POPULAR ARTICLES

- Lido DAO steadies recovery, reclaiming support above $1.00 on Wednesday.

- Lido V3 final testnet goes live, aiming to upgrade Lido Core contracts on the main protocol.

- Traders pile into LDO long positions as the Open Interest-weighted funding rate flips positive.

Lido DAO (LDO) upholds a bullish outlook, trading above $1.00 at the time of writing on Wednesday. The token native to the Ethereum-based liquid staking protocol rises amid heightened volatility in the broader cryptocurrency market, supported by positive sentiment surrounding the launch of the Lido V3 final testnet.

Lido DAO’s V3 testnet launch ignites interest in LDO

Lido DAO announced the launch of Lido V3 Testnet-3 on Monday, marking the final testnet phase ahead of the mainnet rollout. The software update aims to upgrade Lido Core contracts on the main protocol Hoodi testnet environment and will support stVaults.

Lido DAO stated that stVaults, short for staking vaults, is a newly developed staking protocol designed to ensure flexibility and seamless customization of Lido on the Ethereum mainnet.

The new staking protocol marks a significant improvement in Lido’s staking infrastructure while building on the current Lido Core. The stVaults protocol allows users to customize fee structures, select specific Node Operators and configure validator setups, ensuring alignment with individual or institutional preferences.

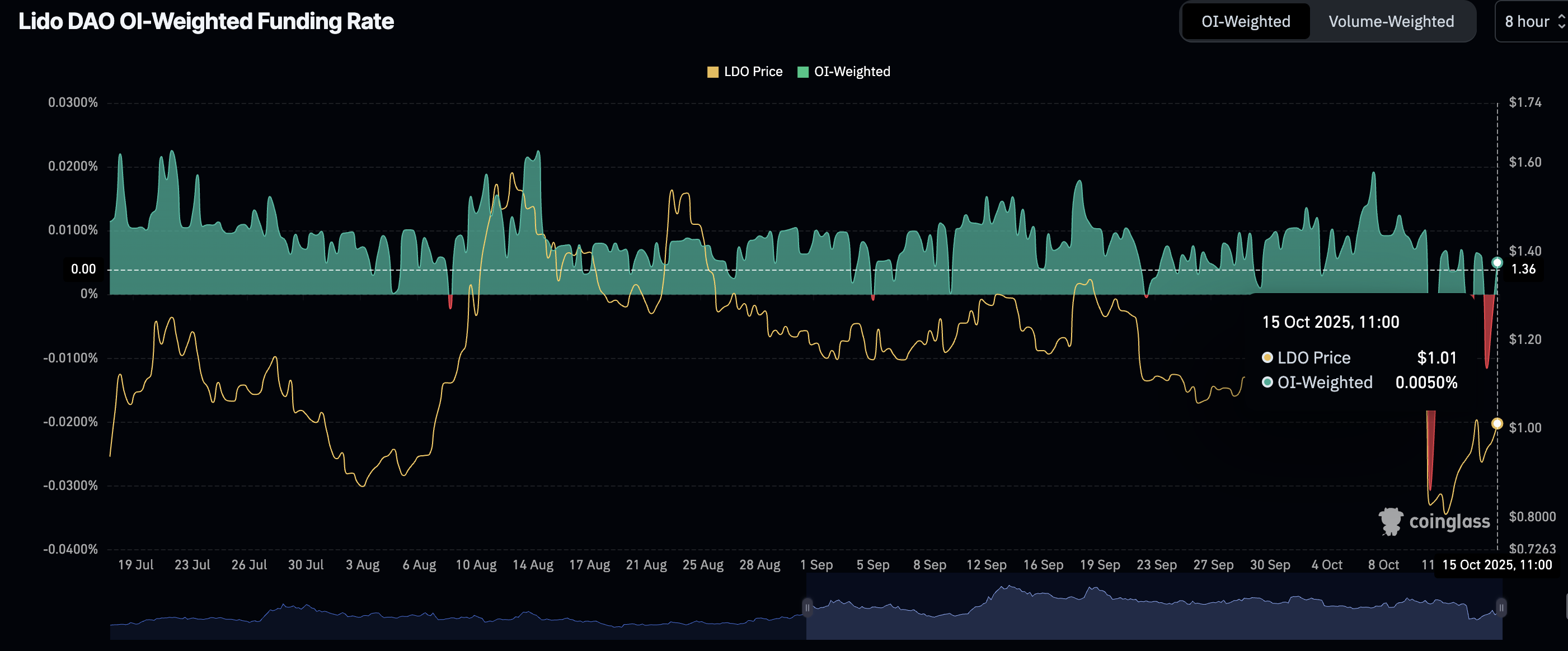

Meanwhile, interest in LDO is gaining momentum following last week’s flash crash, whereby the futures Open Interest-weighted funding rate flipped extremely negative.

The flash crash caught traders unawares, with many counting losses amid massive liquidations. CoinGlass data shows that the LDO OI-weighted funding has recovered, averaging 0.0050% at the time of writing. As sentiment turns positive, it implies that traders are piling into long positions, anticipating the price of LDO to steady above the short-term $1.00 support.

LDO OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Lido DAO bulls attempt breakout

Lido DAO holds above $1.00, marking the first key short-term following Friday’s crash to $0.23. Backing the liquid staking token’s bullish outlook is the uptrending Relative Strength Index (RSI) at 45 on the daily chart. This follows a recovery from near oversold conditions, indicating that bullish momentum is increasing.

Although the Moving Average Convergence Divergence (MACD) indicator has upheld a sell signal since Thursday, a buy signal could be in the offing. Traders should look out for the blue MACD line crossing above the red signal line, encouraging them to increase risk exposure.

LDO/USDT daily chart

A daily close above the $1.00 level would also affirm the bullish outlook. Still, a confluence resistance formed by the 50-day Exponential Moving Average (EMA), the 100-day EMA, and the 200-day EMA at $1.12 could delay the breakout, resulting in profit-taking.

Lido DAO also trades below a descending trendline, which marks the overdrawn downtrend and must be broken to pave the way for a significant breakout. Losing support at the $1.00 level may increase the chances of LDO trimming recently accrued gains. Key areas of interest include $0.77, which was tested on Saturday, and $0.61, last tested in June.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.