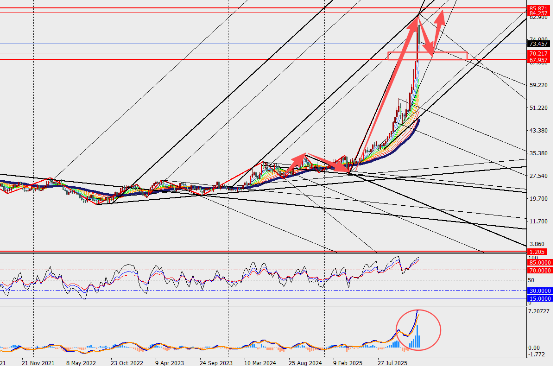

On Monday, the silver market experienced a dramatic shock staging a roller-coaster move of “spike up then sharp drop.” Spot silver surged violently at the open, jumping more than 5% at one point to reclaim the $83 level. It then plunged, briefly breaking below $75, with an intraday swing of as much as $8.

Analysts believe one of the key reasons behind Monday’s pullback from the highs was profit-taking by investors after a record-breaking rally driven by structural supply-demand imbalances.

Since the start of the year, silver prices have staged an epic rally, now up nearly 180% year-to-date. The rapid ascent in silver has been fueled by a combination of factors: tight supply, its inclusion on the U.S. “critical minerals” list, robust industrial demand, heightened safe-haven demand amid geopolitical tensions, expectations for Fed rate cuts boosting precious metals as an asset class, and low market liquidity amplifying volatility.

At this stage, the silver market has clearly entered a high-volatility regime: on the one hand, supply shortages are supporting prices; on the other, speculative sentiment is magnifying risks.

According to data from a global market-cap tracking platform, silver’s current market value stands at $4.485 trillion. Gold tops the global asset ranking with a market cap of $31.719 trillion, while chip giant Nvidia sits in second place at $4.638 trillion.

It is worth noting that it has been only about 10 days since silver advanced into fourth place among global assets. At that time, silver’s market cap overtook that of high-flying AI giant Google.

Market institutions believe silver’s global market-cap ranking could climb even further. If the current uptrend continues, silver may well overtake Nvidia to become the second-largest asset in the world.

As silver prices were staging this roller-coaster move, investor views on the metal became sharply divided. Some high-profile Wall Street economists believe silver prices could break above $100 next year. The pessimists, however, warn that precious metals are now standing at the “edge of a cliff,” with correction risks steadily building.

Market Commentary:

On the weekly chart, silver is pulling back in a choppy fashion, with MACD lines and histogram beginning to contract. Short-term trading risks in precious metals have clearly increased: after fresh record highs, the risk of near-term profit-taking by short-term players has grown, and thin year-end liquidity may be amplifying price swings, making short-term moves even harder to interpret.