인기 기사

Ethereum price today: $3,210

- Whales accumulated 190K ETH while retailers distributed more than 510K ETH last week.

- Weekly active addresses reached a record 706,000, while the daily transaction count surged to a new high.

- ETH could test the 200-day EMA if it sustains a bounce off a key ascending trendline.

Ethereum (ETH) saw mixed sentiments in its on-chain activity over the past week. While whales accumulated amid a surge in network activity, retailers distributed as escalating geopolitical tensions over Greenland eventually pulled down prices.

Whales and retailers move in opposite directions as network activity booms

Whales in the 10K-100K ETH bracket topped their collective holdings by a modest 190K ETH last week. The cohort remained largely silent for over a week, until last Wednesday, when they resumed accumulation.

However, buying faded again following geopolitical tensions between the US and key European countries.

-1768856255356-1768856255358.png)

On the other hand, retailers in the 1K-10K and 100-1K ETH range continued distribution, reducing their collective balance by more than 510K ETH over the past week.

The mixed sentiment among holders comes amid a steady increase in Ethereum's network activity. Over the weekend, weekly active addresses on the network spiked from levels previously reported to a new all-time high above 706,000, surpassing its May 2021 high. Similarly, daily transactions surged to a new all-time high.

-1768856287964-1768856287966.png)

Despite the surge, fees have continued to decline to new lows, a stark contrast with earlier years, when network activity growth often translated into high transaction costs. The change stems from a series of network upgrades over the years, with the most recent, Fusaka, increasing the gas limit and boosting Layer 2 throughput on mainnet.

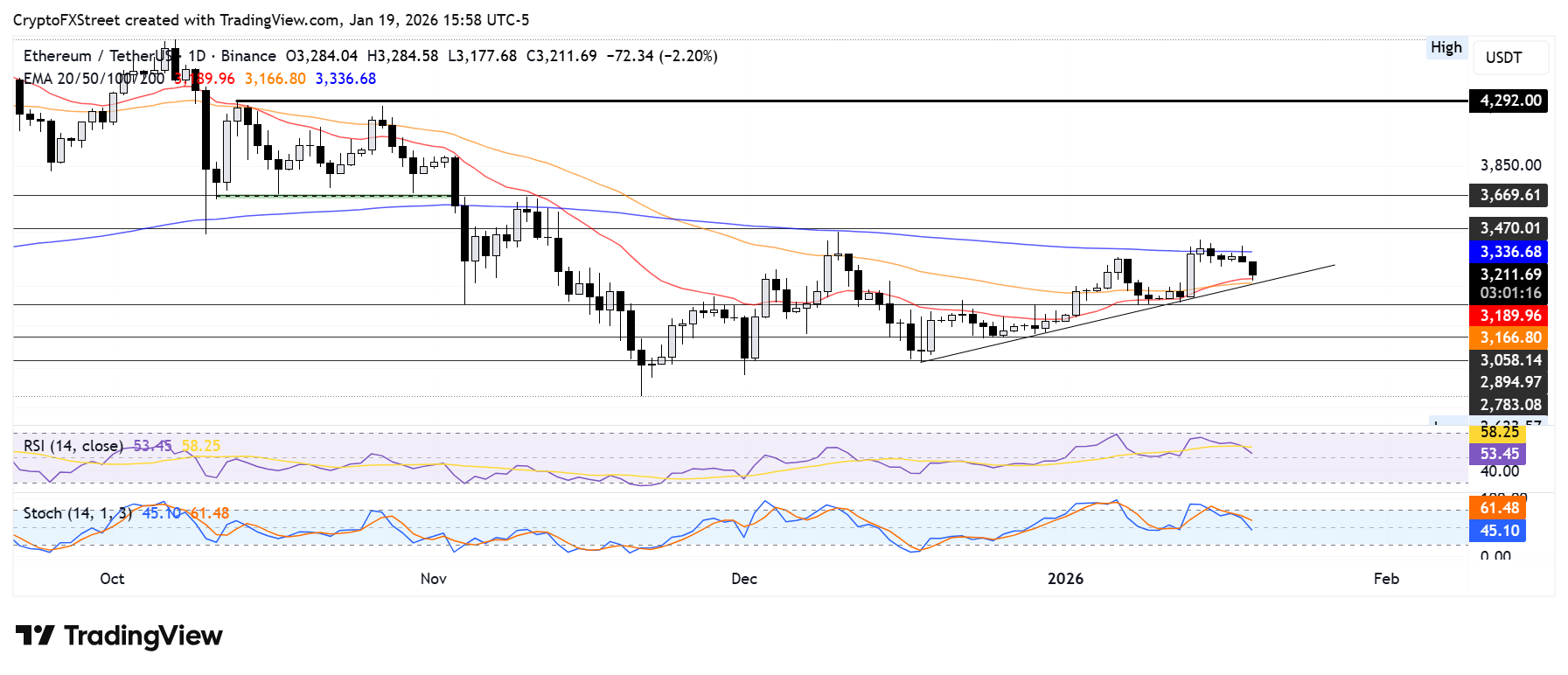

Ethereum Price Forecast: ETH could sustain bounce off ascending trendline and key EMAs

Ethereum has dropped by about 3.5%, sparking $120.6 million in long liquidations over the past 24 hours, according to Coinglass data.

The top altcoin bounced off an ascending trendline extending from December 18, near the 20-day and 50-day Exponential Moving Averages (EMAs). A decline below the trendline could see ETH find support around $3,050. On the upside, if ETH sustains a bounce off the trendline, it could tackle the 200-day EMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are declining and testing their neutral levels. A firm move below will accelerate the bearish momentum.