What is Short Selling?

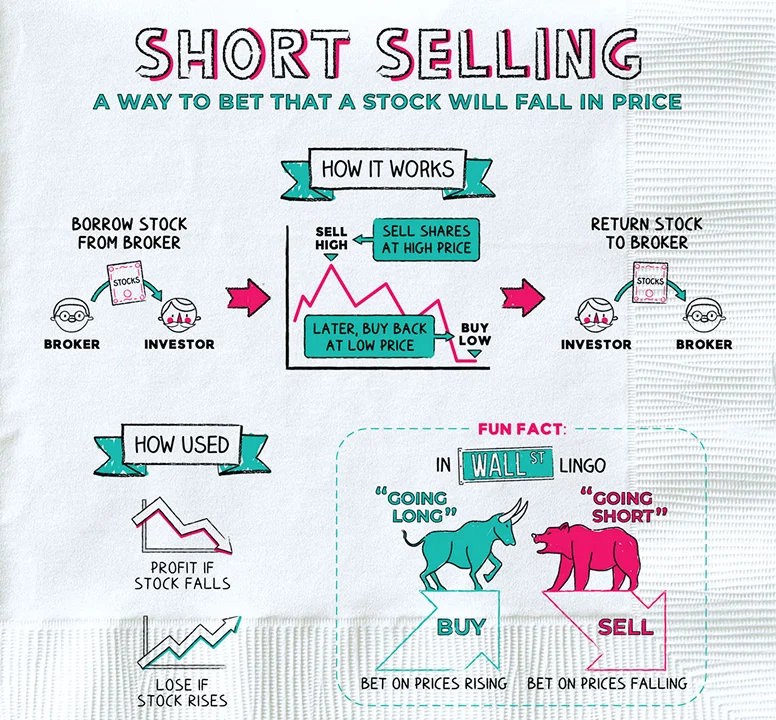

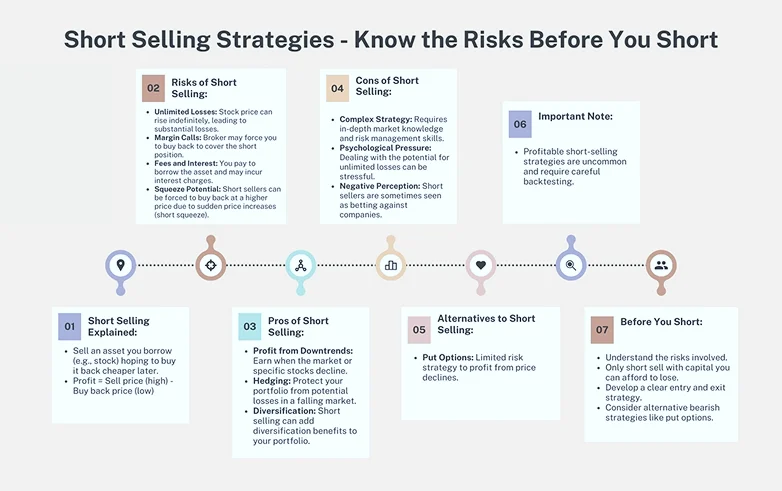

Short selling, or shorting or going short, is a trading strategy where an investor borrows an asset (usually from a broker) and sells it on the open market to buy it back later at a lower price. The goal is to profit from a decline in the asset's price.

Key Points

Short sellers aim to profit from falling prices.

It involves borrowing assets and selling them, then repurchasing them later.

Potential profits are limited (price can only go to zero), but losses can be unlimited.

Short selling is considered riskier than traditional "long" investing.

It plays a crucial role in market efficiency and price discovery.

Historical Context

Short selling has existed for centuries. One of the earliest recorded instances was in 1609 when Dutch trader Isaac Le Maire shorted Dutch East India Company shares. Since then, short selling has been controversial, especially during market downturns, leading to occasional restrictions or bans in various countries.

