POPULAR ARTICLES

- Starknet extends the 20% surge from Monday above the 200-day EMA, signaling further growth.

- Bitcoin staking on Starknet hit a record high of over $106 million, fueled by the BTCFi Season announced last week.

- A record-high Open Interest of over $164 million suggests a risk-on sentiment among traders.

Starknet (STRK) trades above $0.1800 at press time on Tuesday, sustaining the 20% gains from Monday. A rise in Bitcoin (BTC) staked on Starknet after the announcement of BTCFi Season on September 30 signals network growth. Both the technical outlook and derivatives data signal a buy-side dominance, indicating improving investor sentiment.

Starknet’s BTCFi Season boosts Bitcoin staking, network growth

Starknet announced Bitcoin staking on its mainnet last week, incorporating BTC into its network consensus. The STRK token remains the majority consensus weight holder, holding 75% of the weight, while BTC now holds 25% with staking rewards accounting for a 25% share of STRK emissions.

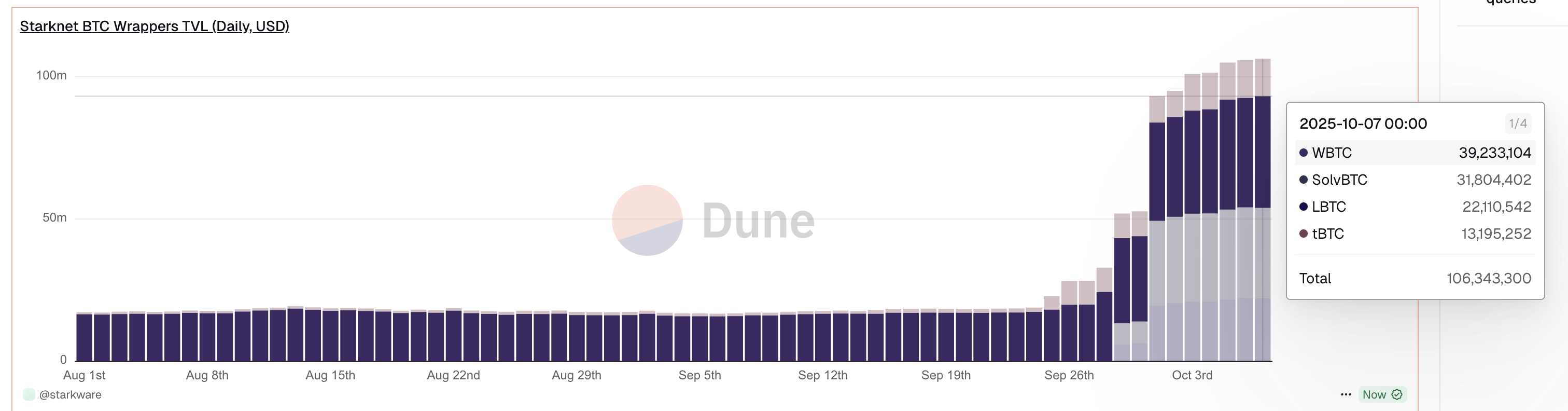

However, there’s no direct staking of BTC, but wrappers are allowed, like WBTC, LBTC, tBTC, and SolvBTC, each with its own reward pool. Dune data shows that the value of staked wrapped BTC tokens has reached $106.34 million as of Friday, signaling an increase in investors' interest.

