POPULAR ARTICLES

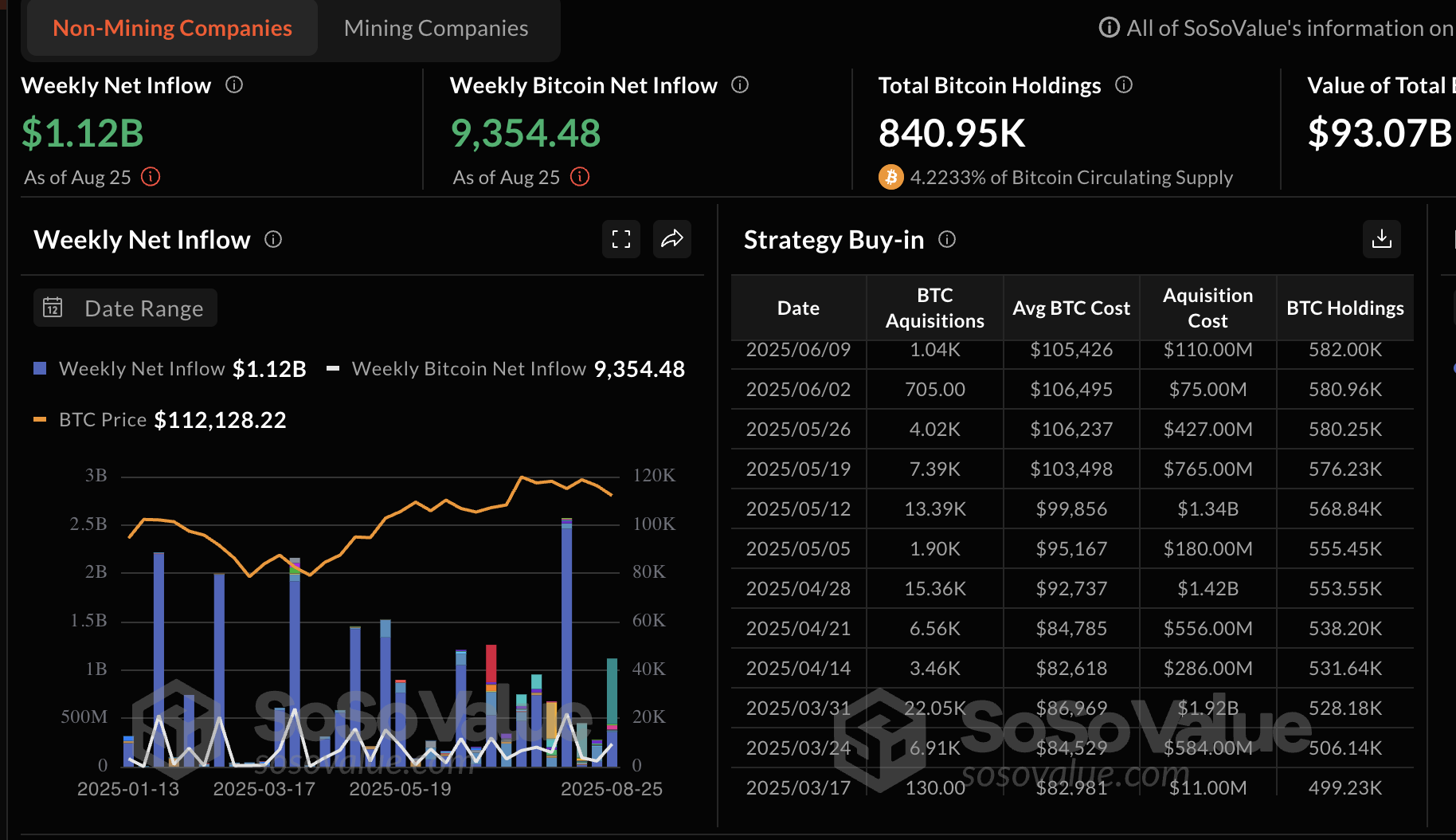

- Bitcoin holdings by non-mining companies surpass 840,000 BTC valued at $93 billion.

- Japan-listed Metaplanet has announced plans to issue new shares, aiming to raise $881 million to finance additional Bitcoin purchases.

