POPULAR ARTICLES

On Monday, precious metals extended their climb, with spot gold touching the $4,600 mark for the first time ever, bringing gains for the first month of the new year to $280.

Multiple factors are pushing gold and silver to fresh record highs. Last Friday’s US nonfarm payrolls report came in below expectations, reinforcing the view that the Federal Reserve may need to cut rates further. At the same time, escalating tensions involving Iran have heightened geopolitical risks. Fed Chair Jerome Powell revealed that the central bank has received a subpoena from a grand jury at the Department of Justice, which is threatening criminal charges over his June testimony regarding the renovation of the Fed’s headquarters.

Meanwhile, the US Supreme Court has so far failed to rule on President Trump’s tariffs and is scheduled to issue its next opinion on Wednesday. A ruling against the tariffs would undercut one of his signature economic policies and could mark his biggest legal defeat since returning to the White House.

In addition, gold is highly sensitive to the annual rebalancing of major commodity indices, including the Bloomberg Commodity Index and the S&P GSCI. It is estimated that these indices will need to sell around $5 billion worth of gold in order to restore target weights. However, this rebalancing will be completed this week, and despite the associated downside risk, many investors believe the broader fundamental backdrop supporting precious metals remains firmly in place.

Gold remains the ultimate geopolitical safe haven, especially as the US government seeks to advance a new foreign-policy framework where “might makes right.” This renewed gunboat diplomacy and weaponisation of economic tools is likely to keep pushing countries to diversify away from the US dollar. Many expect that gold reaching $5,000 per ounce this year is only a matter of time.

The final pillar of the bullish gold outlook is still the Federal Reserve. Markets currently do not expect the Fed to cut rates at its meeting later this month; however, with the labour market continuing to cool, analysts argue that rate cuts are only a matter of time. The only remaining question is how far rates will ultimately fall.

Market Commentary:

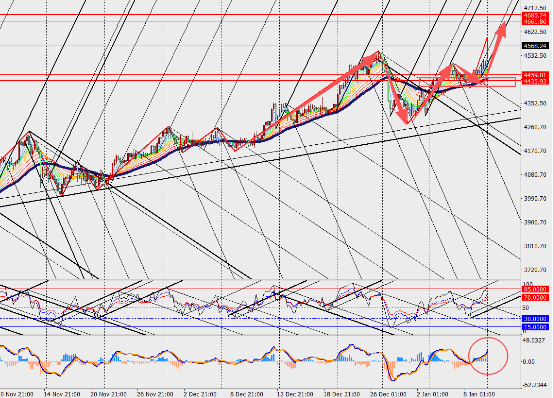

On the 4-hour chart, gold continues to trend higher and break into new territory, with upside momentum strengthening as the price range opens up. After rebounding from support near the 48-day moving average at the start of the year, gold extended its bullish move last Friday, hitting a weekly high of $4,517, establishing higher daily highs and higher lows and laying the groundwork for further gains.