What is Algorithmic Trading?

Algorithmic trading, sometimes shortened to algo trading, involves using computer programs to automate different aspects of trading. Just as automation is a powerful tool in our daily lives, automating aspects of your trading strategy can benefit traders. Some reasons traders might consider algorithmic trading are:

Speed and Precision: Algorithms can analyze data and react to market movements faster than humans, greatly increasing the execution speed of trades.

Optimization: Automating trading systems can help to reduce emotional decision-making and optimize certain trading strategies.

Scalability: Algorithms can handle multiple trades across different markets at once, allowing traders the flexibility to scale up their operations.

In short, algorithms can give traders the essential edge to succeed in the fast-paced world of trading.

About MetaTrader 5 API

MetaTrader 5 is a leading trading platform renowned for its advanced technical tools and flexibility. Some of the key features of MT5 for algorithmic trading include:

Built-in Analysis Tools: Traders can perform advanced technical analysis using MT5’s available indicators and charting functions.

Customizable Trading Systems: MT5 has robust algorithmic trading integration so that traders can design and automate their trading strategies.

API Integration: MT5 includes Application Programming Interface (API) integration, allowing traders to connect their live trading accounts to custom automation scripts seamlessly.

Using Python

Python is one of the most popular programming languages used worldwide and is known for its versatility and ease of learning.

Beginner-Friendly: Python’s straightforward structure makes it easy for beginners, even those without prior programming experience, to pick up.

Library Support: Popular libraries like pandas (data analysis), matplotlib (visualization), and MetaTrader5 (trading operations) simplify the process of building and automating trading strategies.

Large Community and Great Support: With an active global community, Python features vast community-driven resources, forums, and guides for troubleshooting and learning.

Paired with MT5 API, traders can leverage Python to develop, test, and execute trading algorithms effectively.

Step-by-Step Guide to Setting Up a Trading Algorithm with Python and MT5

Download and Install MT5 and Python

Download the TMGM MT5 client

Install Python from python.org

Use Pip to install essential libraries

pandas (data analysis, time series, and statistics)

matplotlib (chart plotting)

Metatrader 5 (for MT5 API with Python)

Tips:

When running Python in your preferred terminal, if the command ‘python’ does not work, try ‘python3’.

Run the terminal as an administrator to avoid permission issues.

Connect Python to MT5

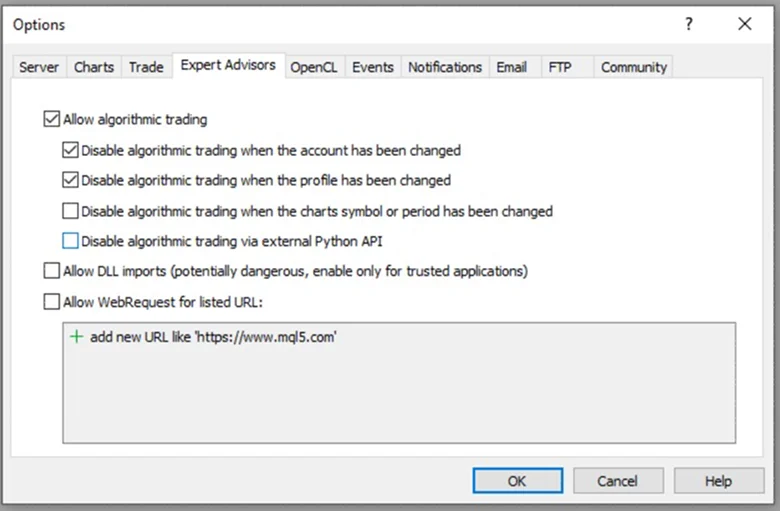

Open MT5 and log in to your trading account or demo account.

Go to Tools > Options > Expert Advisors, and make sure the “Allow Algorithmic Trading” box is ticked.

Open Command Prompt as Administrator.

Run the Python script below to validate the connection with MT5.

Example Python code:

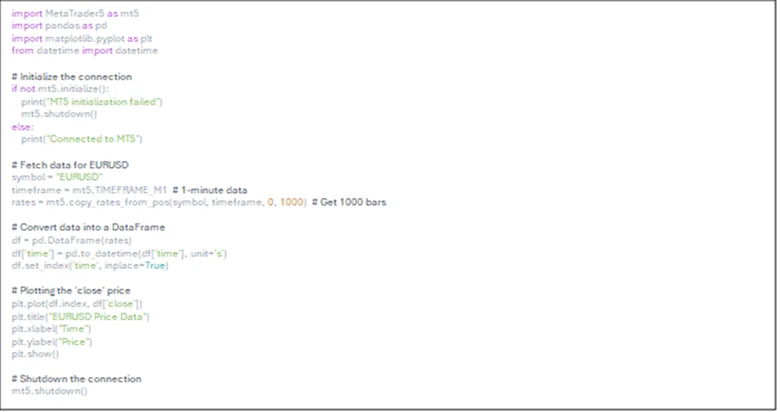

Fetch Live Market Data

Using the MT5 API, we can retrieve live price and market data. For example, we can fetch the data for EURUSD.

This will print a visualization of the live data, as below.

