POPULAR ARTICLES

- XRP declines for three consecutive days, increasing the probability of plunging to $2.50.

- XRP futures post declining Open Interest as liquidations surge on the backdrop of risk-off sentiment.

- XRP on-chain activity slows with Active Addresses falling by more than half to 24,000 since mid-July.

Ripple (XRP) remains subdued as the bears extend control below the $3.00 pivotal level on Friday. The international money remittance token exchanges hands above the $2.80 round-number support, down nearly 5% at the time of writing.

XRP's decline can be attributed to several factors, including risk-off sentiment in the broader cryptocurrency market, suppressed interest in risk assets like cryptocurrency ahead of the Federal Reserve's (Fed) September interest rate decision, and a decline in on-chain activity.

If bulls fail to regain control in the upcoming sessions, XRP could kick off September on the back foot. With weak fundamentals taking center stage, technical indicators project an extended drawdown to the support at around $2.50.

XRP faces weak fundamentals amid suppressed on-chain activity

The drop in XRP price reflects a decline in on-chain activity. According to CryptoQuant data, the number of active addresses has plummeted over the last few weeks, from approximately 50,000 in mid-July to around 24,000.

The Active Addresses metric tracks the number of wallets actively interacting with the XRP Ledger (XRPL) by sending or receiving XRP. Hence, such a significant drop indicates a reduction in risk appetite as investors take a step back, leaving XRP susceptible to supply shocks.

-1756483115579-1756483115580.png)

XRP Active Addresses | Source | CryptoQuant

CoinGlass data mirrors the declining interest in XRP, highlighting a noticeable pullback in the futures Open Interest (OI) from $10.94 billion to $7.97 billion over the same period.

As OI declines, interest in XRP wobbles, implying a lack of conviction in the token's ability to recover or sustain an uptrend. This also increases the likelihood of the downtrend continuing in the short term.

XRP Futures Open Interest | Source: CoinGlass

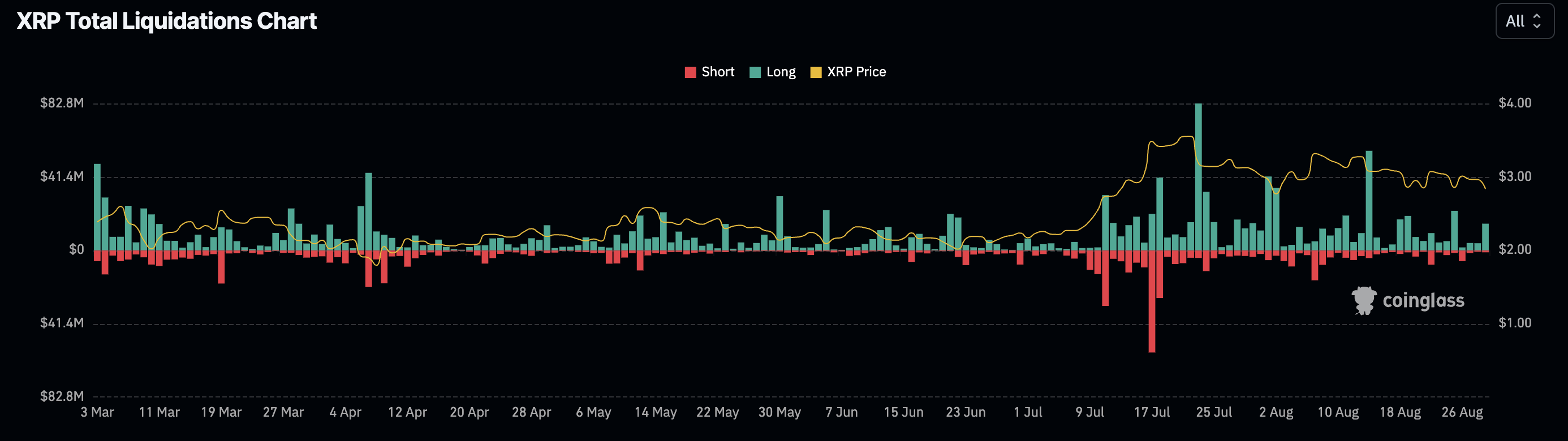

Liquidations have also been on the rise, with over $15 million wiped out in long positions in the last 24 hours. In comparison, short position holders have suffered only $1 million in liquidations, underscoring the risk-off sentiment gripping crypto markets.

