인기 기사

- Gold surges by over 1% as intervention rumors boost the Japanese Yen and drag the US Dollar to multi-month lows.

- DXY slides toward 97.80, fueling strong precious metals demand despite stable Treasury yields.

- Markets still price modest Fed easing in 2026, while the upcoming FOMC meeting looms as a key risk.

Gold (XAU/USD) surges during the North American session on Friday, up by over 1% as the US Dollar (USD) gets smashed on intervention rumors to propel the Japanese Yen (JPY) in the FX markets, amid an improvement in risk appetite that pushed the yellow metal to fresh all-time highs at $4,988.

Bullion hits fresh record highs as sharp Dollar losses outweigh improving risk sentiment and steady yields

Market mood remains upbeat, yet Bullion prices continue to run up as the US Dollar tumbles to its lowest level since October 2025. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, drops close to 0.50% at 97.79, after reaching a daily low of 97.70.

US Treasury bond yields remained stable during the day, even though economic data in the US revealed that American households are turning optimistic, following the University of Michigan Consumer Sentiment survey.

Earlier, business activity in the US improved, according to S&P Global. Despite this, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said that “A worrying subdued rate of new business growth across both manufacturing and services adds further to signs that Q1 growth could disappoint.”

US GDP figures for the third quarter of 2025 improved sharply and exceeded the forecast, with the economy rising 4.4% QoQ.

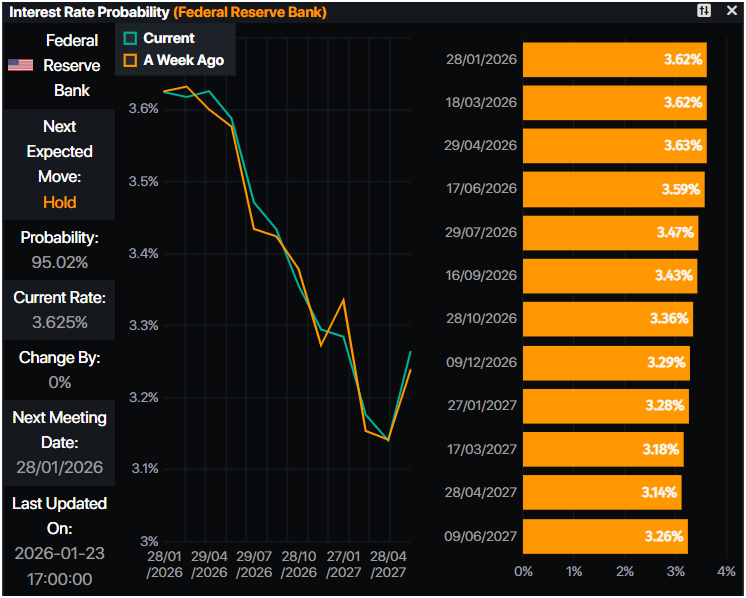

In the meantime, expectations that the Federal Reserve would cut rates in 2026 remained unchanged, with traders projecting 42.5 basis points of easing, according to Prime Market Terminal data.

If traders continued to trim Fed dovish bets, this should cap Gold’s advance, which is up 15% year-to-date (YTD), shy of the 39% reached by Silver since the beginning of 2026.

What’s ahead in the US economic docket?

Next week, traders will eye Durable Goods Orders, the ADP Employment Change 4-week average, the Federal Open Market Committee (FOMC) monetary policy meeting and the Fed Chair Jerome Powell press conference.

Daily digest market movers: Gold surges despite improving Consumer Sentiment

- Consumer Sentiment by the University of Michigan improved in January, climbed to a five-month high of 56.4, up from 54 in the preliminary estimate and above forecasts of 54. Despite improving, Joanne Hsu, the survey’s director, noted that consumers continue to feel pressure on purchasing power, citing elevated prices and concerns about a potential softer labor market.

- Inflation expectations for one-year slipped to 4% from 4.2% and for five-years dipped from 3.4% to 3.3%.

- S&P Global data indicated a modest improvement in US business activity in January, with the preliminary Composite PMI inching up to 52.8 from 52.7. However, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, cautioned that subdued new business growth across manufacturing and services raises the risk that first-quarter growth may underperform.

- The US 10-year Treasury Note is yielding 4.255% flat. US real yields, which are calculated with the nominal yield of the 10-year note minus inflation expectations for the same period, rise nearly three and a half basis points up at 1.945%, but fail to cap Bullion prices.

- US President Donald Trump said on Thursday that he has completed interviews for the next Federal Reserve (Fed) Chair and confirmed he has made his choice, adding that a formal announcement is likely before the end of January. Media reports suggest the shortlist includes Kevin Hassett, Rick Rieder, Christopher Waller, and Kevin Warsh.

Technical outlook: Gold price set to challenge $5,000 in the short-term

Gold’s parabolic uptrend extended for the fifth-straight day, with the yellow metal poised to challenge the $5,000 mark. Price action remains constructive, and bulls continued to gather momentum as shown by the Relative Strength Index (RSI), which, despite being overbought, cleared the latest peak, an indication that the uptrend remains strong.

If XAU/USD clears $5,000, the next key resistance levels would be $5,050 and $5,100. Conversely, if XAU/USD retreats below $4,950, the next support would be $4,900.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.