인기 기사

- XRP edges lower as investors reduce exposure after the Fed’s rate cut.

- XRP faces subdued retail demand, with Open Interest averaging $3.72 billion, compared to the $10.94 billion record high.

- XRP ETFs extend mild inflows despite persistent risk-off sentiment in the broader crypto market.

Ripple (XRP) is trading above $2.00 at the time of writing on Thursday, weighed down by increasing selling pressure in the broader cryptocurrency market. Short-term technical signals underpin the bearish outlook, which could accelerate the downtrend toward April’s low of $1.61.

Meanwhile, the Federal Reserve (Fed) proceeded with the much-anticipated cut, bringing its benchmark lending rate to a range of 3.50%-3.75% on Wednesday. Despite meeting expectations, the rate cut was accompanied by a cautious tone.

Fed Chair Jerome Powell emphasized upside inflation risks and a slow labor market as factors that could support fewer rate cuts in the coming year, dampening sentiment across the cryptocurrency market.

Retail demand wanes as XRP struggles

A weak derivatives market has persisted since the October 10 flash crash, which liquidated almost $611 million in XRP-related long positions and approximately $90 million in shorts.

Meanwhile, demand for XRP derivatives has stabilized, albeit at significantly lower levels, with futures Open Interest (OI) standing at $3.71 billion on Thursday, down from $8.36 billion on October 10 and from the $10.94 billion reached in July.

OI represents the notional value of outstanding futures contracts. Low OI suggests investors are not convinced XRP can sustain an uptrend in the near term.

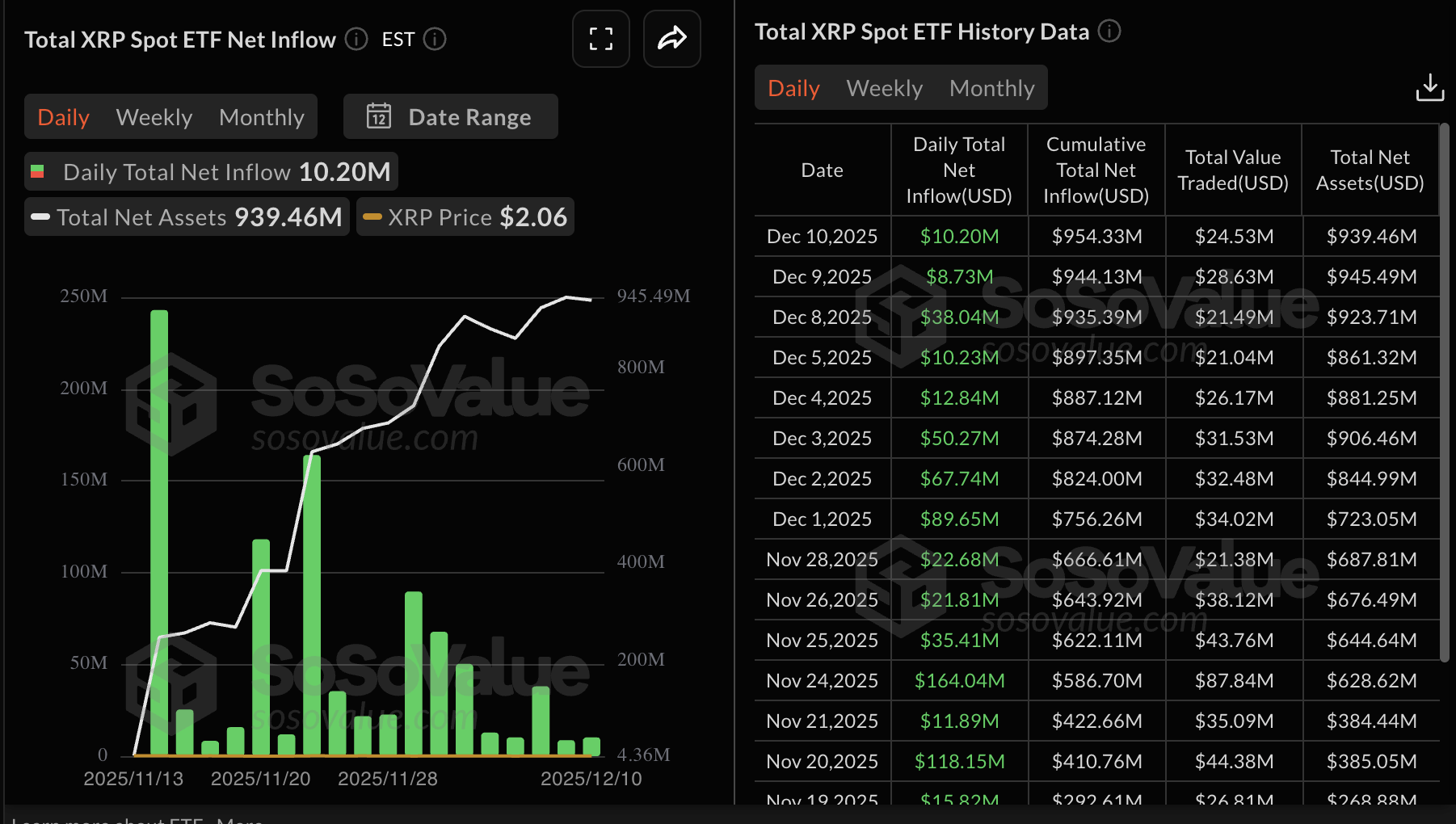

Despite macroeconomic uncertainty and a weak derivatives market, XRP spot Exchange Traded Funds (ETFs) posted inflows of $10 million on Wednesday – a slight improvement from $9 million the previous day.

Since their launch on November 13, XRP ETFs have not experienced outflows, with cumulative inflows totaling $954 million and net assets amounting to $940 million.

Technical Outlook: Assessing XRP’s downside risks

XRP hovers above its short-term support at $2.00 at the time of writing on Thursday, but also sits below the 50-day Exponential Moving Average (EMA), the 100-day EMA, and the 200-day EMA, which slope lower and maintain an overall bearish alignment. The Moving Average Convergence Divergence (MACD) hovers below the zero line, with the blue MACD line marginally above the red signal line and barely positive and contracting green histogram bars. The Relative Strength Index (RSI) at 40 leans bearish, suggesting rallies could stay limited.

The descending trend line from the record of $3.66 caps the upside, with resistance seen at $2.57. Initial resistance stands at the 50-day EMA at $2.25, followed by the 100-day EMA at $2.41 and the 200-day EMA at $2.45. The Average Directional Index (ADX) at 17 reflects weak trend strength.

Still, a daily close above the hurdle $2.25 could ease pressure and open the path toward $2.41 and $2.45, while failure to reclaim the first barrier would keep sellers in control beneath the trend-line cap.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)