POPULAR ARTICLES

- XAU/USD down 1.20%, trading at $3,356 during North American session.

- US President Donald Trump said that Gold will not be tariffed.

- Anticipation builds for Trump–Putin meeting, potential Ukraine truce plan weighs on safe-haven demand.

- July US CPI expected at 2.8% YoY; Core CPI projected above 3% for first time since February.

Gold price dives during the North American session as traders waited for the White House resolution on duties over physical Bullion bars, which triggered a downturn last Friday in the futures market. Traders awaiting the release of inflation data in the United States (US) pushed spot prices down. At the time of writing, XAU/USD trades at around $3,360, down over 1.20%.

Demand for Gold took a hit due to speculation that the meeting between US President Donald Trump and his Russian counterpart, Vladimir Putin, on Friday could unveil a truce plan in Ukraine. The recovery of the US Dollar amid falling US Treasury yields drove Bullion prices below the $3,400 mark.

On Tuesday, the US Bureau of Labor Statistics (BLS) is expected to release the Consumer Price Index (CPI) for July. Estimates suggest that headline inflation would be at around 2.8% YoY, up from June’s 2.7%. Core CPI is projected to rise above the 3% threshold for the first time since February 2025.

US President Donald Trump posted on his social network that Gold will not be tariffed.

Ahead this week, the US economic calendar will feature the release of inflation on the producer front, jobless claims, Industrial Production data, Retail Sales and the University of Michigan Consumer Sentiment for August. Alongside this, speeches by Federal Reserve (Fed) officials will be scrutinized.

Daily digest market movers: Busy US economic docket to drive Gold prices

- The current week’s economic data will be eyed following the latest jobs data, which has shown signs of cracking. However, if the July CPI rises, Fed officials' reaction to the data will be crucial. If they stress that price stability would be the priority, this could drive Gold prices lower. Otherwise, if the disinflation process progresses, then Bullion might be headed higher as US yields are expected to drop.

- Following CPI, traders will also eye the evolution of the labor market and consumer spending via Retail Sales, which are expected to dip from 0.6% to 0.5% MoM in July. The week will end with the release of US Consumer Sentiment, which is projected to improve from 61.7 to 62 in August’s preliminary reading.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is up 0.26% at 98.52. The US Dollar’s recovery capped Gold’s advance toward $3,400.

- The US 10-year Treasury note yield is down two basis points, sitting at 4.265%.

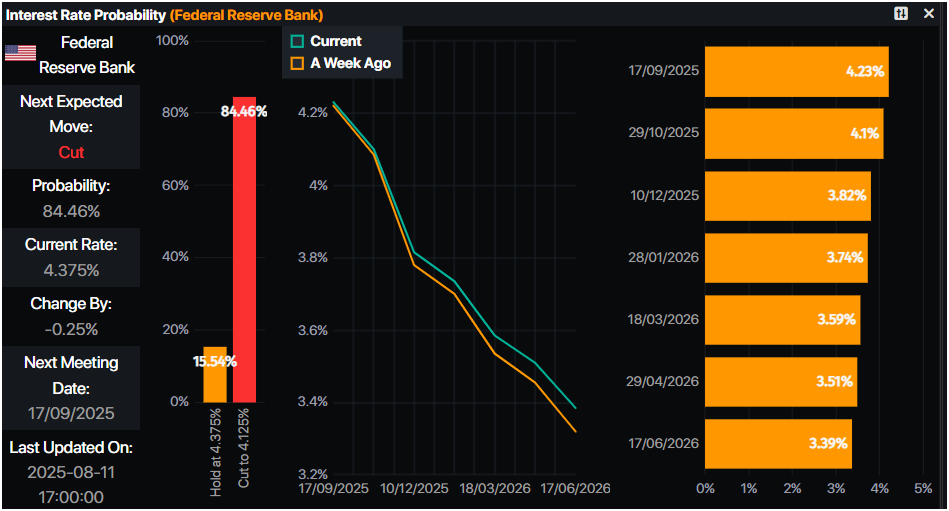

- Fed Interest Rate Probabilities show that traders have priced in an 84% chance of a 25 bps rate cut at the September meeting, according to Prime Market Terminal data.

Source: Prime Market Terminal

Technical outlook: Gold price tumbles and tests confluence of 20/50-day SMAs

Gold dropped below $3,380 after clearing the bottom of the $3,380-$3,400 trading range set on Friday, which drove XAU/USD toward a daily low of $3,341. Despite this, the yellow metal remains upwardly biased as it tests the confluence of the 50-day and 20-day at around $3,356/$3,349, with buyers eyeing $3,380.

If XAU/USD climbs above $3,400, the next area of interest would be the June 16 peak at $3,452, followed by the record high of $3,500. Conversely, if Gold ends the day below $3,350, Bullion could slide toward the 100-day SMA at $3,283.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.