POPULAR ARTICLES

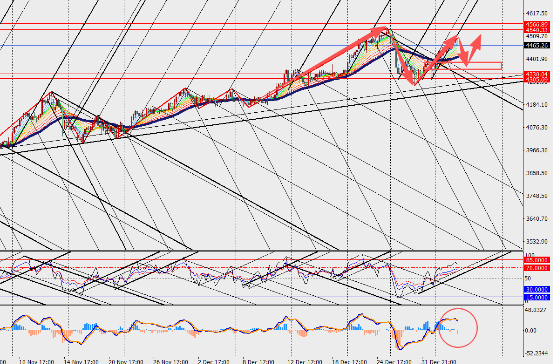

On Tuesday, spot gold extended the previous trading day’s gains, rising a further 1% and once again approaching USD 4,500 per ounce — very close to the all-time high of USD 4,549.71 set on 24 December last year.

This latest leg higher in gold prices is primarily driven by a sharp increase in investor anxiety over global uncertainty, particularly following the United States’ military action against Venezuela over the weekend, which triggered broad-based risk aversion and a strong flow of capital into precious metals.

At present, precious-metals traders are detecting risk more acutely than participants in equity and bond markets, further fuelling sustained safe-haven demand for both gold and silver. This highlights how sensitive the market has become to geopolitical events, with those risks now translating directly into strong buying interest in gold.

On Monday, Maduro firmly pleaded not guilty in court to drug-related charges, insisting he is innocent. This episode not only underscores the severe upheaval in Venezuela’s political landscape, but also heightens tensions within the international community. In the wake of Maduro’s ouster, U.S. President Trump is scheduled to meet with executives from several oil companies at the White House later this week to discuss how to rapidly revive Venezuela’s struggling oil industry.

Echoing the Venezuela situation, President Trump has also repeatedly reiterated in recent weeks his desire to gain control over Greenland, an idea he first floated during his initial term in 2019. He argues that Greenland is crucial to U.S. national security and has criticised Denmark for not doing enough to protect the island.

On Tuesday, the leaders of France, the United Kingdom, Germany, Italy, Poland, Spain, and Denmark issued a joint statement, making it clear that Greenland belongs to its own people and that only Denmark and Greenland have the right to decide on matters related to the island.

Greenland’s prime minister welcomed the unity shown by European leaders and called for dialogue with the United States based on mutual respect and international law. This dispute further underscores the instability of the global geopolitical environment, providing additional support for gold prices.

Market Commentary:

At the start of 2026, global financial markets are standing at the crossroads of elevated geopolitical risk and shifting monetary policy. Gold’s status as a safe-haven asset has been further reinforced; last year it climbed 64.4%, marking its best annual performance since 1979.

With the Venezuela and Greenland developments continuing to unfold, and potential support from future Federal Reserve rate cuts, gold prices are well-positioned to keep challenging new record highs.