How Short Selling Works

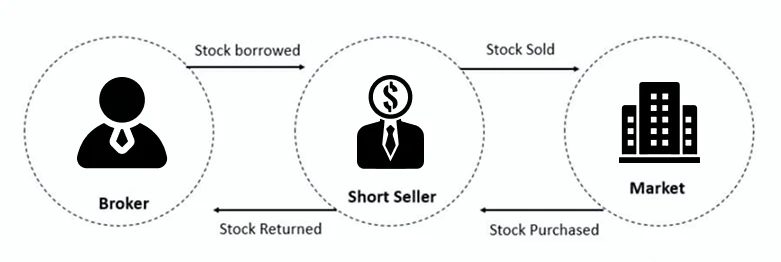

Borrowing

The trader borrows shares from a broker. The shares often come from the broker's inventory, another client's margin account, or an institutional lender.

Selling

The borrowed shares are sold at the current market price. The proceeds are credited to the trader's account, but this is not profit - it's essentially collateral for the borrowed shares.

Waiting

The trader waits for the price to fall. During this time, they may have to pay interest on the borrowed shares and reimburse the lender for any dividends paid.

Buying Back

The trader repurchases the shares at the new, lower price. This is called "covering" the short position.

Returning

The shares are returned to the lender, closing the short position.

Profit/Loss

The difference between the selling and buying prices (minus fees and any dividends paid) is the trader's profit or loss.

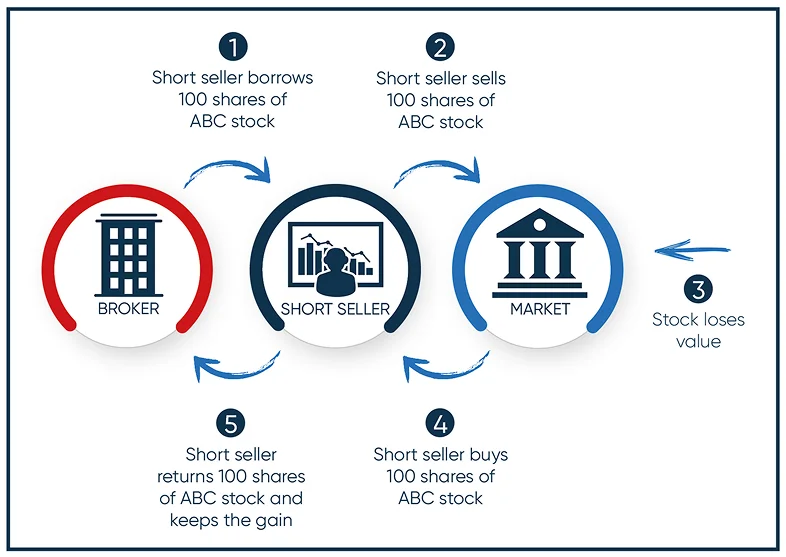

Example

Let's say a trader believes that XYZ Corp's stock, currently trading at $100, is overvalued:

- They borrow 100 shares and sell them for $10,000.

- The stock price falls to $80.

- They buy back 100 shares for $8,000.

- The profit is $2,000 minus any fees and dividend payments.

If the stock had risen to $120 instead, they would have lost $2,000 plus fees and dividends.

When to Consider Short Selling

Overvalued Assets

When you believe an asset's price is higher than its intrinsic value. This could be due to inflated earnings, unsustainable growth projections, or market hype.

Negative News or Events

When you anticipate negative impacts from upcoming events or news, such as poor earnings reports, regulatory changes, or industry disruptions.

Technical Indicators

When technical analysis suggests a potential price decline. This could include bearish chart patterns, momentum indicators, or moving average crossovers.

Market or Sector Downtrends

Traders can profit from broad market or sector-wide declines during bear markets or when specific sectors are underperforming.

Pair Trading

As part of a strategy to profit from the relative performance of two related securities, going long on one while shorting the other.

Hedging

To protect a long portfolio during market downturns. Institutional investors often use this strategy.

Arbitrage Opportunities

When price discrepancies between related securities or markets are expected to converge.

Bubble Detection

When you believe a market or asset is in a bubble and due for a correction.

Fraud Detection

If you suspect fraudulent activity in a company, short selling can be a way to profit from (and draw attention to) your findings.

Short Selling Strategies

Fundamental Short Selling

Based on analyzing a company's financials and business model to identify overvaluation.

Example:

Shorting a company with deteriorating fundamentals, like declining revenues or increasing debt.

Technical Short Selling

Using chart patterns and technical indicators to identify potential short entries.

Example:

Shorting when a stock breaks below a key support level or moving average.

News-Based Shorting

Reacting quickly to negative news that could impact a stock's price.

