인기 기사

U.S. President Donald Trump has announced plans to impose additional tariffs on eight European countries over the Greenland issue, triggering a sharp backlash from European leaders and bipartisan criticism in the U.S. Congress.

The EU has convened an emergency meeting to discuss countermeasures, while the U.S. Senate Democratic leader has made clear he will push legislation to block the move. This flare-up in geopolitical tensions is expected to significantly unsettle market sentiment and dominate gold’s short-term trading direction.

Trump stated that from 1 February, the U.S. will impose a 10% tariff on imports from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands and Finland, and threatened to raise tariffs to 25% from 1 June if the U.S. fails to reach a deal to fully acquire Greenland. European governments immediately condemned the remarks as unacceptable blackmail and fundamentally wrong.

The core fundamental impacts can be distilled into two main channels: first, the amplification of risk-off sentiment, and second, rising concerns over potential disruption to Europe’s energy supply.

On the EU side, the largest political group in the European Parliament has already stated it will move to suspend approval of the EU–U.S. trade agreement and freeze any planned tariff reductions on U.S. products.

This implies that transatlantic trade relations may not only fail to deepen but could even slip into reverse. Crucially, domestic political resistance in the U.S. is also building. Senate Democratic leader Chuck Schumer has vowed to push legislation to block the tariffs from taking effect.

Co-chairs of the Senate NATO Observer Group from both parties have likewise warned that such rhetoric only benefits adversaries who hope to see NATO fragmented. These bipartisan objections from Congress inject substantial political uncertainty into whether the tariff threats will actually be implemented.

The current situation provides multiple layers of support for gold. First, the direct escalation of geopolitical risk—especially when it involves confrontation between the U.S. and its core traditional allies—naturally drives safe-haven flows into gold. Second, with global populist policy already at historically elevated levels, and the next 10–15 years likely to feature slower growth, higher inflation and reduced trade openness, the broader macro backdrop is structurally supportive of non-credit assets such as gold.

Market Commentary:

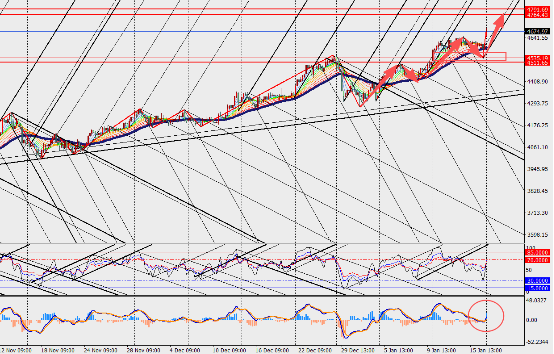

On the four-hour chart, gold has posted a sharp upside jump, with MACD lines and histogram crossing and expanding near the zero line. Recently, gold has shown signs of decoupling from its traditional negative correlation with U.S. real yields. This suggests that, in today’s structural macro and geopolitical environment, safe-haven demand and the push toward diversified, de-dollarised reserve holdings are becoming more powerful price drivers than real rates themselves.