FTSE 100 Macroeconomics

After reaching the Bank of England’s (BOE) valuation of 2.0% in August 2024, interest rates have dipped by 0.50 basis points and are currently at 4.75%.

A recent figure released by ONS shows that inflation rose by 1.7% in September to 3.2% in October, caused by a rise in energy prices. Although this may have been expected with pressure to lessen inflation, interest rates still held up at 4.75 basis points, with the next BOE on course to meet on 19 December.

Inflationary pressures are rumoured to decrease for this year. Whilst the UK economy is likely to experience interest rate deductions following a recent budget, subsequent cuts are expected to be more incremental.

Investing in FTSE 100 dividend stocks can be an effective strategy for generating income/ and achieving long-term growth. As of January 2025, several companies within the FTSE 100 are notable for their attractive dividend yields and consistent payout histories.

Here is an expanded guide to the best FTSE 100 dividend stocks for 2025, factors to consider when investing, and why dividend investing remains a powerful strategy.

What Makes FTSE 100 Dividend Stocks Attractive?

Consistent Income

Dividend stocks are particularly appealing to investors looking for consistent cash flow. The FTSE 100 features many companies with long histories of paying and growing dividends.

Stability and Resilience

FTSE 100 companies are large-cap businesses that are less volatile than smaller firms. This makes them attractive during periods of economic uncertainty.

Dividend Growth Potential

Some companies focus on growing their dividends over time, in addition to high yields, making them a smart choice for long-term investors seeking both income and capital appreciation.

Best FTSE 100 Dividend Stocks to Watch for 2025

#1 Legal & General Group (LGEN)

Legal & General Group PLC (LGEN) has a consistent history of dividend payments, making it an attractive option for income-focused investors.

• Sector: Financial Services

• Dividend Yield: Approximately 9.8%

Key Points:

• A leader in insurance, retirement solutions, and investment management.

• Consistently high dividend yield backed by strong cash generation.

• Attractive for income investors seeking exposure to the financial sector.

#2 M&G (MNG)

Since 2021, M&G plc will deposit your dividends straight into your bank accounts, with no cheques issued. This is because direct payments are more secure, efficient, and friendlier to the environment.

• Sector: Investment Management

• Dividend Yield: Around 13%

Key Points:

• Offers one of the highest yields on the FTSE 100.

• Focuses on asset management and long-term wealth generation.

• Suitable for investors seeking robust income despite market volatility.

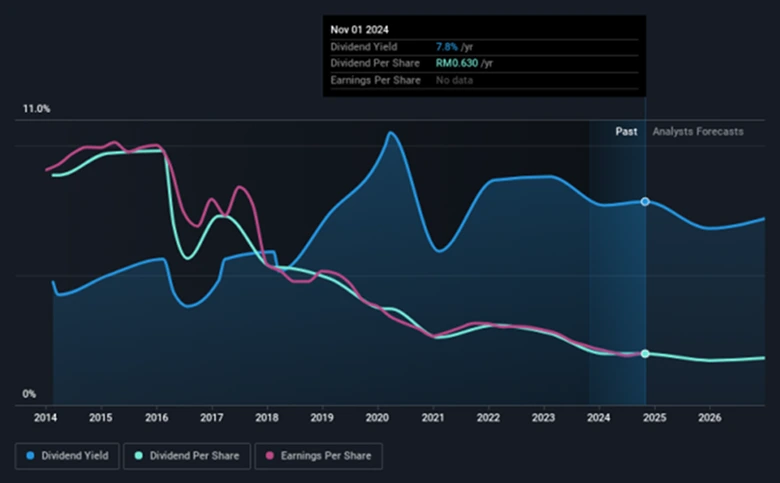

#3 British American Tobacco (BATS)

British American Tobacco makes it easy for shareholders to accept their dividends, as they are credited directly into their nominated bank accounts.

• Sector: Tobacco

• Dividend Yield: Approximately 7.9%

Key Points:

• A global leader in tobacco products with strong cash flow.

• Consistent dividend payments supported by its diversified product portfolio.

• Attracts investors who value income despite ethical concerns surrounding tobacco investments.

#4 Phoenix Group Holdings (PHNX)

Phoenix Group Holdings Plc's dividends are set ex in 3 months, and shareholders can expect to be paid in around 4 months. There are usually two dividends each year (not including specials), and the dividend cover is around 1.0.

• Sector: Insurance

• Dividend Yield: Around 10.2%

Key Points:

• Specializes in life insurance and pensions.

• Delivers a high and stable dividend, appealing to income-focused portfolios.

• Has a strong record of accomplishment of profitability and growth in retirement markets.

#5 B&M European Value Retail (BMEB)

B&M European Value Retail SA is expected to pay a dividend of £0.15. This corresponds to a dividend yield of approximately 3.74%.

• Sector: Retail

• Dividend Yield: Approximately 9.7%

Key Points:

• Operates as a discount retailer with a focus on cost-conscious consumers.

• Robust performance even in challenging economic environments.

• High dividend yield reflects its consistent profitability.

#6 Shell (SHEL)

• Sector: Energy

• Dividend Yield: Around 4.6%

Key Points:

• A major player in oil, gas, and renewable energy.

