POPULAR ARTICLES

Ethereum price today: $3,920

- Ethereum briefly reclaimed $4,000 as the US recorded a softer-than-expected CPI in September.

- ETH is showing signs of recovery, with investors projecting an 85% chance of two more rate cuts in 2025.

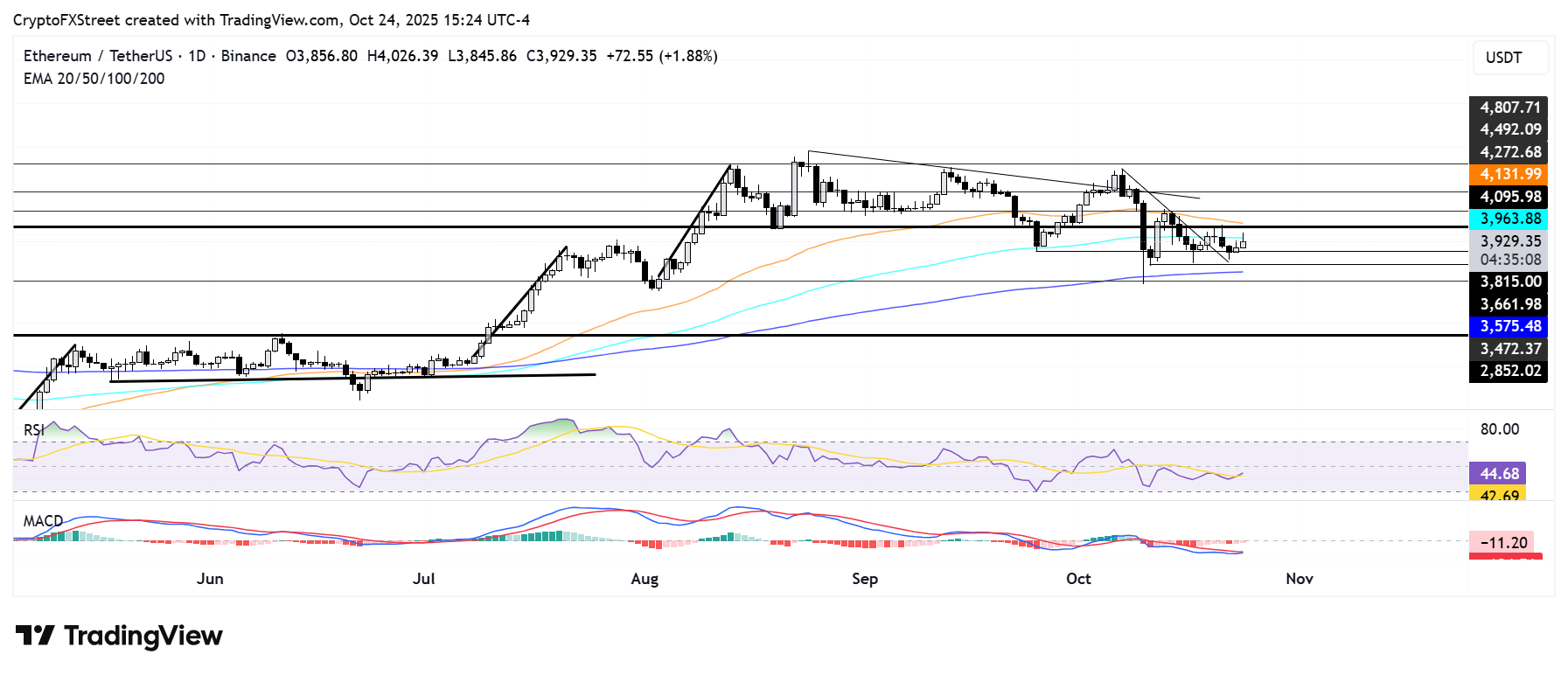

- The top altcoin has remained subdued by the 100-day and 50-day EMAs.

Ethereum (ETH) briefly rose above $4,000 on Friday following a lower-than-expected US Consumer Price Index (CPI) print, reinforcing market expectations of rate cuts.

ETH jumps as rate cut expectations rise amid soft CPI

Ethereum saw a short-lived rise above $4,000 as the release of US CPI data for September stirred positive sentiments across risk assets.

The delayed report, released by the US Department of Labor Statistics amid the ongoing government shutdown, showed inflation cooled in September. Headline CPI rose by 3% YoY, slightly higher than the previous month but below forecasts of 3.1%. The Core CPI, which excludes food and energy components, also rose 0.2% MoM, below the 0.3% forecast. On a yearly basis, core inflation rose 3%, below the 3.1% forecast and the 3.1% reading seen in the previous month.

With the US government shutdown pausing several economic data releases, September's CPI print remains the major data that the Federal Reserve (Fed) will see heading into its October 29-30 meeting.

Market expectations that the Fed will continue its monetary easing path with two more rate cuts before year-end jumped to 85% on prediction marketplace Kalshi.

Historically, risk assets, including cryptocurrencies and stocks, perform better during monetary expansion cycles. This is evident in investors' positioning in response to the CPI, as Ethereum's open interest saw a slight uptick to 11.75 million ETH, its highest level since the October 10 crash.

Ethereum Open Interest. Source: Coinglass

The S&P 500 also posted gains, reaching a new all-time high of $6,806 on Friday.

However, ETH's price action suggests cautious sentiment remains dominant amid US-China trade tensions.

Ethereum Price Forecast: ETH remains subdued by 100-day and 50-day EMAs

Ethereum recorded $69.4 million in futures liquidations over the past 24 hours, comprising $41.4 million and $28 million in long liquidations, per Coinglass data.

ETH tested the 100-day Exponential Moving Average (EMA) again on Friday, as it looks set to continue consolidating in the $3,800-$4,100 tight range. The top altcoin could rise to test the $4,500 key level if it clears the $4,100 resistance, which is strengthened by the 50-day EMA.

ETH/USDT daily chart

On the downside, ETH could fall to find support near $3,470 if it loses the $3,815 and $3,660 key levels.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) histograms remain below their neutral levels, indicating a bearish dominant momentum.