POPULAR ARTICLES

- XRP shows recovery signals targeting $3.38, underpinned by strong technical indicators.

- Declining exchange reserves underscore positive sentiment and strong conviction in the XRP price recovery.

- XRP futures funding rate and Open Interest point to investor optimism and possible price rebound.

Ripple (XRP) offers short-term recovery signals on Wednesday after reclaiming support at $3.00. Backing the reversal in the cross-border money remittance token is, among other factors, renewed interest in the derivatives market, growing retail demand and a significant decrease in XRP exchange reserves.

XRP eyes short-term recovery as exchange reserves shrink

XRP is poised for another bullish move above $3.00, buoyed by growing optimism among token holders. According to CryptoQuant data, the XRP Exchange Reserves on-chain metric has significantly declined from its July peak of 3 billion XRP to 2.9 billion XRP. This peak also coincided with the local top in XRP price, following the run-up to $3.66, the highest level on record.

The reduction in the exchange reserves implies fewer tokens on crypto exchange platforms, which subsequently reduces potential selling pressure. If this trend persists and demand increases, a strong tailwind will propel XRP higher, increasing the chances of reaching the medium-term resistance at $3.38 and later the record high of $3.66, set on July 18.

-1756311742402-1756311742404.png)

XRP Exchange Reserves | Source: CryptoQuant

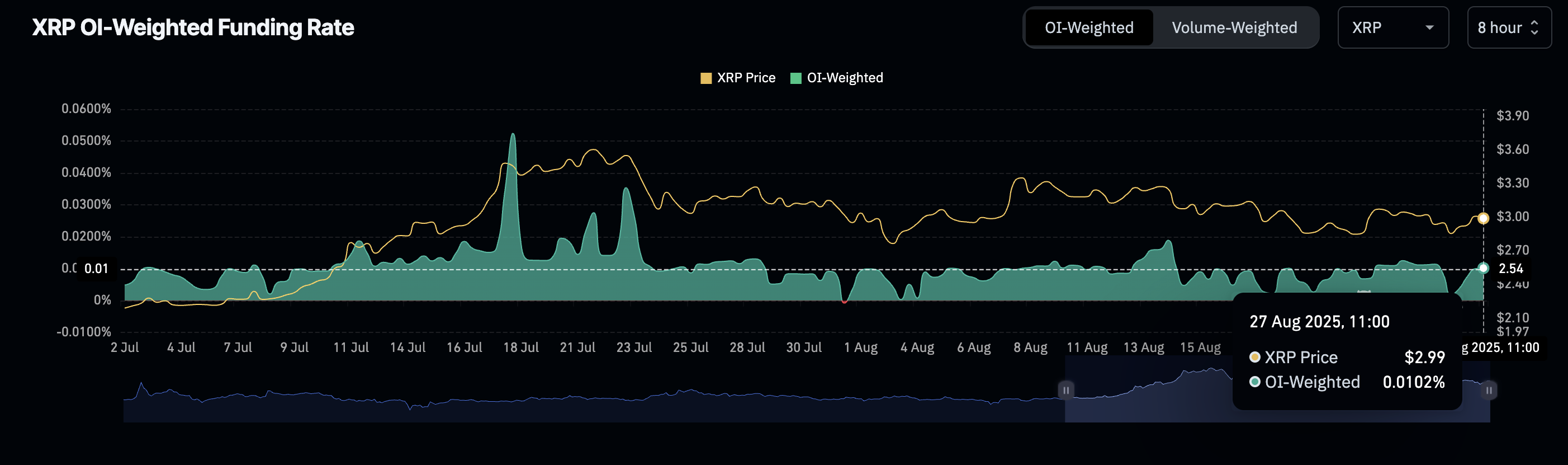

Interest in XRP remains relatively high, despite fluctuations in the price over the past few weeks, as reflected in the futures funding rate. CoinGlass data shows the funding rate averaging at 0.0102% at the time of writing, suggesting that more traders are increasingly leveraging long positions in XRP. A strong conviction in XRP’s recovery potential could boost short-term interest.