XRP Futures Liquidations | Source: CoinGlass

Technical outlook: XRP bearish structure taking shape

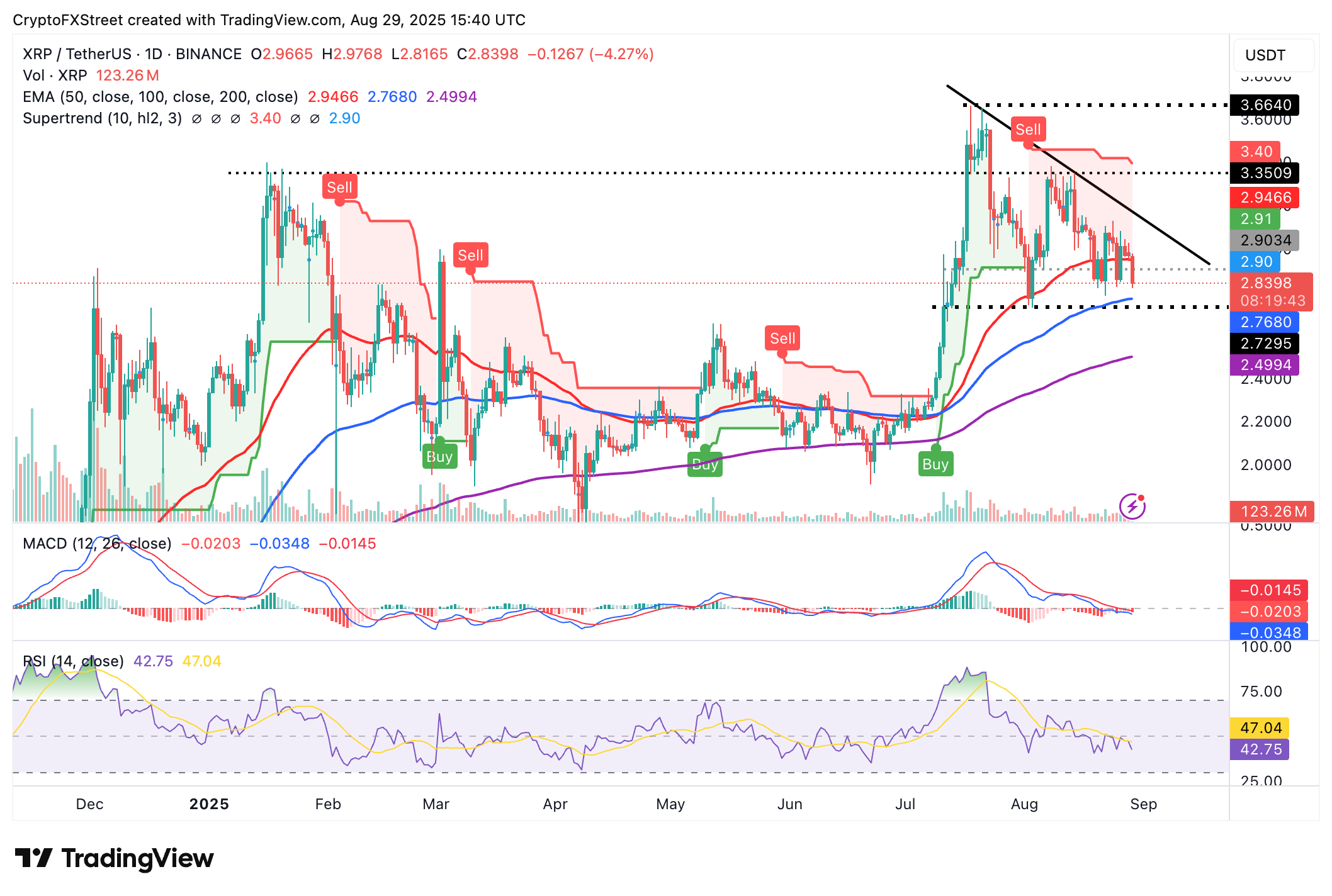

XRP price is trading below two key levels: the pivotal $3.00 and the 50-day Exponential Moving Average (EMA), signaling a shift in sentiment from bullish in July to bearish heading into September. Historically, September has been a bearish month in crypto, which could further cause sentiment to deteriorate.

The Moving Average Convergence Divergence (MACD) indicator's sell signal underlines the bearish outlook, with traders likely to continue de-risking to protect their capital.

A sharp decline in the Relative Strength Index (RSI) below the 50 midline indicates a reduction in buying pressure. Should the RSI at 40 extend the decline toward oversold territory, the path of least resistance could remain downward.

XRP/USDT daily chart

Key areas of interest to traders in the short term are the 100-day EMA at $2.76, which is poised to absorb selling pressure and prevent XRP from extending the pullback toward the 200-day EMA at $2.49.

Still, traders cannot ignore the possibility of a knee-jerk rebound, especially after Friday's sell-off across the crypto market. A reversal above $3.00 could restore retail interest in XRP and reinforce the bullish grip, paving the way for a breakout targeting its $3.66 record high.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.