POPULAR ARTICLES

- XRP bulls tighten grip driven by optimism in the broader cryptocurrency market.

- Retail traders are increasingly piling into long positions as XRP eyes breakout above $3.00.

- XRP exchange reserves have stabilized after a notable increase in September, signaling investor confidence.

Ripple (XRP) upholds an intraday bullish outlook, trading above $2.93 on Wednesday. The crypto market has generally kicked off October on a positive note, providing insight into the direction trading may take in the coming weeks.

XRP is on the cusp of a breakout as funding rates surge

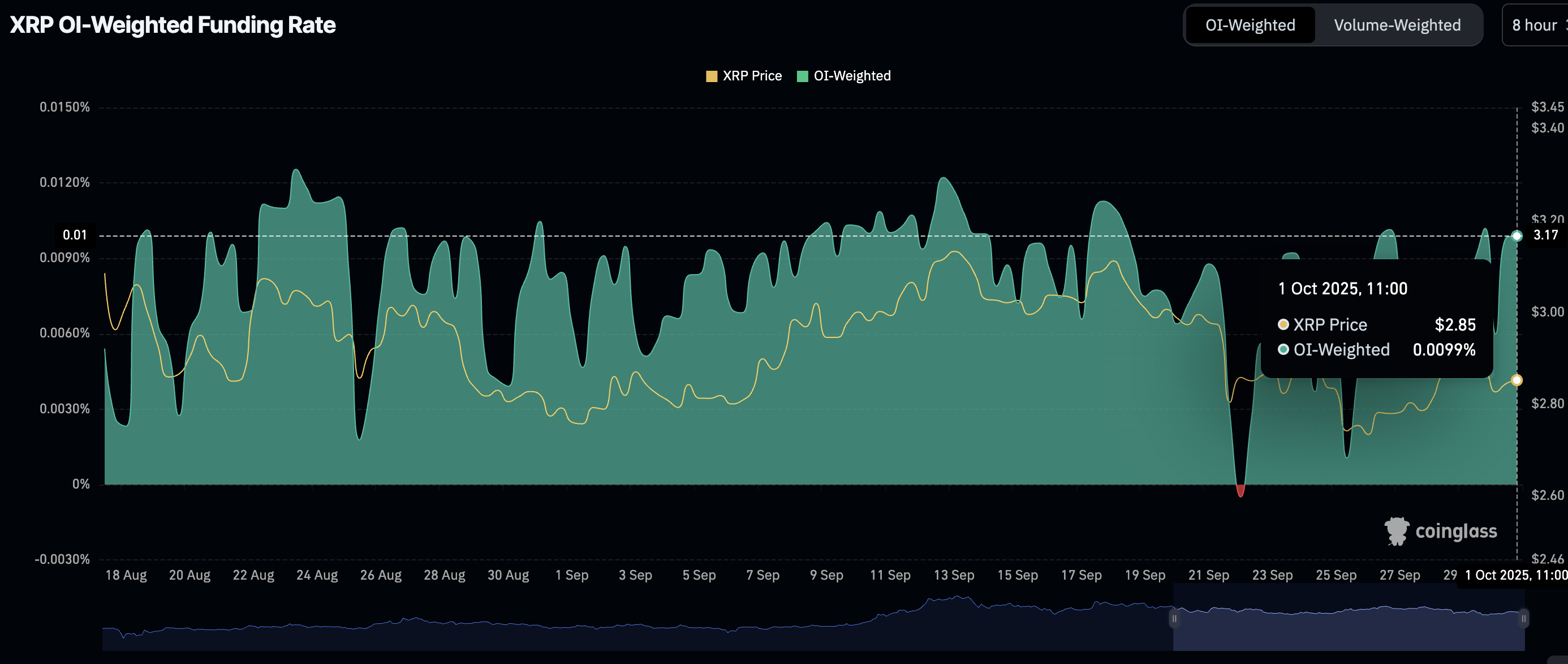

The uptick in price occurred alongside a notable increase in retail interest in the cross-border money remittance token. XRP futures traders are increasingly piling into long positions, according to CoinGlass data on the Open Interest (OI)-Weighted Funding Rate, which averages 0.0099%, up from 0.0011% last Friday.

OI-Weighted Funding Rate is an aggregated metric of XRP perpetual futures contracts across multiple exchanges, calculating the weighted average of funding rates. High positive rates indicate that traders are aggressively piling into long positions.

At the onset of an uptrend in the XRP price, rising OI-weighted funding rates represent a positive signal. However, at extremely high levels above 0.1%, it can serve as a warning for traders to reduce their risk exposure.

For now, XRP OI-Weighted Funding Rate is within the healthy band, encouraging more traders to increase their exposure, as they anticipate a breakout above the critical $3.00 level.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Conversely, Binance activity indicates that investors have slowed asset transfers to the exchange. CryptoQuant data shows the token balance on Binance is approximately 3.57 billion XRP, stable after a significant increase from 2.92 billion XRP on August 31.

Traders typically move assets to exchanges with the intention of trading or selling, so an increase in exchange reserves often indicates impending volatility. On the other hand, declining exchange balances suggest confidence in the token and its ecosystem is improving, potentially laying the groundwork for a bullish outlook.

-1759331864084-1759331864084.png)

XRP Binance exchange reserves | Source: CryptoQuant

Technical outlook: XRP offers short-term bullish signals

XRP gains momentum above key moving averages, including the 200-period Exponential Moving Average (EMA) at $2.91, the 100-period EMA at $2.88 and the 50-period EMA at $2.86 on the 4-hour chart, buoyed by bullish sentiment in the wider crypto market.

The Relative Strength Index (RSI) remains at 62, following a significant rise from oversold levels last week, reinforcing the increase in buying pressure. Similarly, the Moving Average Convergence Divergence (MACD) has confirmed a buy signal on the same daily chart, encouraging investors to seek risk exposure.

XRP/USDT daily chart

Key areas of interest for traders are the descending trendline in place since mid-July, when XRP reached a new record high of $3.66, and the next supply zone at $3.18, which was tested on September 13 as resistance.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.