ARTIKEL POPULAR

- The Canadian Dollar hit a fresh weekly high to kick off the new week.

- President Trump’s plans to reignite global policy concerns is playing poorly with US Dollar markets.

- The BoC’s latest opinion survey has cemented a tepid economic outlook, Canadian CPI figures came in mixed.

The Canadian Dollar (CAD) caught a leg higher on Monday, climbing to its highest bids against the US Dollar (USD) in almost a week as global markets push down on the Greenback in the face of renewed trade war rhetoric from US President Donald Trump. Trump appears to have his sights set on aquiring Greenland, but pushback from the European Union and Greenland itself has flummoxed Trump’s plans to announce himself king of other countries, drawing renewed threats of sweeping flat tariffs on US imports from the EU in a cyclical repetition of Trump’s scattershot trade war rhetoric through 2025.

According to the Bank of Canada’s (BoC) latest summary of business opinions, Canadian firms remain tepid about economic prospects looking ahead through the rest of the year, but fears of a widespread recession have cooled steadily.

Daily digest market movers: Canadian Dollar follows broader FX market higher as Greenback falters

- US President Donald Trump threatened an additional 10% tariff on all goods from the European Union to begin on February 1, climbing to 25% by summer if the EU doesn’t hand over the entire nation of Greenland to the US.

- European leaders were quick to reject the suggestion of ceding Greenland for no real reason, and have expressed their willingness to enact reciprocal targeted tariffs on US goods, drawing further ire from President Trump.

- The BoC’s Business Outlook Survey showed that Canadian business sentiment remains chronically subdued, but has rebounded from the aggregate low hit through the midpoint of 2025.

- Canadian businesses noted that overall sales growth has remained weak over the past year, thanks to economic impacts from the US-Canada trade war. However, sales growth is expected to rebound modestly in 2026.

- Canadian Consumer Price Index (CPI) inflation rose to 2.4% on an annualized basis in December, despite contracting 0.2% on a monthly basis.

Canadian Dollar price forecast

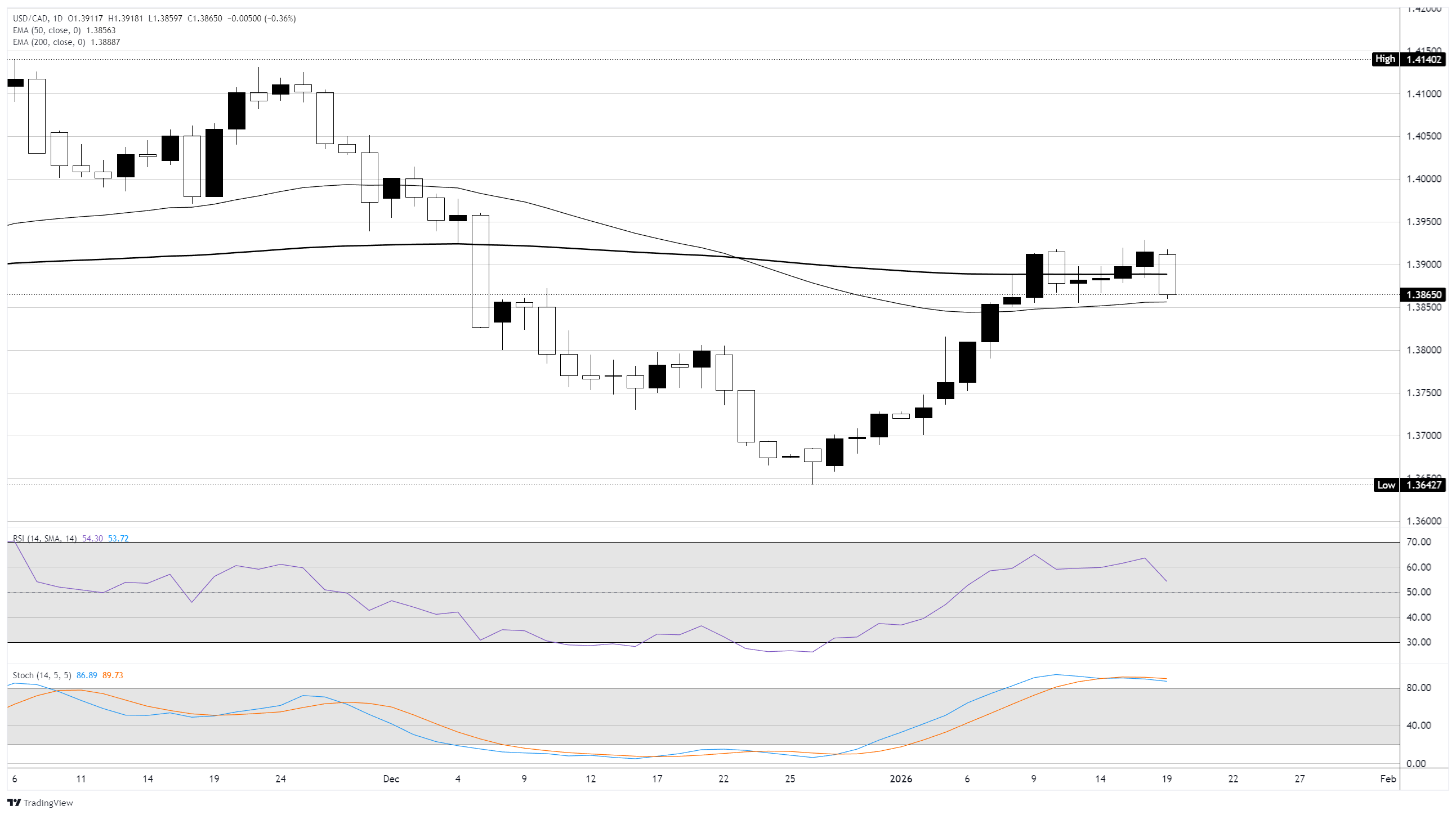

Despite a near-term upswing on fresh Greenback weakness, the Canadian Dollar remains trapped in a key congestion point, with the USD/CAD pair caught between the 200-day and 50-day Exponential Moving Averages (EMA). Price action remains hamstrung near the 1.3900 handle, but overbought conditions on the Stochastic Oscillator are tilting overall odds in favor of further bullish Loonie momentum.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.