POPULAR ARTICLES

Precious metals remain under pressure, and this latest downturn is not being driven by a sudden geopolitical shock or a sharp turn in monetary policy. Instead, the trigger is something far more sober – and far more certain: the annual rebalancing window of the Bloomberg Commodity Index, which officially opened on 8 January.

For investors unfamiliar with the mechanics behind the scenes, this may look like just another ordinary pullback. But for the professional market, it represents a rule-based shock that can be calculated with considerable precision.

What is the BCOM annual rebalancing?

The Bloomberg Commodity Index is one of the most important benchmarks for global commodity investment. Its weight adjustments are not based on forecasts of the future but on a mean-reversion approach to past performance.

The index is designed so that each constituent commodity stays close to a target weight, preventing any single asset from dominating index performance.

The core issue is that gold and silver rose about 65% and 148% respectively in 2025, marking their best annual performance since 1979. This multi-year strength has pushed their actual weights in the index far above the preset targets.

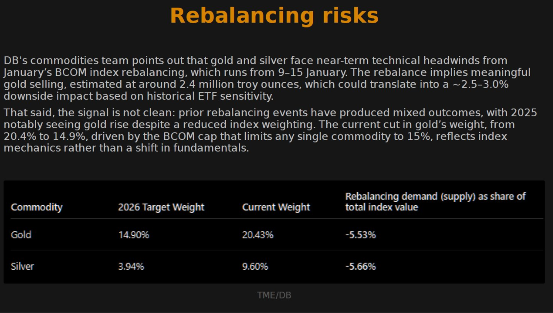

For example, according to institutional estimates, silver futures have grown to around 9% of the index, while their target weight for 2026 will be cut to below 4%. This means that to bring the index back to its intended structure, the roughly USD 109 billion in passive funds tracking BCOM must sell a huge amount of gold and silver positions during this week’s 8–14 January window.

A massive wave of forced selling

The scale of this selling is striking. Based on forecasts from several institutions, this year’s rebalancing is expected to trigger roughly USD 6 billion in gold futures selling and more than USD 5 billion in silver futures selling.

Measured against market liquidity, the impact becomes even clearer: the estimated selling could amount to about 3% of total open interest in COMEX gold futures – and as much as 9% in silver. Some analysts even warn that the silver market may have to digest selling pressure equivalent to around 13% of total positions.

When this kind of programmatic selling is compressed into just a handful of trading days, it almost inevitably injects a significant burst of volatility into the market.

History shows rebalancing does not always mean prices must fall

Deutsche Bank analyst Michael Hsueh has made a particularly insightful observation on this topic. Reviewing the past five annual BCOM rebalancing windows, he identified an interesting pattern: between 2021 and 2024, a sharp cut in a commodity’s index weight usually did coincide with price declines over the same period – technical pressure tended to dominate.

However, markets are full of surprises. Hsueh highlights 2025 as a notable exception. That year, even though gold’s weight in the index was reduced, its price rose during and after the rebalancing window.

The takeaway: when the macro fundamentals are strong enough, they can offset – and even fully reverse – the impact of technical selling.

Why silver is more vulnerable than gold

It’s important to note that silver futures trade in a much smaller and less liquid market than gold.

When billions of dollars in sell orders hit this relatively “shallow pool,” the resulting price swings can be dramatically amplified. TD Securities analyst Daniel Ghali has warned that this could lead to a “sharp downward repricing” in silver.

The market is already bracing for impact. On 7 January, the Shanghai Futures Exchange urgently announced that, from 9 January onward, it would raise margin requirements and daily price limits for silver futures contracts, while also introducing trading limits. These steps are widely viewed as pre-emptive risk-control measures in anticipation of severe volatility.

Understanding the nature of the selling is crucial

Faced with this incoming wave of technical selling, understanding its nature is key. Institutions such as Huatai Securities stress that index-driven rebalancing is a temporary technical disturbance, not a sign that the medium- to long-term allocation story for precious metals has reversed.

Historically, similar index-adjustment windows have often coincided with short-term spikes and pullbacks in gold and silver. But their ability to dictate the medium-term trend has been limited.

The fundamental drivers of the long-term precious metals bull story remain intact:

Market expectations that the Fed will continue cutting rates in 2026

Elevated global geopolitical uncertainty fuelling safe-haven demand

Ongoing central-bank gold purchases

Major banks such as Goldman Sachs and Morgan Stanley remain constructive, forecasting that gold could still challenge the USD 4,800–4,900 range.