Staked wrapped Bitcoin on Starknet mainnet. Source: Dune

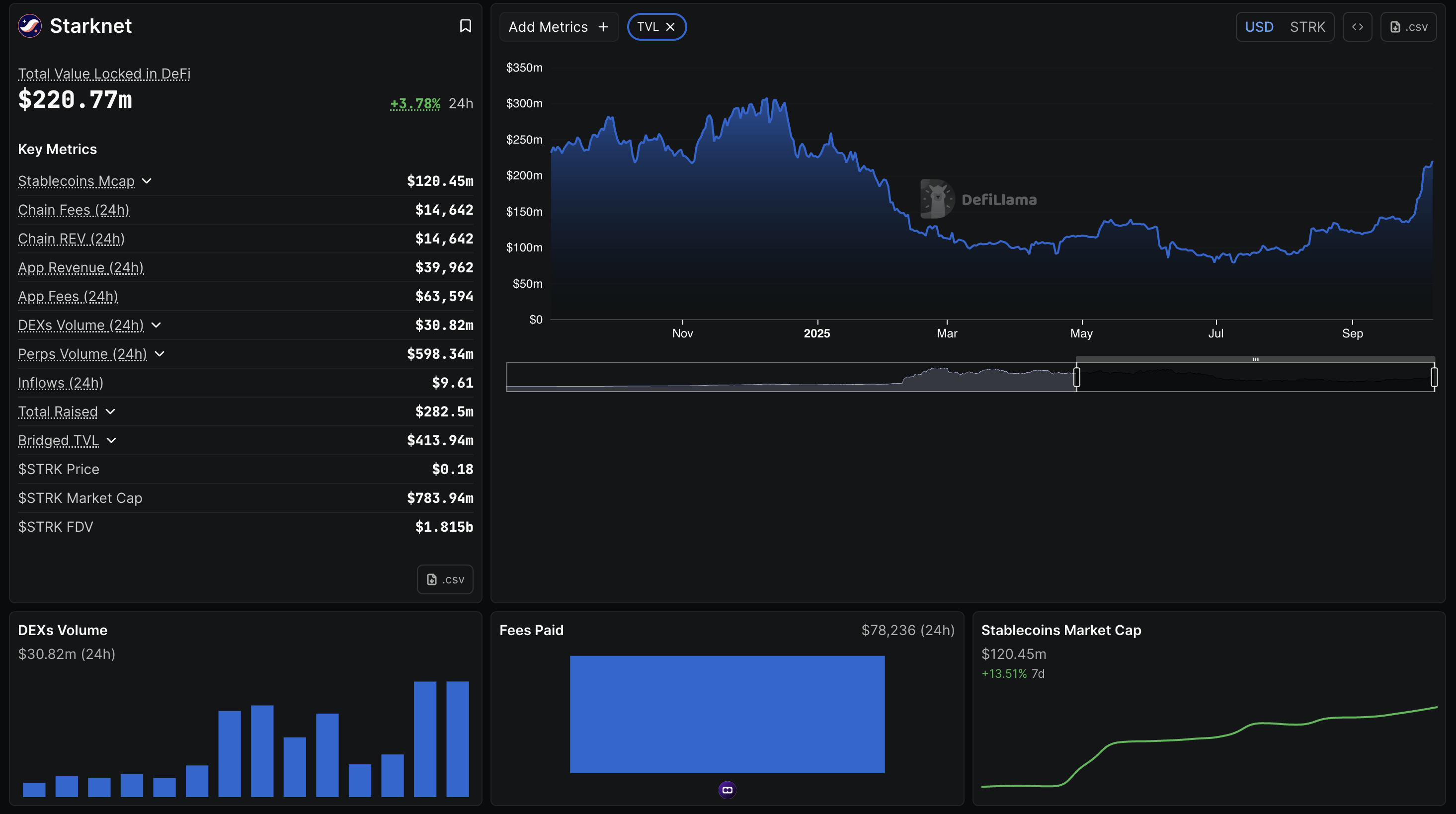

The Total Value Locked (TVL) on Starknet has increased by 3.78% over the last 24 hours, reaching $220.77 million, indicating a rise in digital assets deposited on the network. Typically, a rise in TVL refers to increased network adoption and user trust.

Apart from the deposits, the Decentralized Exchange (DEX) volume on the network holds above $30 million for the second consecutive day, while the stablecoin market capitalization has reached a record high of $120.45 million. This indicates that the trading activity and liquidity have increased significantly on the network.

Starknet DeFi data. Source: DeFiLlama

Starknet recovery run eyes crucial resistance breakout

Starknet trades above its 200-day Exponential Moving Average (EMA) at $0.1788. At the same time, the 50-day EMA converges with the 100-day EMA for a bullish cross, which signals a stronger short-term recovery than the prevailing trend. The uptrend faces opposition at the $0.1976 resistance level, marked by the February 24 close and previously tested on May 13.