Example:

Shorting a pharmaceutical company after a failed drug trial announcement.

Trend Following

Shorting assets that are in an established downtrend.

Example:

Using moving averages to identify short stocks in long-term downtrends.

Pair Trading

Shorting one asset while going long on a related asset, aiming to profit from the relative performance.

Example:

Going long on Coca-Cola while shorting Pepsi, betting on Coca-Cola's outperformance.

Short Squeeze Anticipation

Identifying heavily shorted stocks and anticipating a potential short squeeze.

Example:

Monitoring short interest and days-to-cover ratios to identify potential squeeze candidates.

Earnings Anticipation

Shorting before earnings reports when expecting disappointing results.

Example:

Shorting a retailer before earnings if you believe holiday sales were weak.

Sector or Industry Shorts

Shorting entire sectors or industries expected to underperform.

Example:

Shorting a coal industry ETF based on a belief in the growth of renewable energy.

Arbitrage

Exploiting price differences between related securities or markets.

Example:

Shorting a dual-listed stock on one exchange where it's trading at a premium.

Options Strategies

Using put options or other derivatives to profit from price declines with limited risk.

Example:

Buying put options instead of directly shorting a volatile stock to cap potential losses.

Advanced Short Selling Techniques

Short Interest Analysis

Monitoring the short interest (percentage of float sold short) and days-to-cover ratio can provide insights into market sentiment and potential short squeezes.

Forensic Accounting

Digging deep into financial statements to uncover potential accounting irregularities or unsustainable business practices.

Crowded Trade Analysis

Being aware of heavily shorted stocks to avoid getting caught in a short squeeze or potentially profiting from one.

Event-Driven Shorting

Focusing on specific events like mergers, spinoffs, or index rebalancing that might create short-term mispricings.

Alpha Shorts

In long/short equity strategies, use shorts not just for hedging but also to generate alpha (excess returns) through superior stock selection.

Macro Shorting

Taking short positions based on macroeconomic trends or geopolitical events.

Seasonal Shorting

Exploiting known seasonal patterns in certain stocks or commodities.

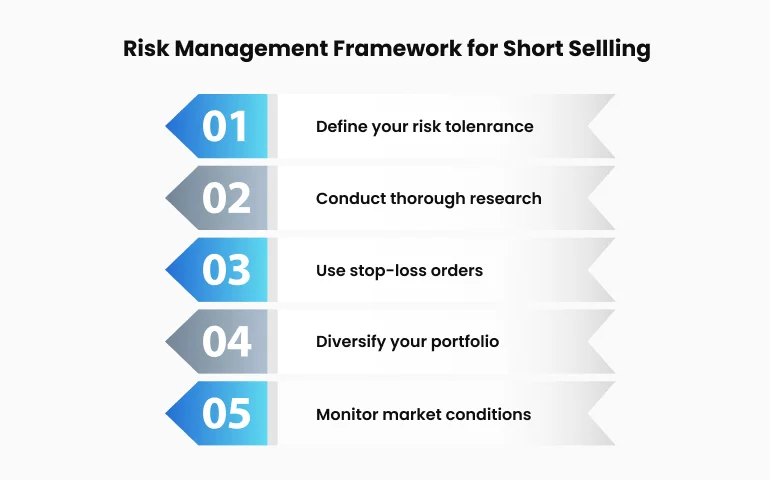

Risks and Considerations

#1 Unlimited Loss Potential

Theoretically, there's no limit to how high a stock's price can go, leading to potentially unlimited losses.

Risk Management: Use stop-loss orders, put options for protection, or strict position sizing rules.

#2 Short Squeeze

When a heavily shorted stock rises, short sellers may rush to buy it back, increasing the price.

Mitigation: Monitor short interest and be cautious of crowded shorts.

#3 Borrowing Costs

Fees for borrowing shares can eat into profits, especially for longer-term shorts.

Consideration: Factor in borrowing costs when calculating potential profit/loss.

#4 Dividends

Short sellers are responsible for paying any dividends issued while they hold the short position.

Strategy: Consider ex-dividend dates and factor dividend payments into your analysis.

#5 Regulatory Risks

Some markets have restrictions on short selling, which can change unexpectedly.

Approach: Stay informed about regulatory changes in your trading jurisdiction.

#6 Timing

It can be challenging to time correctly both the entry and exit of a short position.

