Apple: A Tech Giant That Keeps Innovating

Continued Market Leadership: Apple maintains its dominance in the global tech industry, with flagship products like the iPhone, Mac, and Apple Watch driving significant revenue growth.

Innovation in AI and AR: The company is at the forefront of integrating artificial intelligence (AI) and augmented reality (AR) into its hardware products, setting trends that competitors follow.

Loyal Customer Base: Apple's ecosystem of interconnected devices ensures high customer retention, contributing to consistent sales and service revenue.

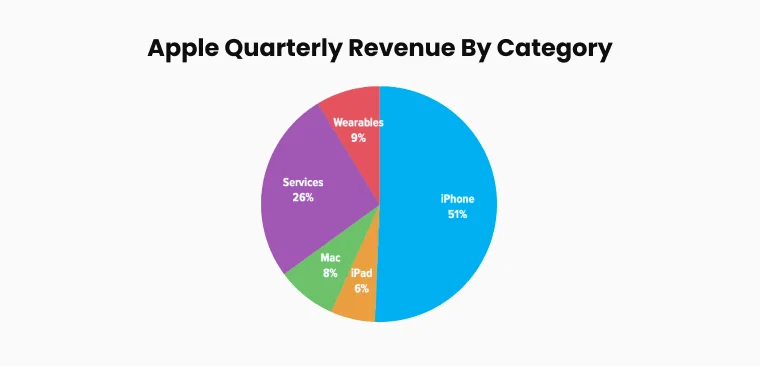

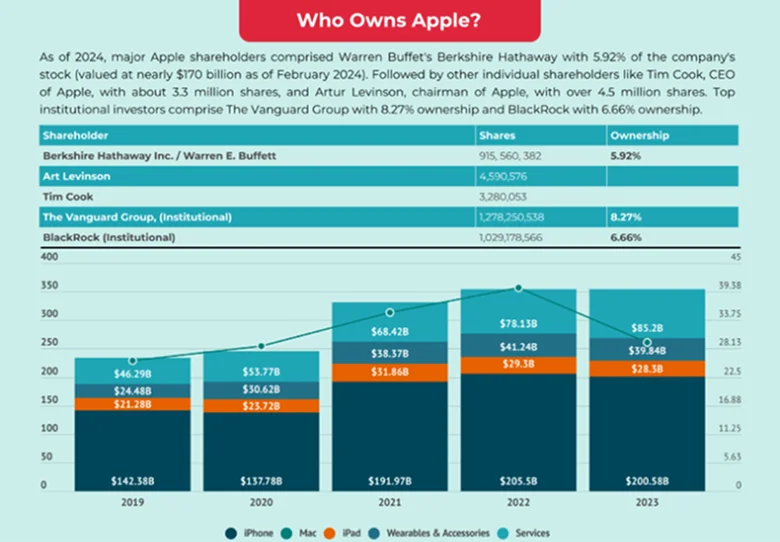

Revenue Diversification: In addition to hardware, Apple’s growing services segment—such as Apple Music, iCloud, and App Store—provides a recurring income stream.

Strong Financial Fundamentals

Robust Balance Sheet: Apple has one of the healthiest balance sheets in the industry, boasting substantial cash reserves and manageable debt levels.

Impressive Earnings Performance: Quarterly earnings reports often exceed Wall Street expectations, reinforcing investor confidence.

Reliable Dividend Payouts: Apple shares are attractive for dividend-seeking investors due to consistent payouts and a history of dividend growth.

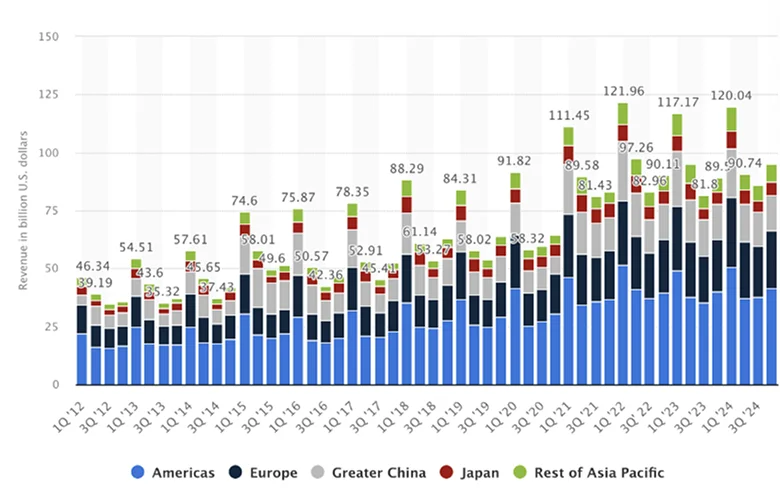

Global Demand for Apple Products

Expanding Market Share in Emerging Economies: Regions like India and Southeast Asia represent key growth areas as disposable incomes rise and consumers seek premium products.

Sustainable Growth in Services: Subscription-based services, such as Apple TV+ and Fitness+, cater to a global audience, ensuring revenue streams beyond hardware sales.

Resilient Supply Chain: Apple's strategic supplier partnerships and manufacturing advancements minimize disruptions, even in volatile global markets.

Why Consider Trading Apple CFDs?

Leverage Market Opportunities: CFDs allow you to trade on Apple shares’ price movements without owning the shares outright, requiring less capital upfront.

Short-Selling Options: With CFDs, you can profit from rising and falling markets, offering flexibility in diverse economic conditions.

Access to Global Markets: Platforms like TMGM provide access to Apple CFDs, enabling real-time trades and analysis from anywhere.

Advanced Trading Tools: CFD trading platforms offer features like margin trading, technical analysis tools, and risk management options to enhance your trading strategy.

Risks and Rewards of Investing in Apple Shares

Potential Rewards:

Exposure to a globally recognized and respected brand.

Participation in Apple’s long-term growth and innovation.

Dividend income and capital appreciation opportunities.

Key Risks:

Dependency on high-margin products like the iPhone, which could face stiff competition.

Regulatory scrutiny in major markets, including antitrust concerns.

Potential challenges in global supply chains due to geopolitical tensions.

How to Start Investing in Apple Shares or CFDs

Choose the Right Platform: Ensure you select a reliable broker offering low fees, intuitive platforms, and educational resources.

Research and Analyze: Stay updated on Apple’s financial reports, market trends, and technological developments.

Use Risk Management Tools: Employ stop-loss orders and other strategies to protect your investments.

Leverage Educational Resources: Platforms like TMGM provide tools and tutorials to help you make informed investment decisions.

Apple Shares Are a Strong Bet for 2025

As the global economy evolves, Apple shares continue representing stability and innovation. Whether you prefer holding shares for long-term growth or trading Apple CFDs to capitalize on market fluctuations, the company’s robust fundamentals and forward-thinking strategies make it a compelling choice.

With a proven track record, diversified revenue streams, and an ever-growing global presence, Apple is positioned for success in 2025 and beyond.

Start Your Investment Journey Today!

Explore advanced strategies and educational resources for trading Apple shares and CFDs on TMGM’s platform. Visit TMGM to access world-class tools and insights that empower your trading decisions.