Principais Conclusões

Um corretor de CFDs conecta os traders ao mercado e executa ordens por meio de plataformas de negociação, ferramentas e feeds de preços.

Traders de varejo precisam de um corretor para acessar CFDs, pois não podem negociar esses produtos diretamente nas bolsas.

Os custos de negociação vêm do spread ou de uma comissão e do financiamento overnight quando as posições permanecem abertas.

Compare corretores considerando a regulamentação e segregação dos fundos dos clientes, qualidade da plataforma, variedade de produtos, educação, suporte e preços transparentes.

A alavancagem aumenta tanto o potencial de lucro quanto o risco de perda, portanto, uma gestão de risco sólida e atenção à qualidade da execução são essenciais.

O que é um Corretor em Negociação de CFDs

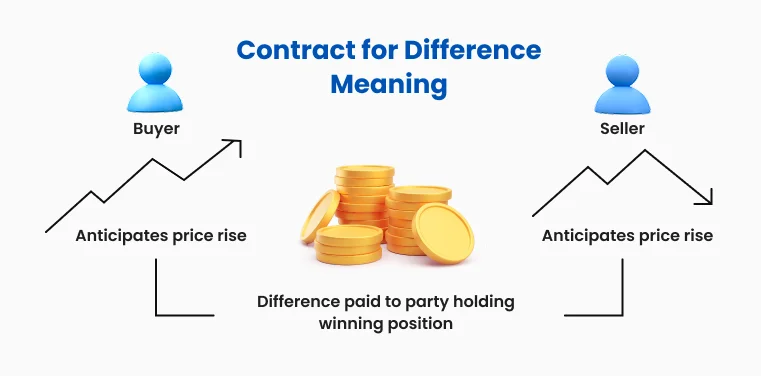

O que é um corretor em negociação de CFDs? É uma pergunta que todo trader iniciante deve fazer antes de entrar nos mercados. À medida que a negociação de Contratos por Diferença (CFDs) ganha popularidade entre traders de varejo, entender o papel de um corretor de CFDs torna-se essencial.

Um corretor atua como intermediário entre traders e mercados financeiros, fornecendo a infraestrutura, plataformas e ferramentas necessárias para executar negociações. Sem uma compreensão clara de o que é um corretor em negociação, iniciantes podem ter dificuldades para navegar nas complexidades de produtos alavancados como os CFDs.

Tipos de Corretores de CFDs

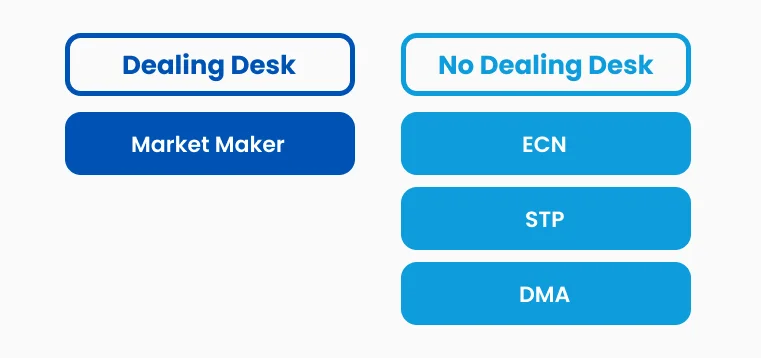

A indústria de CFDs inclui vários tipos de corretores com modelos distintos. Market makers, o tipo mais comum, definem seus preços de compra/venda e oferecem spreads apertados com execução rápida, sendo ideais para traders ativos.

Corretores Electronic Communication Network (ECN) conectam traders a provedores de liquidez, oferecendo preços transparentes e spreads variáveis. Direct Market Access (DMA) é um tipo de corretor de CFDs que oferece acesso direto a livros de ordens em tempo real e profundidade de mercado, atraindo profissionais que buscam transparência e estão dispostos a pagar comissões mais altas.

Figura 1: Market makers são corretores Dealing Desk (DD); enquanto ECN, DMA e STP (Straight Through Processors) são corretores Non-dealing desk (NDD), significando que conectam traders diretamente ao mercado interbancário em vez de facilitar o lado oposto da negociação do cliente'.

O Que Corretores de CFDs Fazem?

