Is Crypto Trading Legal In India

What is Crypto?

The term crypto refers to cryptocurrencies, which are digital or virtual assets that use cryptography to secure transactions. Unlike traditional money issued by central banks, cryptocurrencies are decentralized and operate on blockchain technology. Popular examples include Bitcoin, and Ethereum.

These assets are not only seen as a speculative investment but also as a potential store of value, similar to gold. Traders often compare the volatility of crypto to more traditional assets, and discussions sometimes draw parallels with other investment returns, such as gold returns in last 10 years.

What is Crypto Trading?

Crypto trading is the practice of buying and selling cryptocurrencies through online exchanges or trading platforms. Just like forex trading, traders aim to profit from price fluctuations.

Types of crypto trading include:

Spot Trading

Figure 1: Spot Trading.

Spot trading refers to buying or selling digital coins at their current market price. When you engage in spot trading, you own the actual cryptocurrency, such as Bitcoin or Ethereum, which can be stored in a digital wallet. This type of trading is straightforward and often preferred by beginners because it allows them to directly participate in the crypto market. However, it also exposes traders to full market volatility since their profits or losses depend entirely on the asset’s price movement.

Derivatives Trading

Figure 1: Derivatives Trading.

Derivatives trading in crypto involves contracts such as futures or CFDs (Contracts for Difference), which allow traders to speculate on price movements without owning the actual cryptocurrency. Instead of holding the coin itself, traders enter into an agreement based on the future value of the crypto asset. This approach provides flexibility, as traders can profit from both rising and falling markets. It also allows the use of leverage, meaning you can control larger positions with smaller capital. However, while derivatives offer more opportunities, they also carry higher risks and require solid risk management strategies.

For Indian beginners, understanding what crypto trading is is the first step before entering the market. It is similar in concept to trading other asset classes, but with higher volatility and unique regulatory considerations.

Is Crypto Trading Legal in India?

The direct answer is yes, crypto trading is legal in India, but with certain restrictions. As of now, there is no outright ban on trading cryptocurrencies. Indian residents are free to buy, sell, and hold digital assets through registered exchanges and platforms, but any profit from these actions is taxable under India’s tax regulations.

However, it is important to note that cryptocurrencies are not recognized as legal tender in India. Furthermore, the Reserve Bank of India (RBI) has issued several advisories cautioning about the risks involved.

This means traders can legally participate, but they must comply with tax regulations and understand that crypto is treated as a digital asset, not a currency.