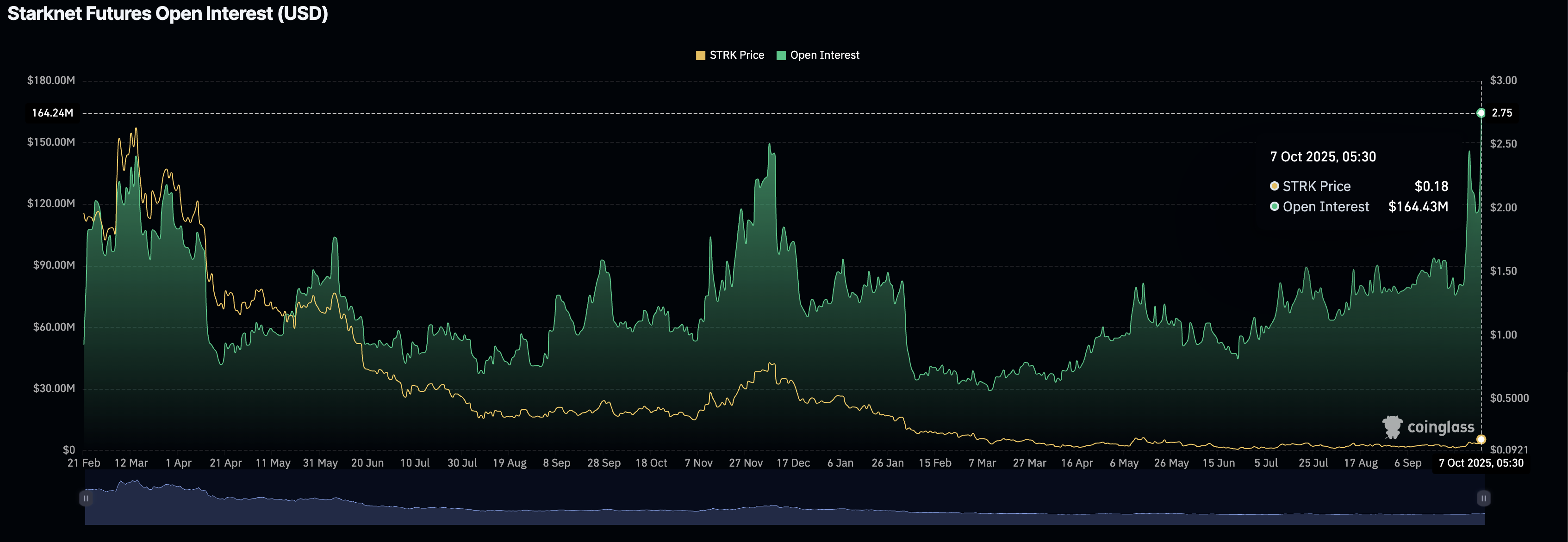

The retail demand for Starknet continues to grow, as evidenced by CoinGlass data showing that the STRK Futures Open Interest (OI) has reached a record high of $164.43 million, up from $117.63 million on Monday. Generally, a surge in Futures OI is associated with a rise in risk-on sentiment among derivatives traders who accumulate larger long positions, anticipating further gains.

STRK Futures Open Interest. Source: CoinGlass

A decisive close above $0.1976 could extend the STRK rally to the 1.272 Fibonacci extension level at $0.2266, extended from the May 13 high at $0.1987 to the June 22 low of $0.0962. Furthermore, the 1.618 Fibonacci extension level could serve as a secondary target at $0.2620.

The Relative Strength Index (RSI) on the daily chart reads 72, indicating a move upwards into the overbought zone, which suggests a bullish control over the trend. However, the risk of a potential reversal increases in this zone, which could foreshadow a reversal from the $0.1976 resistance level.

Additionally, the Moving Average Convergence Divergence (MACD) on the same chart keeps a steady uptrend with its signal line amid successive rises of green histogram bars, which suggests that bullish momentum is intensifying.

STRK/USDT daily price chart.

Looking down, a slip below the 200-day EMA at $0.1788 could result in a retest of the 50-day EMA at $0.1364.