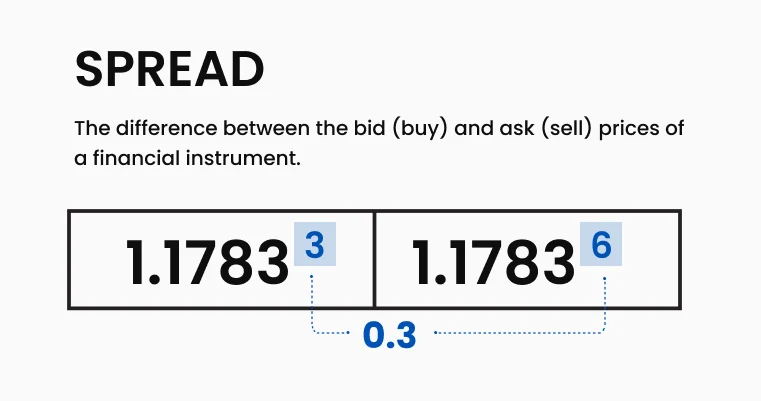

What is Spread?

The spread is the difference between a financial instrument's buy (ask) price and its sell (bid) price. It's the cost of a trade and represents the broker's profit.

Key Points about Spread

Measurement

Spreads are typically measured in pips, the smallest price moves a given exchange rate can make.

Types of Spread

Fixed Spread: Remains constant regardless of market conditions.

Variable Spread: Fluctuates based on market liquidity and volatility.

Factors Affecting Spread

- Market volatility

- Liquidity of the asset

- Time of day (spreads are often wider during less liquid hours)

- Major news events or economic releases

Impact on Trading

- Wider spreads increase the cost of trading

- Traders need to factor in the spread when setting take-profit and stop-loss orders

Example of Spread Calculation

Let's say you're trading EUR/USD:

- The bid price (selling price) is 1.1000

- The ask price (buying price) is 1.1002

The spread would be the difference: 1.1002 - 1.1000 = 0.0002, or 2 pips.

If you're trading a standard lot (100,000 units), the cost of this spread would be 0.0002 * 100,000 = $20

This means you'd need the market to move at least two pips in your favor to break even on the trade.

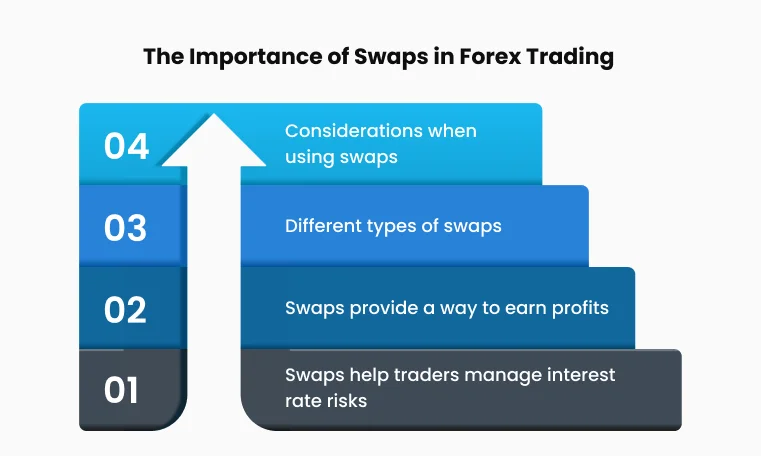

What is Swap?

Swap, or rollover, is the interest paid or earned for holding a position overnight in the forex market.

Key Points about Swap

Concept

It's based on the interest rate differential between the two currencies in the pair you're trading.

Calculation

Swap is calculated based on the position size, the current interest rates of the currencies involved, and whether you're buying or selling the pair.

Swap Rates

Can be positive (you earn interest) or negative (you pay interest).

Triple Swap

On Wednesdays, many brokers apply triple swap to account for the weekend.

Timing

The swap is typically applied at 5 PM EST (or 10 PM GMT during daylight saving time), the start of the new forex trading day.

Factors Influencing Swap Rates

Interest Rate Differentials

The difference in interest rates between the two currencies in a pair is the primary factor in determining swap rates.

Central Bank Policies

Changes in monetary policy can significantly affect interest and swap rates.

Market Conditions

During economic uncertainty, swap rates can become more volatile.

Broker Markup

Some brokers may add a markup to the interbank swap rates.

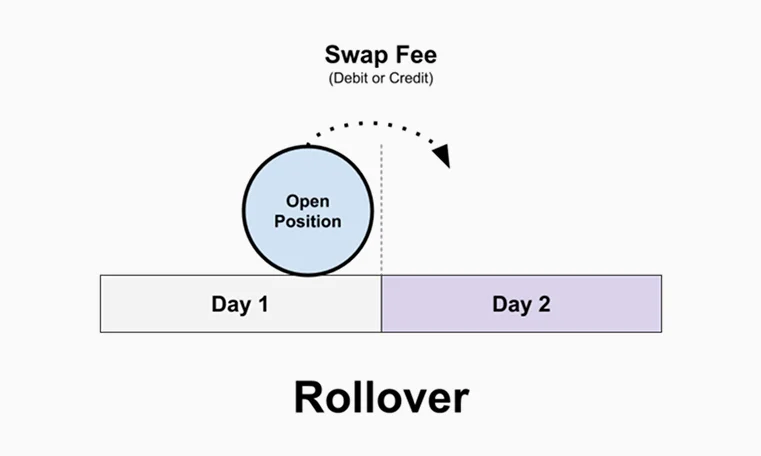

What is a Swap Fee?