Technique: Use multiple confirming indicators and have a clear exit strategy.

#7 Contrary to Overall Market Trends

Shorting can be psychologically difficult, especially in bullish markets.

Mindset: Develop a contrarian mindset and stick to your analysis.

#8 Buy-In Risk

If the borrowed shares are recalled and can't be replaced, you might be forced to close your position.

Precaution: Understand your broker's policies on buy-ins.

#9 Margin Requirements

Short selling typically requires a margin account, and margin requirements can change.

Management: Monitor your margin levels and be prepared for margin calls.

#10 Emotional Toll

The unlimited loss potential of shorting can be stressful for many traders.

Self-care: Develop a robust risk management strategy and maintain emotional discipline.

Short Selling with TMGM

TMGM offers various instruments and features that facilitate short selling:

CFD Trading

TMGM allows traders to short-sell a wide range of assets through CFDs (Contract for Difference), including stocks, indices, commodities, and currencies.

Advantage: CFDs allow easy access to short selling without the need to borrow physical shares.

Leverage

TMGM provides leverage, which can amplify profits and increase risks when short-selling.

Caution: While leverage can increase potential returns, it also magnifies potential losses. Use it judiciously.

Advanced Platforms

MetaTrader 4 and MetaTrader 5 offer sophisticated charting and analysis tools for identifying short-selling opportunities.

Benefit: These platforms provide a wide range of technical indicators and charting tools for short sellers.

Education

TMGM provides educational resources to help traders understand and implement short-selling strategies effectively.

Recommendation: Use webinars, tutorials, and articles to enhance your short selling skills.

Risk Management Tools

Features like stop-loss orders are available to help manage the risks associated with short selling.

Best Practice: Always use stop-loss orders when short-selling to limit potential losses.

Market Analysis

Regular market updates from TMGM can help traders identify potential short selling opportunities.

Tip: Combine TMGM's market analysis with your research for more informed decisions.

Customer Support

TMGM's support team can answer questions about short-selling mechanics and platform features.

Advice: Don't hesitate to reach out if you're unsure about any aspect of short selling on the platform.

Diverse Asset Classes

TMGM offers short-selling across various asset classes, allowing for diverse short-selling strategies.

Strategy: Consider short-selling opportunities across different markets for better diversification.

Competitive Spreads

TMGM offers competitive spreads, which is crucial for short sellers, especially for shorter-term trades.

Impact: Lower spreads can significantly impact the profitability of short-selling strategies, especially for high-frequency traders.

Demo Account

TMGM provides a demo account where traders can practice short-selling strategies without risking real money.

Recommendation: Use the demo account to test and refine your short-selling strategies before trading with real funds.

Regulatory Landscape

Short-selling regulations vary by country and can change over time. Here's an overview of some standard regulatory measures:

Uptick Rule

Short selling is only allowed on an uptick price in some markets. This rule aims to prevent short selling from exacerbating a declining market.

Naked Short Selling Ban

Many jurisdictions prohibit naked short selling (shorting without first borrowing the shares or ensuring they can be borrowed).

Short Sale Disclosure

Some regulators require the disclosure of significant short positions.

Circuit Breakers

Trading halts may be imposed if a stock's price falls too quickly.

Temporary Bans

Regulators may temporarily ban short selling on certain stocks or entire markets during market crises.

Always check the current regulations in your jurisdiction and stay informed about any changes.

Short selling is a powerful but complex trading strategy that allows traders to profit from declining markets. While it offers significant profit potential, it also comes with unique risks that must be carefully managed. Traders can incorporate short selling into their overall trading approach by understanding the mechanics, strategies, and risks of short selling and leveraging the tools and services provided by platforms like TMGM.

Remember, successful short selling requires thorough research, strong risk management, and, often, the ability to go against prevailing market sentiment. As with all trading strategies, it's crucial to practice in a demo environment, start small, and continuously educate yourself about market dynamics and regulatory changes.

TMGM provides a robust short-selling platform across various asset classes and the necessary tools and support. However, the responsibility for trading decisions and risk management ultimately lies with you, the trader. Always ensure you fully understand the risks involved and never risk more than you can afford to lose.

Visit TMGM today to explore their platform and take your trading to the next level. Whether you’re just starting or looking to refine your strategy, TMGM provides the tools and support you need to succeed in the markets.