish Reversal Patterns

These patterns occur after an uptrend and indicate potential downward price movement.

1. Shooting Star

Description: A small body near the bottom with a long upper shadow.

Meaning: Suggests rejection of higher prices, often signalling a reversal to the downside.

2. Hanging Man

Description: Similar in appearance to the Hammer but occurs at the top of an uptrend.

Meaning: Warns of potential bearish reversal as buying pressure weakens.

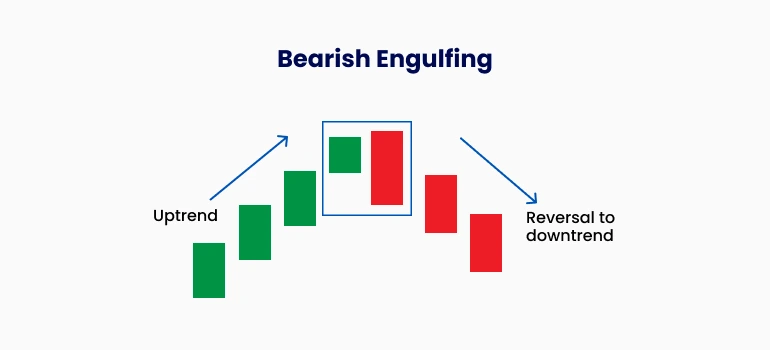

3. Bearish Engulfing

Description: A red (bearish) candle completely engulfs the previous green (bullish) candle.

Meaning: Indicates strong selling momentum and potential trend reversal.

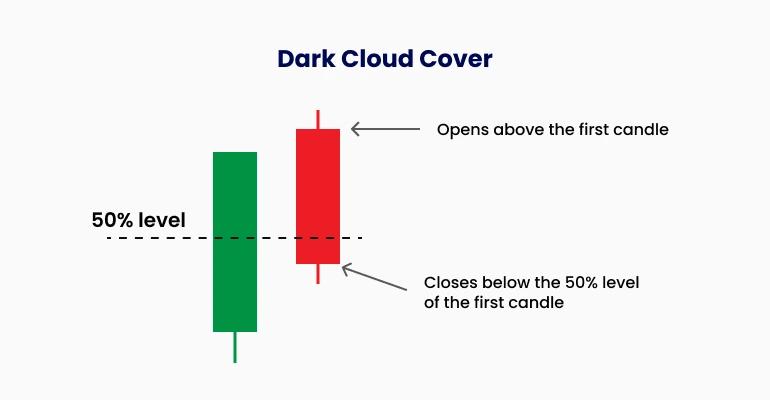

4. Dark Cloud Cover

Description: A two-candle pattern where the second candle opens higher but closes below the midpoint of the first bullish candle.

Meaning: Signals aggressive selling pressure, hinting at a reversal.

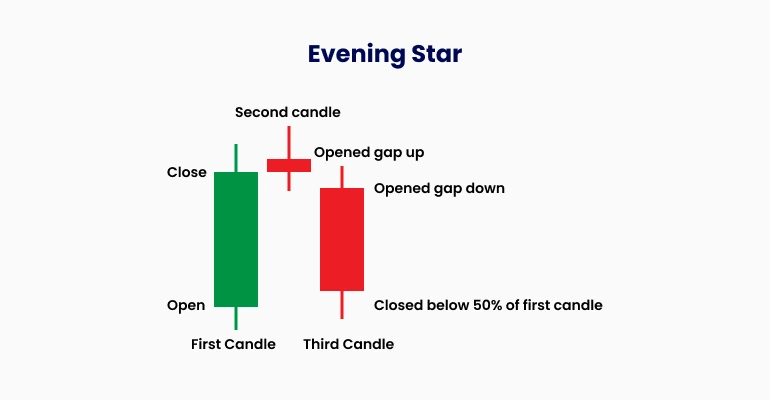

5. Evening Star

Description: A three-candle pattern consisting of:

A long bullish candle.

A small-bodied indecisive candle (gap up).

A bearish candle that closes into the body of the first bullish candle.

Meaning: Shows a transition from buying to selling dominance.

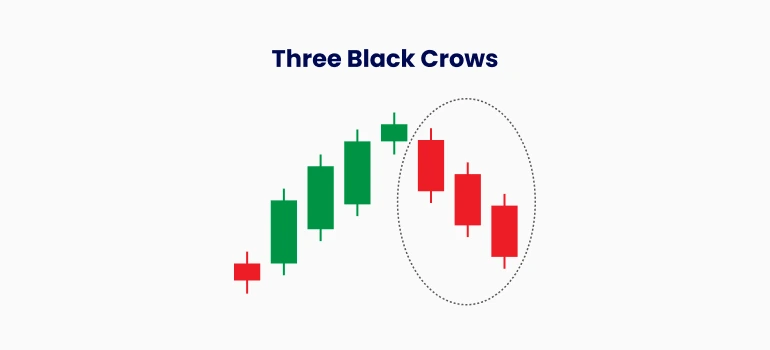

6. Three Black Crows

Description: Three consecutive bearish candles with progressively lower closes.