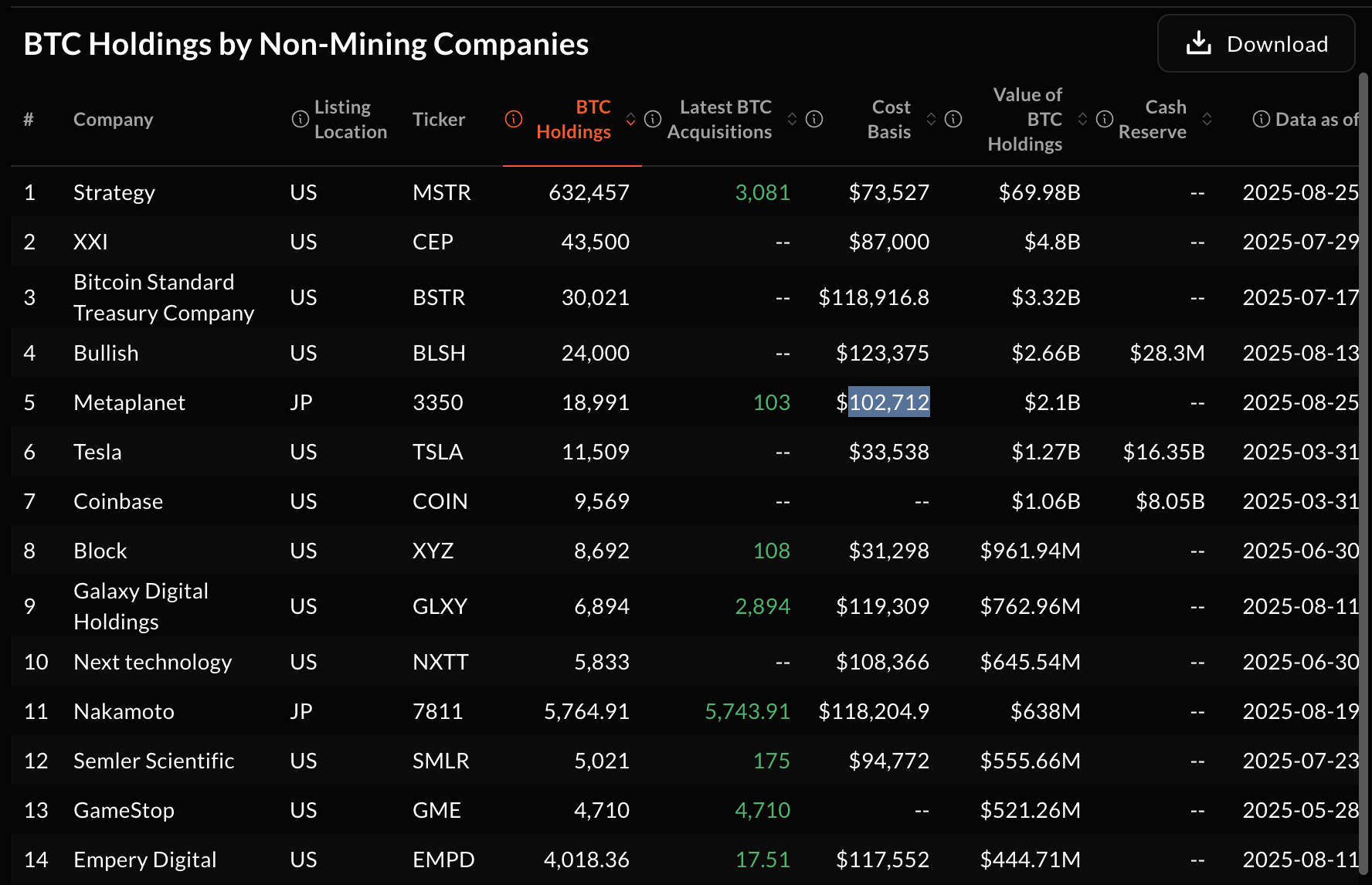

- Metaplanet is the fifth-largest holder of Bitcoin, valued at $2.1 billion at an average cost basis of $102,712.

Metaplanet, one of the largest corporate holders of Bitcoin (BTC), plans to raise additional funds to purchase BTC for its steadily growing treasury. The company announced in a press release on Wednesday that the purchase is expected to take place between September and October.

Metaplanet to raise $880 million via international share offering

The Metaplanet Board of Directors has resolved to issue new shares through an international offering. In total, the company will issue shares valued at approximately $881 million. Of this, approximately $837 million will be allocated to bolster its digital asset treasury. The balance, valued at around $44 million, will be used to support Metaplanet’s Bitcoin financial operations.

According to the press release, the international offering will be carried out in a manner that ensures the total number of issued shares remains below the company’s total number of authorised shares.

Metaplanet cited prevailing severe macroeconomic conditions in Japan, including high levels of national debt, extended real negative interest rates and the depreciation of the Japanese Yen, as factors driving its Bitcoin treasury strategy.

“This decision was made to hedge against asset risk caused by yen depreciation and to capitalize on BTC’s long-term appreciation potential. Through capital raising, the Company intends to increase its BTC holdings in the future and believes it can isolate its treasury from the Yen’s decline, eliminate inflation risk, and achieve sustained enhancement of corporate value,” Metaplanet said in the press release.

As of August 25, Metaplanet holds 18,991 BTC, valued at around $2.1 billion. It is the fifth-largest corporate holder of Bitcoin, behind Bullish (BLSH), which holds approximately 24,000 BTC worth around $2.6 billion.

Strategy (MSTR) operates the largest Bitcoin treasury, with 632,457 BTC valued at $69.98 billion, followed by XXI (CEP) with 43,500 BTC worth approximately $4.8 billion, and Bitcoin Standard Treasury Company (BSTR) with 30,021 BTC valued at around $3.32 billion.

Bitcoin treasuries holdings | Source: SoSoValue

Cumulatively, non-Bitcoin mining companies hold slightly under 841,000 BTC valued at $93 billion. A total of 33 companies operate active Bitcoin treasuries, according to SoSoValue.

Bitcoin holdings by Non-mining companies | Source: SoSoValue

Bitcoin’s (BTC) bullish case has primarily been supported by institutional interest and demand dating back to the launch of spot Exchange Traded Funds (ETFs) in the United States (US) in January 2024 and before Michael Saylor’s Strategy.

Since the launch of financial products that allow investors to directly seek exposure to the price of Bitcoin via stock exchanges such as NASDAQ, corporate interest in the digital asset has significantly increased.

Macroeconomic uncertainty, weakening sovereign currencies and rising national debt are some of the reasons driving companies to Bitcoin, which is viewed as digital Gold – a hedge against inflation and other macroeconomic uncertainties.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.