ARTIKEL POPULAR

- XRP trades amid increasing downside pressure, as steady ETF inflows fail to shift sentiment.

- Retail demand remains suppressed as Open Interest in the derivatives market stabilizes at around $3.71 billion.

- A weak technical structure weighs down on XRP, making a recovery unlikely in the short term.

Ripple (XRP) is extending its decline for the second consecutive day, trading at $2.06 at the time of writing on Friday. Sentiment surrounding the cross-border remittance token continues to lag despite steady inflows into XRP spot Exchange Traded Funds (ETFs).

A reversal below the prevailing market level will likely extend the pullback to Monday’s low of $1.98. Hence, the next few days would help gauge sentiment ahead of the Federal Reserve’s (Fed) monetary policy meeting on December 10.

XRP ETFs steady, but sentiment remains weak

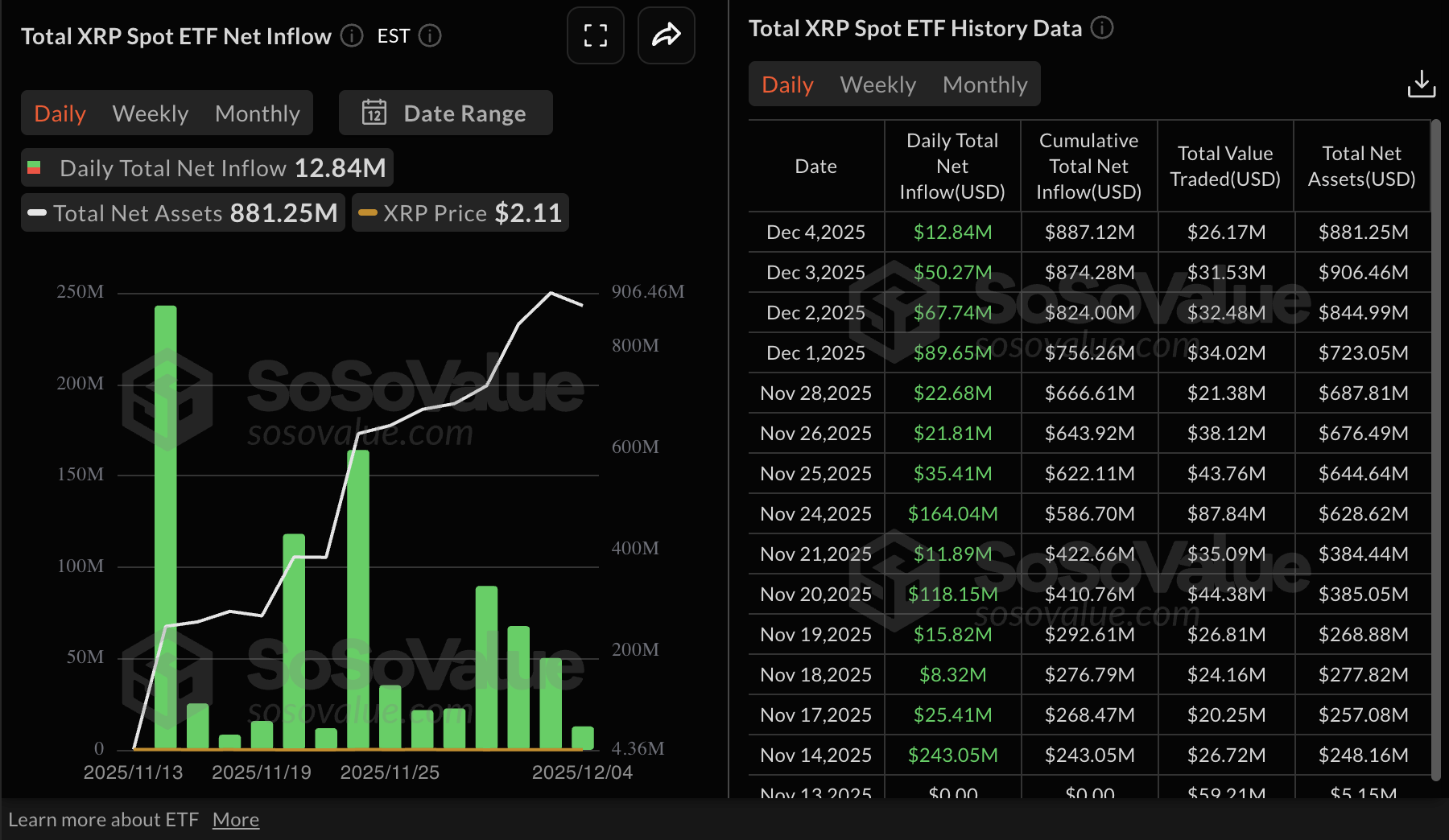

Interest in XRP spot ETFs has steadied since their debut on November 13, signaling a potential shift to altcoin-based crypto investment products. A total of $13 million marked a 14-day streak of positive inflows on Thursday, according to SoSoValue data.

XRP ETFs have cumulative inflows of $887 million and net assets of $881 million. A break above $1 billion would mark the next milestone and possibly set the stage for larger inflows.

Steady ETF inflows support positive sentiment, encouraging investors to increase exposure and anticipate a sustained uptrend.

Meanwhile, the demand for XRP derivatives remains shaky, with futures Open Interest (OI) dropping to $3.71 billion on Friday, from $3.85 billion the previous day.

OI has been on a general downtrend since mid-July, when the price of XRP reached a new all-time high of $3.66. The October 10 deleveraging event left many traders in losses, further weakening sentiment.

A significant decline in OI indicates that investors have lost confidence in the token’s ability to sustain an uptrend, which may continue to cap rebounds.

Technical outlook: XRP sellers tighten their grip

XRP is trading at $2.06 at the time of writing on Friday, but the token is also pressed below the 50-day Exponential Moving Average (EMA) at $2.30. The 100-day EMA at $2.46 and the 200-day EMA at $2.49 slope lower and cap rebounds.

The Moving Average Convergence Divergence (MACD) line about to slide below the signal line on the daily chart, as green histogram bars contract, suggesting fading momentum. At the same time, the Relative Strength Index (RSI) stands at 42 on the same chart, below the neutral midline, indicating lingering bearish pressure.

Parabolic SAR indicator sits beneath price, with the latest dot at $1.88, offering nearby trailing support. The descending trend line from $3.66 caps XRP's upside, with resistance seen at $2.63, while the rising trend line from $1.62 offers support near $1.83. A daily close above the 50-day EMA at $2.30 would ease pressure and open room toward the 100-day EMA at $2.46. Still, a drop through the trend-line (green) base would reassert the downtrend and risk fresh lows.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

(The technical analysis of this story was written with the help of an AI tool)