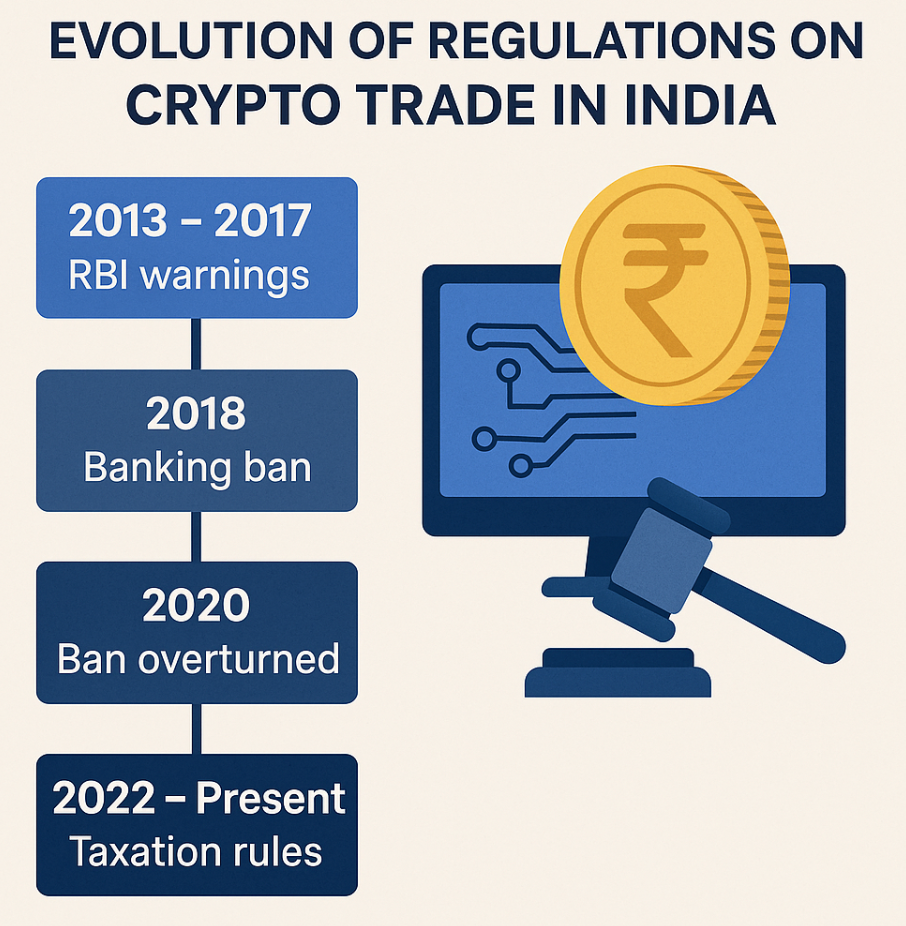

Evolution of Regulations on Crypto Trade in India

The regulatory landscape has evolved significantly:

Figure 3: Evolution of Crypto Trade Regulation in India.

2013 – 2017: RBI repeatedly warned against the risks of trading digital currencies.

2018: RBI imposed banking restrictions on entities dealing with cryptocurrencies.

2020: The Supreme Court of India struck down the RBI’s banking ban, reopening doors for crypto exchanges.

2022 – Present: The government introduced taxation rules on crypto income, indirectly acknowledging its legality while discouraging speculative trading.

The journey shows India’s cautious approach. While the country has not fully legalized crypto as a currency, the acceptance of taxation clearly confirms that crypto trading is legal in India.

Opportunities and Risks in Crypto Trading

Like any financial market, crypto trading presents both opportunities and challenges.

Opportunities:

One of the biggest attractions of crypto trading is that it gives Indian traders access to a completely new asset class with significant growth potential. Digital currencies like Bitcoin and Ethereum have seen tremendous price increases over the years, making them appealing for those seeking higher returns compared to traditional markets.

Crypto also provides a chance for portfolio diversification. By adding cryptocurrencies to their investment mix, traders can balance exposure across different assets such as stocks, forex, and gold. This diversification helps spread risk and may increase the resilience of an overall portfolio, especially since crypto often moves independently of other markets.

Another advantage is the global exposure and round-the-clock trading environment. Unlike stock markets that operate within fixed hours, crypto markets are open 24/7, allowing traders in India to participate at any time of day. This accessibility provides more flexibility, especially for those who want to trade alongside their daily schedules or capitalize on international market movements.

Risks:

Despite the opportunities, it is crucial to recognize that crypto trading carries high risks. The most notable is the extreme volatility of the market. Prices can swing dramatically within hours, creating the possibility of both large profits and sudden losses. This volatility makes crypto appealing to active traders but risky for those without proper strategies.

Another concern is regulatory uncertainty. While crypto trading is legal in India, the government’s cautious stance means that new regulations could be introduced at any time. Policy changes may impact how cryptocurrencies are taxed, traded, or even accessed, which adds a layer of unpredictability for traders.

Lastly, there are security risks associated with online wallets and exchanges. Since cryptocurrencies are digital, they are vulnerable to hacking, scams, and phishing attacks. Traders must take steps to secure their holdings, such as using reliable platforms, enabling two-factor authentication, and storing assets in safe wallets. Without proper precautions, the risks of theft or loss can be significant.

Traders must balance the potential for high returns with the risks, using effective strategies and sound risk management practices.

TMGM’s Role in Helping Indian Traders Navigate Crypto Markets

For Indian traders looking to explore crypto trading safely and professionally, TMGM offers direct access to global cryptocurrency CFDs. This means traders can speculate on the price movements of popular digital assets without the need to actually own or store the coins themselves. By operating within a regulated environment that follows strict compliance standards, TMGM ensures that clients can trade with confidence and security.

In addition, TMGM provides advanced trading platforms such as MetaTrader 4 and MetaTrader 5, which support not only crypto but also forex and other asset classes. The broker also delivers educational resources designed for beginners, helping them understand what crypto trading is and build their skills step by step. With these tools, Indian traders are better equipped to approach the fast-paced crypto market with clarity and discipline.

Start Your Trading Journey with TMGM

Ready to explore the world of crypto trading with confidence? TMGM offers a secure and user-friendly platform for Indian traders to get started.

Open a TMGM demo account to practice trading with virtual funds.

Start live trading with real opportunities through a TMGM live account.

Learn more about TMGM’s offerings in cryptocurrency trading.

Negocie de Forma Mais Inteligente Hoje

Real

Conta

Instantaneamente