ARTIKEL POPULAR

Wells Fargo on Thursday raised its price target for Broadcom from USD 410.00 to USD 430.00 and upgraded the stock from Equal Weight to Overweight.

The investment bank said its more constructive stance reflects two key factors: the recent pullback in Broadcom’s share price and rising confidence in major incremental catalysts that could emerge before 2026.

Wells Fargo lifted its estimates for 2026 and 2027 revenue/EPS from USD 97.0 billion / USD 10.36 to USD 100.3 billion / USD 10.80, and from USD 130.5 billion / USD 13.90 to USD 143.8 billion / USD 15.35.

The revised forecasts reflect higher expectations for Broadcom’s AI semiconductor revenue, which is now projected to reach USD 52.6 billion in 2026 (up 116% year on year) and USD 93.4 billion in 2027 (up 78% year on year).

Wells Fargo has kept its outlook for Broadcom’s non-AI semiconductor revenue broadly unchanged, while forecasting low double-digit year-on-year growth for the company’s infrastructure software division in fiscal 2026. It also highlighted that Broadcom ended fiscal 2025 with approximately USD 73 billion in backlog for infrastructure software.

The company’s proposed senior notes issuance has received credit ratings from S&P Global Ratings and Fitch Ratings, with S&P assigning an “A-” rating and Fitch a “BBB+” rating. Broadcom also announced the issuance of USD 4.5 billion in senior notes maturing in 2056. These notes are unsecured and non-subordinated, ranking pari passu with the company’s other debt obligations.

Research houses have been actively reassessing Broadcom’s outlook. RBC Capital initiated coverage with a Sector Perform rating, citing discussions around the impact of AI-driven growth and potential collaboration opportunities with Anthropic and OpenAI. Meanwhile, Bernstein reiterated its Outperform rating, expressing confidence in Broadcom’s positioning in the AI market despite intensifying competition. Taken together, these developments underscore the investment community’s continued focus on Broadcom’s strategic direction and financial health.

Market Commentary:

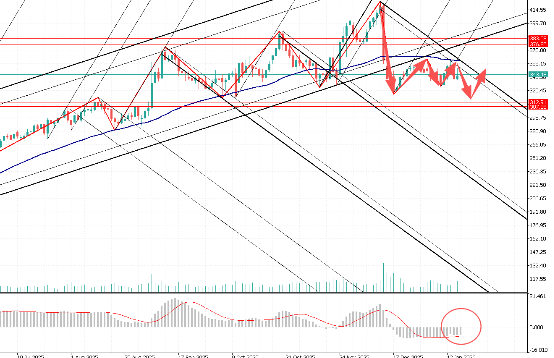

On the daily chart, Broadcom shares remain in a consolidation phase, with MACD lines and histogram further converging above the zero line. Broadcom reported that for fiscal 2025, which ended on 2 November 2025, revenue grew a robust 24% year on year. That increase included a sharp 65% expansion in AI semiconductor revenue, which reached USD 20 billion, underscoring the company’s powerful leverage to AI infrastructure demand.