Meaning: Reflects strong and consistent selling pressure, signalling the start of a downtrend.

Neutral/Continuation Patterns

These patterns indicate market indecision or a continuation of the existing trend.

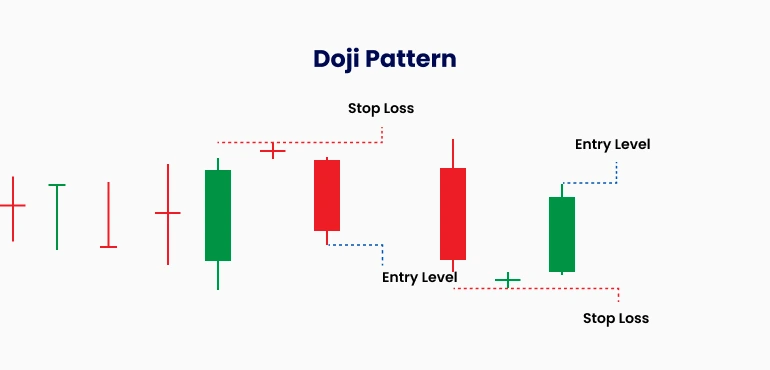

1. Doji

Description: A candle with little to no body, where the open and close prices are nearly equal.

Meaning: Reflects market indecision. Depending on the context, it can signal a reversal or continuation.

2. Spinning Top

Description: A small body with long upper and lower shadows.

Meaning: Indicates market indecision, often found during periods of consolidation.

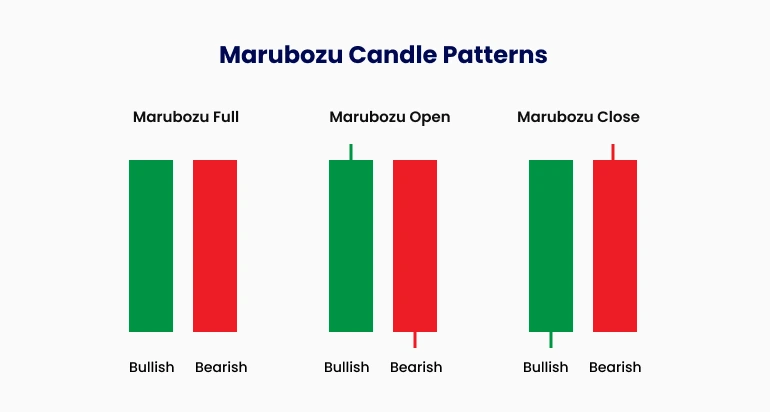

3. Marubozu

Description: A candle with no shadows, where the opening and closing occur at the extremes.

Bullish Marubozu: Shows strong buying momentum.

Bearish Marubozu: Indicates strong selling pressure.

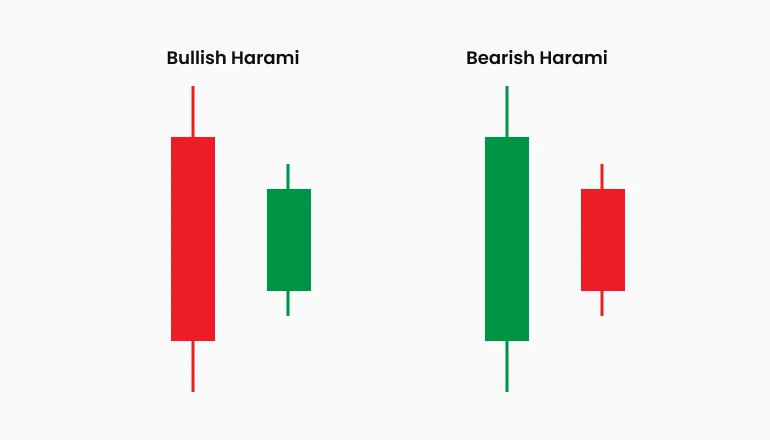

4. Harami

Description: A two-candle pattern where the second candle is smaller and contained within the body of the first.

Bullish Harami: Found at the bottom of a downtrend, signalling a potential reversal.

Bearish Harami: Found at the top of an uptrend, signalling a potential reversal.

Usage Tips

Combine Indicators: For better accuracy, use candlestick patterns alongside other tools like volume, RSI, or moving averages

Higher Timeframes: Patterns tend to be more reliable on higher timeframes.

Wait for Confirmation: Always look for additional signals (e.g., a follow-up candle) before acting.