POPULAR ARTICLES

- Cardano price hovers around $0.64 on Monday after falling nearly 7% last week.

- Derivatives data show bearish signs as open interest dips to a year-to-date low while short bets hit a monthly high.

- The technical outlook indicates potential for a deeper correction, pushing ADA below the $0.60 level.

Cardano (ADA) hovers around $0.64 at the time of writing on Monday, having corrected nearly 7% in the previous week. Derivatives data signal waning trader confidence and growing expectations of further downside as Open Interest (OI) drops to a yearly low, coupled with a surge in short bets. The technical indicators also suggest the potential for a deeper correction targeting levels below $0.60.

Cardano’s derivatives hint at further correction

Cardano’s futures Open Interest (OI) dropped to $112.82 million on Monday, the lowest year-to-date level and levels not seen since November 2024, according to Coinglass data. This drop in OI reflects waning investor participation and projects a bearish outlook.

ADA futures OI chart. Source: Coinglass

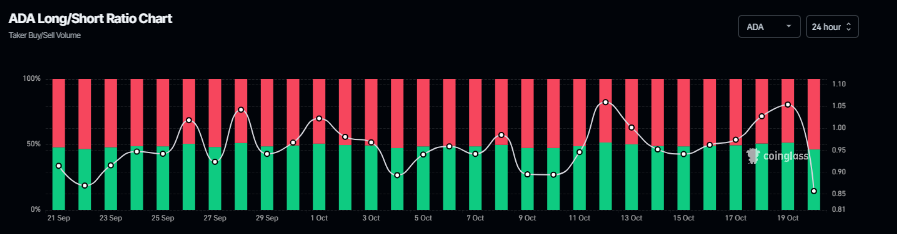

CoinGlass’s ADA long-to-short ratio, which stands at 0.85, is the lowest value in a month. This ratio, below one, reflects bearish sentiment in the markets, as more traders are betting on the asset price to fall.

Cardano long-to-short ratio chart. Source: Coinglass

Cardano Price Forecast: ADA bears aiming for levels below $0.60

Cardano price faced rejection from the 61.8% Fibonacci retracement level at $0.73 on Tuesday and corrected more than 15% by Friday, closing below the $0.64 level. However, ADA recovered slightly during the weekend. At the time of writing on Monday, it hovers at around $0.65.

If ADA continues its correction, it could extend the decline toward the next key support level at $0.56.

The Relative Strength Index (RSI) on the daily chart reads 37, below the neutral level of 50, indicating that the bears are in control of the momentum. Moreover, the Moving Average Convergence Divergence (MACD) also showed a bearish crossover in early October, which remains in effect, further supporting the bearish view.

ADA/USDT daily chart

On the other hand, if ADA recovers, it could extend the recovery toward the 61.8% Fibonacci retracement level at $0.73.