Ao explorar o que um corretor faz em negociação de CFDs, fica claro que’ corretores de CFDs desempenham um papel fundamental ao oferecer plataformas de negociação equipadas com ferramentas gráficas, indicadores técnicos e sistemas avançados de gerenciamento de ordens.

Um corretor de CFDs completo como a TMGM oferece acesso a uma gama diversificada de instrumentos financeiros, incluindo ações, índices, commodities, moedas, e criptomoedas, tudo através de uma única conta.

A gestão de risco representa outra função crucial, pois os corretores implementam requisitos de margem, ordens stop-loss e controles de dimensionamento de posições para ajudar os traders a gerenciar sua exposição.

Para entender melhor o que um corretor faz, é essencial saber que seu papel também inclui garantir conformidade regulatória, aderir às leis financeiras e manter contas segregadas dos clientes para maior segurança.

Figura 2: O que é um corretor em negociação de CFDs e como ele opera?

Como Corretores de CFDs Ganham Dinheiro

Um corretor de CFDs gera receita por meio de vários mecanismos, sendo os spreads a principal fonte de renda para a maioria dos market makers. O spread, que é a diferença entre os preços de compra e venda, permite que os corretores obtenham lucro em cada negociação executada.

Outra fonte de receita para um corretor de CFDs são as cobranças de financiamento overnight, onde juros são aplicados às posições mantidas durante a noite, dependendo dos custos de financiamento do ativo subjacente.

Escolhendo um Corretor de CFDs Confiável

Selecionar um corretor de CFDs adequado requer consideração cuidadosa de múltiplos fatores além de apenas spreads e comissões competitivas. A supervisão regulatória é o critério mais crítico, pois corretores devidamente regulamentados devem aderir a rígidos padrões financeiros e manter a segregação dos fundos dos clientes.

Os traders devem verificar se o corretor escolhido possui licenças de órgãos reguladores respeitáveis e oferece esquemas adequados de proteção ao investidor.

A diferença entre corretor e dealer torna-se particularmente relevante ao avaliar modelos de execução de ordens, pois alguns corretores atuam como dealers assumindo o lado oposto das negociações dos clientes, enquanto outros funcionam apenas como intermediários.

Suporte ao cliente confiável, recursos educacionais e políticas de preços transparentes distinguem ainda mais corretores profissionais de operadores menos reputados.

Figura 3: Entendendo os riscos inerentes a ser um corretor de CFDs

Riscos e Responsabilidades

Embora um corretor de CFDs forneça acesso ao mercado, os traders devem entender os riscos que acompanham a negociação alavancada. A diferença entre corretor e dealer em responsabilidades torna-se crucial na avaliação de risco, pois corretores market makers podem ter conflitos de interesse quando as perdas dos clientes se tornam seus lucros.

O risco de contraparte é outra preocupação significativa, pois os traders enfrentam perdas potenciais se seu corretor tornar-se insolvente ou não cumprir suas obrigações.

Além disso, os traders são responsáveis por entender os efeitos da alavancagem, requisitos de margem e a possibilidade de perdas que excedam seus investimentos iniciais.

Negocie com mais inteligência com a TMGM

Entender o que é um corretor, especialmente no contexto da negociação, é essencial para uma jornada de trading bem-sucedida. Um corretor de CFDs atua como intermediário financeiro, fornecendo acesso ao mercado, plataformas de negociação e ferramentas cruciais, ao mesmo tempo em que assegura conformidade regulatória.

Os traders devem avaliar a regulamentação do corretor, condições de negociação e modelo de negócios, além de entender’ o que um corretor faz, incluindo como sua estrutura de receita afeta os custos de negociação e a execução.

Escolher um corretor de CFDs reputado e bem regulamentado permite que os traders gerenciem o risco de forma eficaz e mantenham o foco em sua estratégia de negociação. Também esclarece a diferença entre corretor e dealer, o que apoia uma melhor tomada de decisão.

Para aqueles interessados em explorar a negociação de CFDs, é recomendável testar estratégias de negociação primeiro antes de comprometer fundos reais, usando uma conta demo TMGM. Uma vez que os usuários se familiarizem mais com a plataforma e a mecânica da negociação, podem abrir uma conta real de negociação com a TMGM, utilizando o aplicativo móvel TMGM ou o aplicativo para desktop.