POPULAR ARTICLES

Citi remains optimistic that the precious metals bull run will continue into early 2026. The bank has lifted its 3-month target for gold to $5,000 per ounce, and its target for silver to $100 per ounce. The main drivers cited include escalating geopolitical risks, persistent tightness in the physical market, and renewed uncertainty around the Federal Reserve’s independence. At the same time, Citi warns that tariff policy is a two-way risk factor. The bank reiterates its view that silver will outperform gold, and it remains constructive on industrial metals.

International gold prices have recently climbed to fresh record highs, gaining about 7% over the past month and 12% over the past three months. Citi, however, continues to emphasize its long-standing view that silver’s performance will outstrip gold’s over the cycle.

Silver’s gains over the same period have been even more striking, rallying 36% in the past month and around 60% in the past three months. The bullish momentum has also spilled over into industrial metals, with both copper and aluminium posting strong advances.

Tightness in the physical market remains unresolved, particularly for silver and the platinum-group metals (PGMs). Under Section 232 of the U.S. Trade Expansion Act of 1962, delays and uncertainty around tariff decisions on critical minerals pose significant two-way risks for trade flows and prices of these metals.

Citi warns that if a high-tariff scenario is ultimately implemented, the concentration of related metals shipments into the U.S. market could further exacerbate short-term shortages in the global market and even trigger extreme price spikes.

Once the policy direction on tariffs becomes clearer, metal inventories stockpiled in the U.S. could start to flow back into the global market. That would help ease physical supply stress in other regions and exert downward pressure on prices.

Even so, Citi stresses that within the context of a major bull market, such price pullbacks should be seen as buy-the-dip opportunities, as the core bullish drivers underpinning the strength across the metals complex have not changed.

Market Commentary:

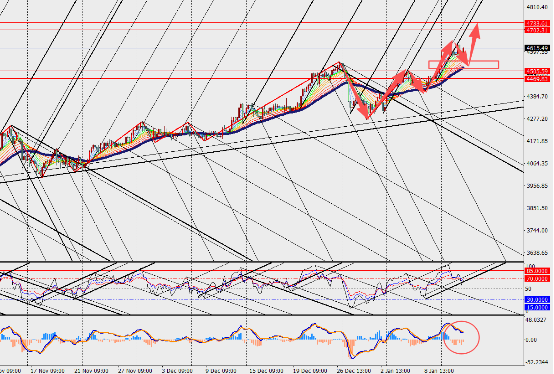

On the 4-hour chart, gold continues to consolidate at high levels, with MACD lines and histogram narrowing above the zero line. Looking ahead to the first quarter of 2026, Citi’s base case assumes that easing geopolitical tensions later in the year will gradually erode the demand for precious metals as hedging tools, with gold likely to feel the impact most acutely.