A swap fee is the cost or earnings of holding a position overnight.

Important Aspects of Swap Fees

Purpose

Compensates for the interest rate differential between currencies.

Application

Applied at the end of each trading day (typically 5 PM EST in forex).

Variability

Swap fees can change based on market conditions and central bank policies.

Long vs. Short Positions

Depending on whether you're long or short on a currency pair, you may pay or receive swap fees.

Impact on Strategy

Swap fees can significantly affect the profitability of long-term positions, especially in carry trades.

Example of Swap Fee Calculation

Let's say you're long one lot of USD/JPY, and the daily swap rate for a long position is -0.18 pips.

1 pip on one lot of USD/JPY (assuming an exchange rate of 110.00) is worth approximately $9.09.

So, the daily swap fee would be: -0.18 * $9.09 = -$1.64

If you hold this position for 30 days, the total swap fee would be 30 * -$1.64 = -$49.20

How Swap and Spread Affect Your Trading

Cost Consideration

Swaps and spreads contribute to the overall cost of trading. Traders need to factor these into their potential profits and losses.

Strategy Implications

- Day traders are more affected by spread

- Swing and position traders need to pay close attention to swap rates

Broker Selection

Comparing spreads and swap rates can be crucial when choosing a broker.

Risk Management

Understanding these costs helps set more accurate stop-loss and take-profit levels.

Advanced Concepts

Carry Trades

Carry trades involve buying a high-yielding currency while selling a low-yielding currency. Traders aim to profit from the interest rate differential (positive swap) while benefiting from potential price appreciation.

Example:

Buying AUD/JPY when Australian interest rates are significantly higher than Japanese rates.

Impact on Different Trading Styles

Scalping

Scalpers are highly sensitive to spreads and make numerous trades in short time frames. They typically avoid holding positions overnight to avoid swap fees.

Day Trading

Day traders focus on intraday price movements and are primarily concerned with spreads. They usually close positions before the daily swap is applied.

Swing Trading

Swing traders hold positions for days or weeks and must factor in both spreads and swap fees in their trading plans.

Position Trading

Swap fees significantly impact long-term traders. Positive swaps can add to profits, while negative swaps can erode gains over time.

Swap-Free (Islamic) Accounts

Some brokers offer swap-free accounts, also known as Islamic accounts, which do not involve paying or receiving swap fees. These accounts are designed to comply with Islamic finance principles prohibiting the charging or earning of interest.

Note: While these accounts don't charge swap fees, they may have other costs or restrictions to compensate for the lack of swap charges.

Trading with TMGM: Applying Your Knowledge of Swap and Spread

As you've learned, understanding swaps and spreads is crucial for effective trading. When you trade with TMGM (Trademax Global Markets), you can apply this knowledge to optimize your trading strategy. Here's how TMGM's offerings align with these important concepts:

Competitive Spreads with TMGM

TMGM is known for offering competitive spreads across a wide range of financial instruments:

- Forex Pairs

TMGM provides tight spreads on major, minor, and exotic currency pairs. For example, spreads on EUR/USD can be as low as 0.0 pips on ECN Raw accounts.

- CFDs

Whether you're trading indices, commodities, or cryptocurrencies, TMGM offers competitive spreads to help minimize your trading costs.

- Transparency

TMGM provides clear information about their spreads, allowing you to calculate your potential trading costs accurately.

TMGM's Trading Platforms and Swap/Spread Information

TMGM offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which provide easy access to spread and swap information:

- Real-Time Spreads

Participate in educational sessions that often cover topics related to trading costs and strategy optimization.

- Swap Rate Access

You can view swap rates for any instrument by right-clicking on it in the Market Watch window and selecting "Specification."

- Swap Calculation

The platforms automatically calculate and apply swap fees to your positions, which you can view in your account history.

Educational Resources

TMGM is committed to trader education and provides resources to help you understand concepts like swap and spread:

- Trading Guides

Access comprehensive guides that explain trading costs, including detailed information on spreads and swaps.

- Webinars and Seminars

Participate in educational sessions that often cover topics related to trading costs and strategy optimization.

- Personal Account Managers

Get personalized support to understand how spreads and swaps apply to your trading approach.

Maximizing Your Trading with TMGM

- Choose the most suitable account type for your trading style.

- Accurately calculate your potential trading costs.

- Make informed decisions about holding positions overnight.

- Utilize TMGM's educational resources to improve your trading strategy continually.

- Effectively use the platforms and tools provided by TMGM to monitor and manage your trading costs.

Remember, successful trading is not just about predicting market movements—it's also about managing costs and understanding the mechanics of the market. With TMGM's competitive offerings and your knowledge of swap and spread, you can navigate the markets more effectively.

Always stay informed about the latest rates and any changes in trading conditions. TMGM's customer support team can assist you with any questions regarding spreads, swap rates, or any other aspect of your trading account.

Visit TMGM today to explore their platform and take your trading to the next level. Whether you're just starting or looking to refine your strategy, TMGM provides the tools and support you need to succeed in the markets.