XRP futures funding rate | Source: CoinGlass

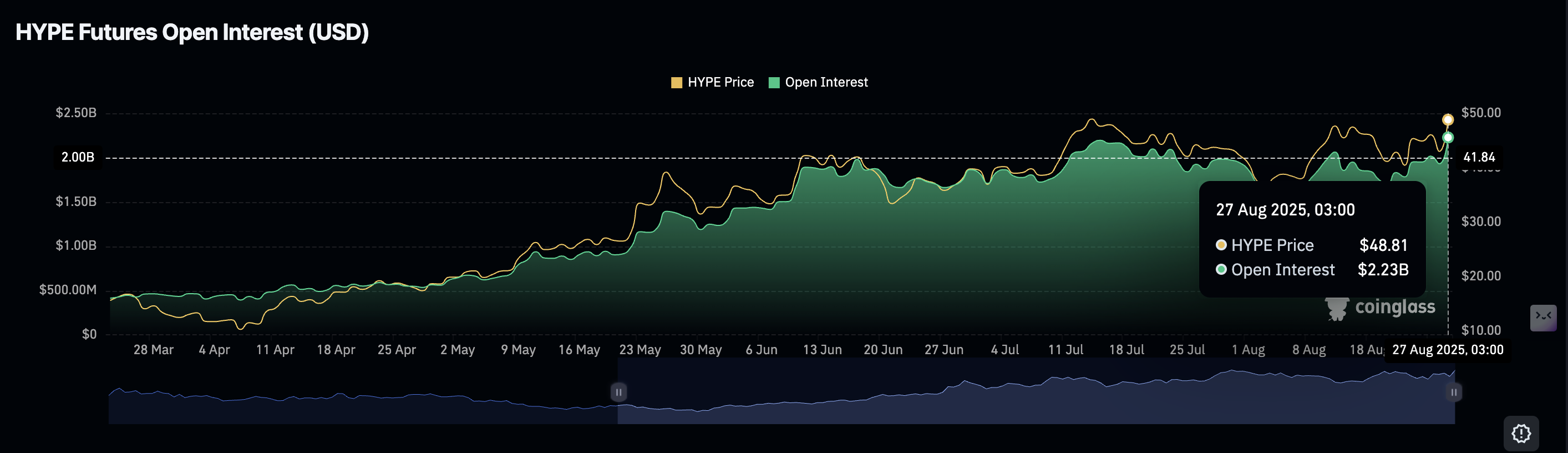

XRP Open Interest (OI), representing the value of outstanding futures contracts, is back above the $8 billion mark after falling to $7.36 billion on August 22 and $7.02 billion on August 3.

If the OI steadies in the coming days and weeks, it will indicate positive sentiment and heightened trading activity as traders increasingly bet on higher XRP prices.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP bulls target 12% breakout

XRP price remains above $3.00 at the time of writing, underpinned by multiple positive technical indicators. A buy signal from the SuperTrend indicator on the 4-hour chart calls on traders to increase exposure.

Additionally, the Moving Average Convergence Divergence (MACD) indicator backs XRP’s short-term bullish outlook after validating another buy signal on Tuesday.

The Relative Strength Index (RSI), positioned above the midline and stabilizing at 54, upholds steady buying pressure. A reversal toward overbought territory would corroborate the growth in retail demand as highlighted by the recovery in the futures Open Interest and increase the probability of testing resistance at $3.38 – a 12% move above the current level.

XRP/USDT -4-hour chart

Still, XRP is not out of the woods despite the short-term support at $3.00. If sentiment wobbles in the broader crypto market ahead of the potential Federal Reserve (Fed) interest rate cuts in September, XRP could drop to test the 50-period Exponential Moving Average (EMA) at $2.98. Other areas of interest for traders include the support at $2.90, which was tested on August 6 and the demand at $2.72, tested on August 3.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.