• Reliable dividend payouts supported by robust cash flow from diversified operations.

• Attractive for those seeking exposure to the energy sector with a sustainability focus.

#7 HSBC Holdings (HSBA)

• Sector: Banking

• Dividend Yield: Approximately 6.7%

Key Points:

• A global banking powerhouse with significant operations in Asia and Europe.

• Regular dividends backed by strong financial performance and global diversification.

• A strong pick for those looking for exposure to the financial sector.

#8 Unilever (ULVR)

• Sector: Consumer Goods

• Dividend Yield: Around 3.6%

Key Points:

• Produces essential goods in food, home, and personal care sectors.

• Known for its defensive nature and reliable dividend payments.

• A stable choice for income investors seeking low-risk exposure to consumer goods.

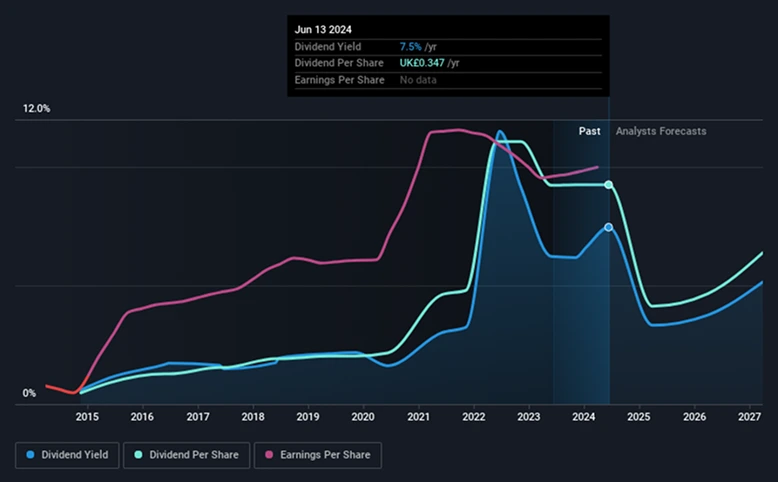

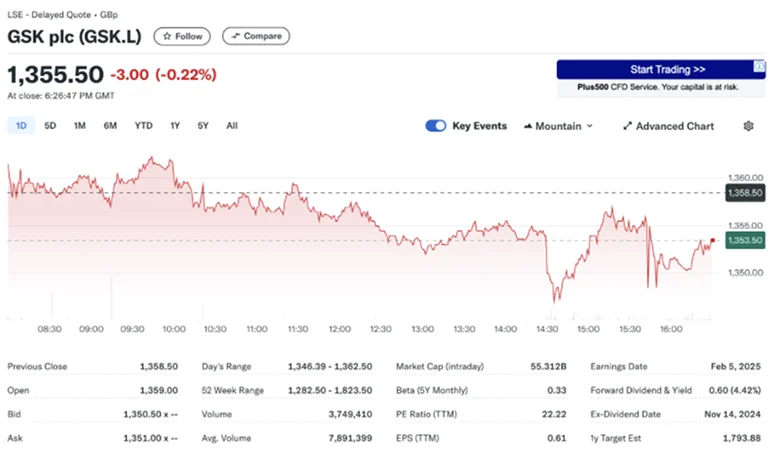

#9 GlaxoSmithKline (GSK)

• Sector: Pharmaceuticals

• Dividend Yield: Approximately 4.9%

Key Points:

• Focuses on vaccines, pharmaceuticals, and healthcare innovations.

• Consistent dividend payouts backed by a robust product pipeline.

• Offers stability in a defensive sector, especially during uncertain times.

#10 Diageo (DGE)

• Sector: Beverages

• Dividend Yield: Around 3.7%

Key Points:

• A leader in premium alcoholic beverages with brands like Johnnie Walker and Guinness.

• Generates reliable cash flow, supporting stable dividend growth.

• Attractive to investors seeking income from consumer staples.

Conclusions

Key Considerations for Dividend Investors

Dividend Sustainability

High yield is enticing, but not all dividends are sustainable. Assess payout ratios, cash flow, and debt levels to ensure the company can maintain its dividends.

Sector Diversification

Avoid overexposure to a single industry. A diversified portfolio across energy, financials, and consumer goods can mitigate risks.

Economic and Market Conditions

Economic downturns can impact company earnings and dividend payouts. Focus on companies with resilient business models and strong balance sheets.

Dividend Growth vs. High Yield

Consider whether you prioritize high current yields or consistent dividend growth over time. Dividend growth stocks often outperform overall.

Why Dividend Investing Works

Dividend investing offers a balance of income generation and long-term capital appreciation. Reinvesting dividends can compound returns, while steady payouts cushion during market downturns.

By focusing on reliable dividend payers within the FTSE 100, investors can create a portfolio that aligns with their income needs and risk tolerance while benefiting from the stability of established companies.

Investing in FTSE 100 dividend stocks remains a tried-and-tested strategy for generating wealth and securing a sustainable income stream.

Are you looking for an ideal Forex Trading broker? Why not register for a TMGM account now and explore the trading markets?