POPULAR ARTICLES

- Pi Network announces faster KYC verifications powered by built-in AI.

- Sign collaborates with the Pi Network community for its first-ever meetup in Seoul on Monday.

- PI remains muted within a consolidation range as CEXs' wallet balances decline.

- Large volume transactions in the last 24 hours indicate investors accumulating PI tokens.

Pi Network (PI) consolidates above $0.3500 for the fifth consecutive day, as the recently launched AI-powered Know Your Customer (KYC) fails to uplift investors' sentiment. Still, a decline in Centralized Exchanges (CEXs) wallet balances and the moves from whales suggest that large-wallet investors are buying the dip.

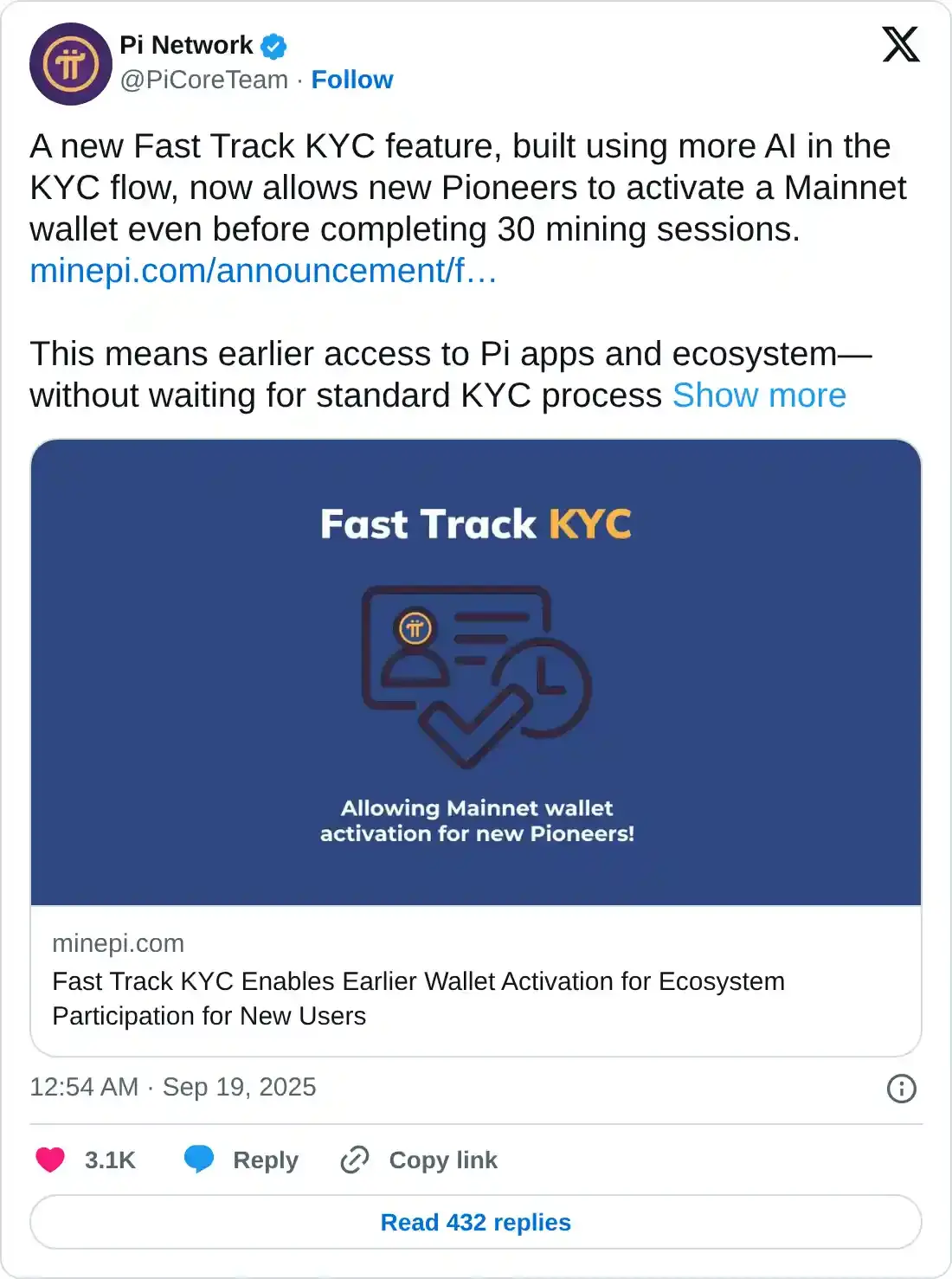

Pi Network releases fast-track KYC feature

Pi Network has announced a faster KYC flow with more AI features, which will allow network users, commonly referred to as Pioneers, to activate the mainnet wallet before completing the 30 mining sessions.

This feature is currently reserved for eligible users with fewer than the previously required sessions. The faster KYC only allows mainnet wallet activation and not mainnet migration of the PI tokens.

Sign collaborates with the Pi Network community for a get-together in Seoul

Sign protocol, an Ethereum-based digital verification protocol, announced an upcoming collaboration with Pi Network through a community meetup in Seoul on Monday. The meetup will begin at 10:30 hours GMT on Monday, featuring a chat between Sign Xin Yan's CEO and one of the Pi Network’s co-founders, whose name hasn't yet been confirmed.

Whales continue to accumulate as PI coin consolidates

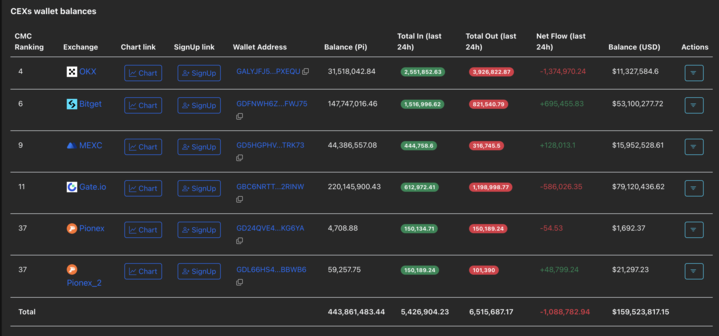

PiScan data indicates a net outflow of 1.08 million PI coins from the CEX's wallet balances, as investors accumulate at lower prices. Generally, a decline in exchange reserves often translates to lowered selling pressure, which could support prices.

CEXs wallet balances. Source: PiScan

Validating a rise in demand, PiScan data shows that four out of the five highest volume transactions on the network are from large wallet investors, popularly known as whales, withdrawing over 3.40 million PI coins. Typically, an increase in whale activity also serves as an early signal of a trend reversal.

Largest transaction on Pi Network. Source: PiScan

Selling pressure declines as PI extends consolidation

Pi Network above $0.3500 in a larger consolidation range between the $0.3220 support floor and the $0.4000 ceiling. A potential close above the $0.4000 could extend the rally to the $0.5032 level, marked by the June 22 close.

The momentum indicators on the daily chart remain unchanged as the Keltner channels sustain a sideways move, indicating lowered volatility. At the same time, the Relative Strength Index (RSI) remains flat at 50, suggesting that trend momentum is dampened.

Still, the Accumulation/Distribution line at -283 million, up slightly from -289 million on Thursday, indicates a decline in selling pressure.

PI/USDT daily price chart.

If PI slips below $0.3200, the $0.3000 round figure could act as the immediate support.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.