Define the Trading Rules

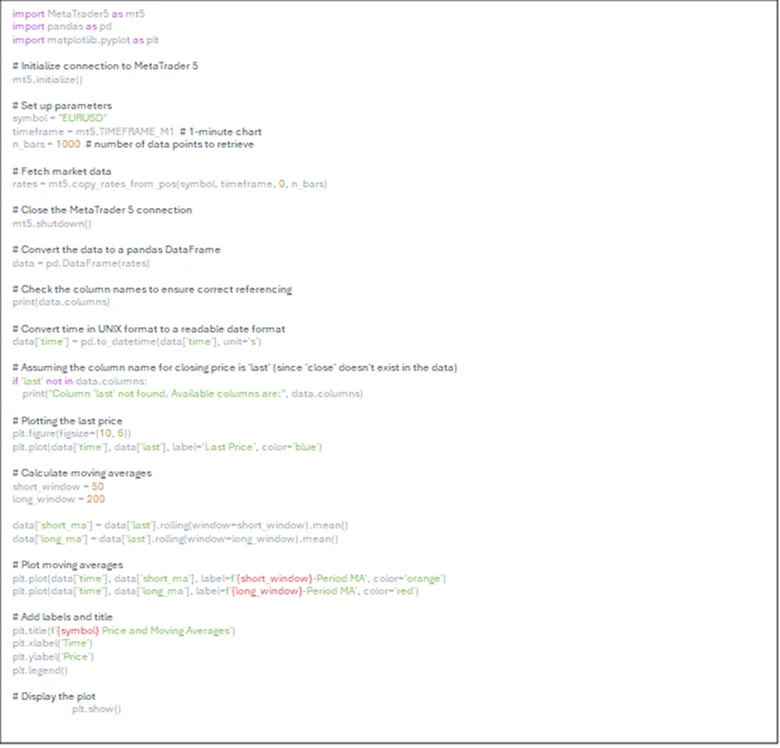

Apply a trading algorithm based on some rules or conditions. In this example, we will use a basic moving average cross strategy as below:

Buy Signal: The short-term moving average crosses above the long-term moving average.

Sell Signal: The short-term moving average crosses below the long-term moving average.

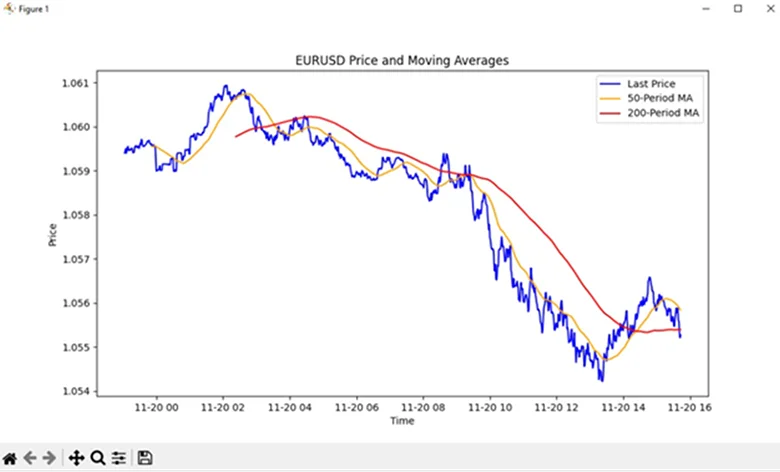

To visualize the moving averages, we can use matplotlib to print them with the example code below:

The moving averages (MA) should be printed, as below.

Algorithmic Trading Script

Sample code snippet below:

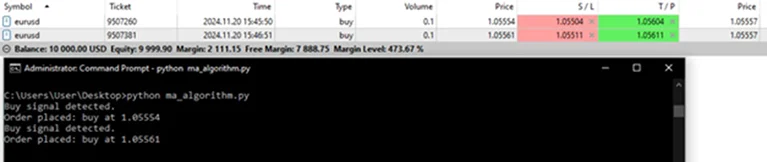

The algorithm will run in an infinite loop, and the trades will then be automatically placed based on the trading rules set.

You can view the placed trades in the Toolbox Window in MT5.

To stop the algorithm, simply use a keyboard interrupt in the command prompt or terminal window by pressing “Control + C.”

Explanation and Notes on the Sample Code

Fetch and Prepare Trading Data

Retrieves historical prices for the specified symbol (EURUSD) and timeframe (M1 – 1 Minute).

Calculates two moving averages (short_ma and long_ma) using the pandas rolling() method.

Generate Signals

A signal column is added to indicate trade actions based on the moving averages crossover.

Place Trades

Based on the latest generated signal, the script places a buy or sell order.

Risk Management

The script assumes a fixed volume of 0.1. Modify this according to your risk tolerance and trading strategy.

Testing

Test your automated trading strategies and scripts with a demo account before live trading to work out the bugs.

Explore Algorithmic Trading with TMGM

What we have shown here is just a simple example, there are endless possibilities for creating and refining your trading algorithms. Python and MT5 empower traders to develop and optimize trading strategies that excel in speed, precision, and market efficiency.

Choose a trusted and innovative broker like TMGM to ensure you have the right tools and support to succeed in algorithmic trading.

With TMGM, you can take your algorithmic trading to the next level: access advanced trading tools, the MetaTrader 5 API, deep liquidity, and diverse markets. Whether you’re a beginner or an experienced, tech-savvy trader, TMGM provides the resources, education, and robust trading environment to seamlessly integrate and automate your custom trading strategies.

Ready to Get Started?

Sign up now and gain access to global markets in under 3 minutes.